|

|

|

|

|||||

|

|

Deere & Company DE is scheduled to report second-quarter fiscal 2025 results on May 15, before the opening bell. While the company is seeing strong demand from product launches, elevated production expenses and low commodity prices are anticipated to have marred the gains.

Low Commodity Prices & Shipment Volumes: Deere has been facing challenges due to weak farmer spending amid low commodity prices. In the wake of challenging conditions in the global agricultural and construction sectors, DE has been aligning its production with demand levels. The company has, thus, been reporting lower shipment volumes in the past few quarters and this is likely to have weighed on the company’s fiscal second-quarter performance as well.

Higher Expenses: High production expenses; selling, administrative and general expenses; and research and development expenses are likely to have impacted the company’s margin in the quarter.

Favorable Pricing: Deere is assessing its cost structure by reviewing organizational efficiency and footprint assessment, which, in turn, will help improve margins. Its price realization action is expected to offset higher material and freight costs. Favorable price realization is expected to have negated some of these headwinds, as seen in the previous quarters.

Our model predicts the Production & Precision Agriculture segment’s revenues to be $4.61 billion for the fiscal second quarter, suggesting a year-over-year decrease of 23.9%. We expect the segment’s operating profit to be $619 million, indicating a 62.5% fall from the prior-year quarter’s reported figure. Gains from price realization are likely to have been offset by escalated production expenses and lower shipment volumes.

Our estimate for the Small Agriculture & Turf segment’s revenues is pegged at $2.78 billion for the fiscal second quarter, indicating a 12.6% decline from the prior-year quarter’s actual. The segment’s operating profit is estimated at $485 million, suggesting a 15.1% year-over-year fall. The Small Agriculture & Turf segment’s performance is expected to have been affected by elevated production expenses; higher research and development, and selling, general and administrative expenses; and lower shipment volumes, partially offset by price realization.

The Construction & Forestry segment’s sales are estimated to be $3.29 billion for the fiscal second quarter, suggesting a 14.4% dip from the prior-year quarter’s reported number on lower volume. We predict the segment’s operating profit to plunge 12% year over year to $588 million.

Our estimate for the Financial Services segment’s revenues is pegged at $1.48 billion for the fiscal second quarter, indicating a 6.7% rise from the year-ago quarter’s actual. Our projection for the segment’s operating profit is $232 million. The segment reported operating profit of $209 million in the prior-year quarter.

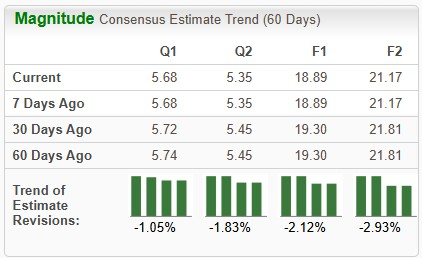

The Zacks Consensus Estimate for Deere’s earnings has moved down 1.1% over the past 60 days to $5.68 per share. The consensus mark implies a 33.4% plunge from the year-ago actual. The consensus estimate for revenues is pegged at $10.6 billion, indicating a 21.7% year-over-year decline.

Deere’s earnings beat the Zacks Consensus Estimates in the trailing four quarters, the average surprise being 8.9%. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Our proven model does not conclusively predict an earnings beat for DE this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The Earnings ESP for Deere is -0.03%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: Deere currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

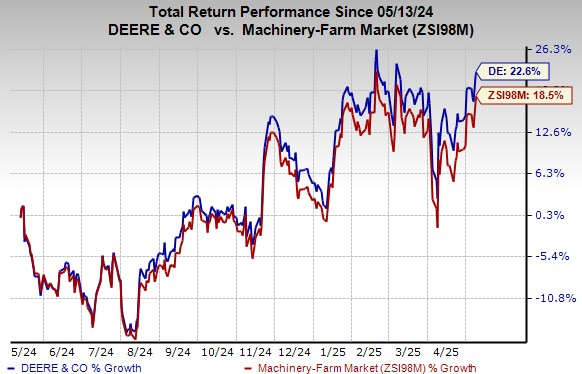

Deere’s shares have gained 22.6% in the past year compared with the industry’s 18.5% growth.

AGCO Corp. AGCO delivered an adjusted EPS of 41 cents in first-quarter 2025 compared with the prior-year quarter’s $2.32. The reported figure topped the Zacks Consensus Estimate of 3 cents.

Net sales decreased 30% year over year to $2.05 billion in the March-end quarter. The top line beat the Zacks Consensus Estimate of $2.02 billion. Excluding the unfavorable currency-translation impacts of 2.4%, net sales fell 27.6% year over year.

CNH Industrial N.V. CNH reported first-quarter 2025 adjusted earnings per share (EPS) of 10 cents, which declined from 33 cents in the prior-year quarter. The figure, however, surpassed the Zacks Consensus Estimate of 9 cents.

In the first quarter, CNH Industrial’s net sales declined nearly 21% from the year-ago level to $3.82 billion but topped the Zacks Consensus Estimate of $3.79 billion. The company’s net sales from industrial activities came in at $3.17 billion, down 23% due to lower shipment volumes.

Lindsay Corporation LNN delivered earnings per share of $2.44 in second-quarter fiscal 2025 (ended Feb. 28, 2025), beating the Zacks Consensus Estimate of $1.89. The bottom line rose 49% year over year.

Lindsay generated sales of $187 million, up from $152 million in the year-ago quarter. The top line beat the Zacks Consensus Estimate of $180 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite