|

|

|

|

|||||

|

|

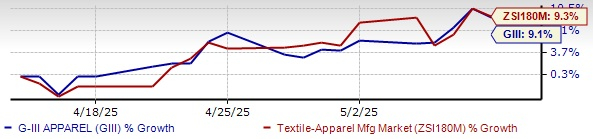

G-III Apparel Group, Ltd. GIII shares are trading 27% below their 52-week high of $36.18 reached on Dec. 13, 2024, making investors contemplate their next moves. In the past month, GIII stock has gained 9.1% compared with the Textile - Apparel industry’s 9.3% growth.

GIII Stock Past-Month Performance

This leading global fashion entity is currently trading at a low price-to-earnings (P/E) multiple, which is below the average of the industry and Consumer Discretionary sector. With a forward 12-month P/E of 6.27, GIII is priced lower than the industry average of 11.55 and the sector average of 18.52. This makes G-III stock undervalued relative to its industry peers, presenting an attractive opportunity for investors seeking exposure to the sector. Moreover, the company’s Value Score of A underscores its appeal as a potential investment.

GIII Looks Attractive From Valuation Standpoint

G-III is undergoing a major transformation, with owned brands now accounting for more than 50% of total net sales as of March 13. This marks a sharp increase from previous years. The company has significantly reduced its reliance on licensed labels like Calvin Klein and Tommy Hilfiger, which now represent just 34% of fiscal 2025 sales compared with more than 50% two years ago. This strategic shift has improved G-III’s profitability, enhanced its brand ownership and strengthened its pricing power.

Core brands such as DKNY, Donna Karan, Karl Lagerfeld and Vilebrequin achieved more than 20% growth in fiscal 2025, driving strong revenue gains. Licensing royalty income also increased 10% year over year, reaching more than $80 million, which supports the success of the company’s owned-brand strategy.

G-III expanded its brand portfolio during the year by launching outerwear lines for Donna Karan, Nautica, Halston and Champion. These introductions helped to boost fourth-quarter fiscal 2025 revenues 9.8% year over year, bringing the total to $839.5 million. The Donna Karan relaunch exceeded expectations with strong sell-through rates and high average unit retail prices. It expanded to more than 1,500 points of sale by the end of the fiscal 2025, with a goal of reaching 1,700 by spring 2026.

The company has signed a seven-year exclusive licensing agreement with ALDO Product Services for G.H.BASS footwear, bags and small leather goods in North America. Launching in Spring/Summer 2026, ALDO will oversee design, manufacturing, distribution and e-commerce. This partnership combines G.H.BASS’s heritage craftsmanship with ALDO’s sourcing and omnichannel strengths, helping to expand the brand’s reach and connect with a new generation of consumers.

Looking ahead, international licensing initiatives for Donna Karan’s new fragrance and jewelry lines are expected to support the company’s target of reaching $1 billion in annual sales. Karl Lagerfeld also surpassed $580 million in net sales for fiscal 2025, growing more than 20% year over year. G-III anticipates continued double-digit growth for DKNY, Karl Lagerfeld and Donna Karan in fiscal 2026, reinforcing its position as a leader in the global fashion market.

International expansion remains a key part of G-III’s growth strategy. Currently, only 20% of its net sales are generated outside North America, indicating a large opportunity for global growth. The company acquired a 20% stake in All We Wear Group (“AWWG”), a European fashion platform operating in 86 countries and generating $650 million in annual revenues. AWWG will support the expansion of DKNY, Donna Karan and Karl Lagerfeld across Spain and Portugal, while G-III will bring AWWG brands like Pepe Jeans and Hackett to North America.

In Latin America, Karl Lagerfeld’s distributor opened five new stores in fiscal 2025, with six more planned for fiscal 2026. Continued expansion in Western Europe and Latin America positions G-III for sustained international growth.

G-III has made strategic investments in digital infrastructure, enhancing its omnichannel capabilities and expanding partnerships with Amazon and Zalando to increase online visibility. Sales from owned-brand digital platforms rose more than 20% in fiscal 2025, demonstrating strong consumer demand and digital traction.

The company is also adopting AI-driven technologies to improve operations, increase supply-chain transparency and optimize digital merchandising. These efforts are contributing to margin expansion. In North America, G-III’s retail turnaround significantly improved profitability, cutting losses by half and generating more than $15 million in gains during fiscal 2025.

Investors may find GIII stock attractive as it shifts focus to higher-margin owned brands, enhancing profitability and pricing power. Core labels like DKNY and Karl Lagerfeld are delivering strong growth, supported by global expansion and strategic partnerships. The company’s digital transformation is boosting online sales and operational efficiency. Retail performance is improving, aided by omnichannel investments. G-III’s low valuation relative to peers adds to its appeal. These factors position it for sustained, long-term growth. The company currently has a Zacks Rank #2 (Buy).

Some other top-ranked stocks are Nordstrom Inc. JWN, Stitch Fix SFIX and Canada Goose GOOS.

Nordstrom is a leading fashion specialty retailer. It carries a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Nordstrom’s fiscal 2025 earnings and revenues indicates growth of 1.8% and 2.2%, respectively, from fiscal 2024 reported levels. JWN delivered a negative trailing four-quarter average earnings surprise of 26.1%.

Stitch Fix delivers customized shipments of apparel, shoes and accessories for women, men and kids. It currently has a Zacks Rank of 2.

The Zacks Consensus Estimate for SFIX’s fiscal 2025 earnings implies growth of 64.7% from the year-ago actual. SFIX delivered a trailing four-quarter average earnings surprise of 48.9%.

Canada Goose is a global outerwear brand. GOOS is a designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for Canada Goose’s current fiscal year’s earnings and revenues implies a decline of 1.4% and 4.9%, respectively, from the year-ago actuals. Canada Goose delivered a trailing four-quarter average earnings surprise of 71.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-19 | |

| Feb-18 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-10 | |

| Feb-08 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite