|

|

|

|

|||||

|

|

Dollar Tree, Inc. DLTR is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 15.85, which is lower than the industry’s average of 32.52 and the broader Zacks Retail-Wholesale sector's 23.07. The company is also trading below the S&P 500's P/E ratio of 20.53. This valuation indicates that DLTR stock may be undervalued relative to its peers, presenting a compelling investment opportunity for value-focused investors.

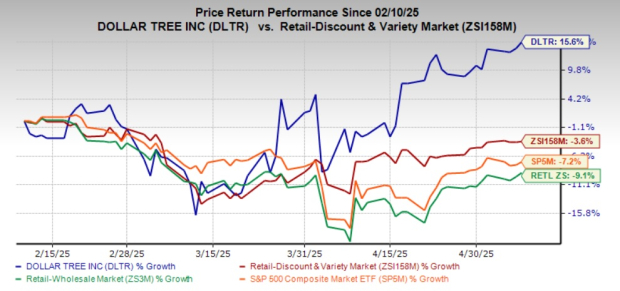

Shares of Dollar Tree have risen 15.6% over the past three months against the industry’s decline of 3.6%. During the same period, the company also surpassed the broader Zacks Consumer Staples sector and the S&P 500, both of which declined 9.1% and 7.2%, respectively.

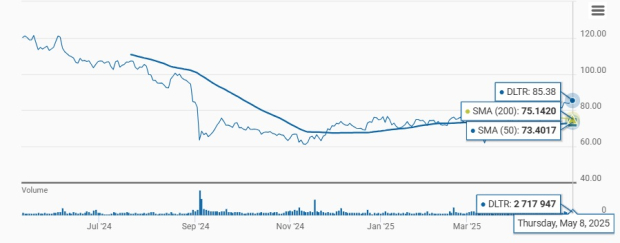

DLTR is currently trading above its 50- and 200-day moving averages, indicating strong upward momentum and price stability. This technical strength reflects positive market sentiment and growing confidence in the company’s financial health and prospects.

Considering the stock's attractive valuation and recent stock performance, it's worthwhile to explore the key factors driving its long-term growth potential.

DLTR is advancing on the back of strong sales growth across segments, higher traffic trends and continued market share gains. In the most recent quarter, enterprise same-store sales (comps) improved 2% year over year, fueled by a 0.7% increase in customer traffic and a 1.3% rise in average ticket size. The company witnessed 4.2% comps growth in consumables and a 0.4% increase in discretionary categories.

Dollar Tree is making strategic moves to strengthen its core business and optimize its retail footprint. Over the years, the company has made notable progress in enhancing its store portfolio through a mix of new store openings, renovations, re-banners and selective closures. Key Real Estate Initiatives, such as the rollout of the $3 and $5 plus assortment and the expansion of Combo Stores, are delivering compelling results.

The company has also completed the nationwide rollout of $3, $4 and $5 frozen and refrigerated items, further advancing its multi-price point strategy. These efforts support an expanded product assortment in key categories like food, snacks, beverages, pet care and personal care, enhancing shopper choice and driving traffic.

A pivotal development came on March 25, 2025, when Dollar Tree entered into a definitive agreement to sell its Family Dollar business to Brigade Capital Management and Macellum Advisors for $1.007 billion, subject to adjustments. This decision followed a strategic review and reflects Dollar Tree’s intent to focus more tightly on its higher-performing Dollar Tree banner. The company has accordingly reclassified Family Dollar as discontinued operations.

Looking ahead, management projects robust top-line growth from the Dollar Tree banner, with sales backed by multi-price expansion, operating improvements in stores, store openings and the ramping up of its recently introduced stores, particularly the former 99 Cents Only portfolio.

For fiscal 2025, management projects comps growth of 3-5% and adjusted EPS of $5.00-$5.50 compared with $5.10 recorded in fiscal 2024. The company is forecasting favorability in mark-on, markdown and freight, partially offsetting increased distribution costs associated with incremental D&A from its supply-chain investments. The outlook for freight costs is positive across the ocean and both inbound and outbound ground. Management anticipates a modest improvement in gross margin.

Management highlighted that 2025 is going to be a transition year as it will be operating Dollar Tree as a standalone entity. It looks forward to boosting top-line results by driving comps and introducing stores, and increased sales productivity will help expand gross margin, leveraging SG&A and driving EPS. It expects comps growth of 3-5% for the first quarter.

Dollar Tree has experienced increased selling, general and administrative (SG&A) expenses in recent quarters, largely due to rising operating costs. The increase was also caused by software impairments and the contract termination costs related to the Family Dollar sale, along with higher depreciation, stock compensation, professional fees and utility costs.

Dollar Tree continues to navigate a challenging macroeconomic landscape that has dampened consumer sentiment and weighed on discretionary spending. One of the most significant external pressures comes from tariffs. For fiscal 2025, the company expects a net impact of $15-$20 million per month from the 10% China tariff, prior to any mitigation.

These factors introduce some uncertainty, prompting a more cautious approach to investing in the company. Dollar Tree currently has a Zacks Rank #3 (Hold), reflecting a neutral outlook for the stock.

Some better-ranked stocks in the same space are Canada Goose GOOS, Nordstrom Inc. JWN and Stitch Fix SFIX.

Canada Goose is a global outerwear brand. GOOS is a designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Canada Goose’s current fiscal year’s earnings and revenues implies declines of 1.4% and 4.9%, respectively, from the year-ago actuals. GOOS delivered a trailing four-quarter average earnings surprise of 71.3%.

Nordstrom is a leading fashion specialty retailer in the United States. The company offers an extensive selection of branded and private-label merchandise. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for Nordstrom’s fiscal 2025 earnings and sales indicates growth of 1.8% and 2.2%, respectively, from the year-ago actuals. JWN has a negative trailing four-quarter average earnings surprise of 26.1%.

Stitch Fix delivers customized shipments of apparel, shoes and accessories for women, men and kids. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for SFIX’s fiscal 2025 earnings implies growth of 64.7% from the year-ago actual. Stitch Fix delivered a trailing four-quarter average earnings surprise of 48.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite