|

|

|

|

|||||

|

|

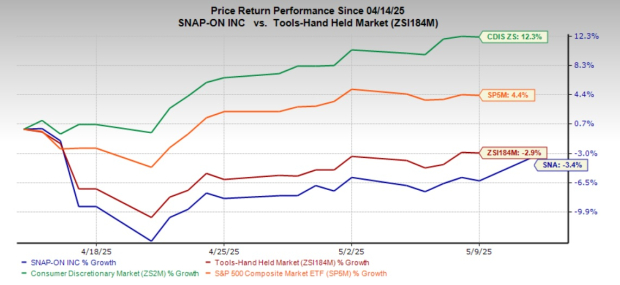

Snap-on Inc. SNA has seen its shares slide 3.4% in the past month. Its downside was more pronounced after it reported soft first-quarter 2025 results on April 16, where the company missed revenue expectations and declined year over year. SNA’s share performance contrasts with the broader industry’s decline of 2%, the broader Consumer Discretionary sector’s rise of 12.3%, and the S&P 500’s growth of 4.4% in the same period.

SNA’s first-quarter 2025 results showed a 3.5% year-over-year decline in revenues and missed the Zacks Consensus Estimate, largely due to a 2.3% dip in organic sales and a $13.9 million impact from unfavorable foreign currency translation.

The decrease in the share price can be attributed to continued softness in the Tools Group segment, led by the reluctance of technician customers to purchase financed products, which underscores the cautious consumer sentiment. Snap-on’s first quarter faced challenges due to economic uncertainty, leading to mixed results.

SNA has been witnessing divergent trends across its business segments, which have contributed to investor caution and a recent decline in its share price. The declines in the Commercial & Industrial Group and Tools Group, both of which missed internal estimates, have raised concerns about demand softness in key customer segments, particularly in critical industries such as the military and U.S.-based technician markets.

The Tools Group segment, a key revenue generator, was a major drag, with sales down 7.4% year over year due to a drop in U.S. operations and technician reluctance to finance purchases, reflecting weaker sentiment in end markets. Similarly, the Commercial & Industrial Group posted a 4.4% decline, hurt by reduced military-related demand and softness in the European hand tools market.

Meanwhile, the Repair Systems & Information Group and Financial Services business stood out as bright spots in the quarter. The Repair Systems & Information Group beat expectations, supported by rising demand from OEM dealerships and independent shops, highlighting the company’s strengths in diagnostics and repair technology. The Financial Services segment also outperformed, with a 2.5% revenue increase, slightly exceeding estimates.

In the first quarter of 2025, Snap-on reported a gross margin expansion of 20 basis points year over year to 50.7%, even as gross profit declined 3.1% year over year. This margin improvement reflects strong execution in cost controls and a favorable product mix, particularly within the Commercial & Industrial Group and Repair Systems & Information Group, both of which achieved record operating margins despite a challenging macroeconomic environment.

Looking ahead, Snap-on’s management maintains a cautiously optimistic outlook for 2025, projecting that the company’s markets and operations will demonstrate resilience amid ongoing macroeconomic uncertainties. Despite a soft first-quarter performance, the company is focused on driving growth through its established strategic runways.

Following the soft first-quarter performance, the Zacks Consensus Estimate for SNA’s earnings per share has seen downward revisions. In the past seven days, the consensus estimate for earnings for 2025 and 2026 has moved down 0.8% to $18.76 and 0.8% to $20.04 per share, respectively.

Snap-on’s underwhelming first-quarter performance signals limited near-term growth potential for the stock. In response, analysts have adopted a more cautious outlook, reflected in recent downward revisions to earnings estimates. Given the ongoing challenges in key segments and soft consumer sentiment, the company may continue to underperform in the near term. The stock currently holds a Zacks Rank #4 (Sell), indicating that investors may want to stay on the sidelines for now.

We have highlighted three top-ranked stocks, namely, Under Armour UAA, G-III Apparel Group, Ltd. GIII and Duluth Holdings DLTH.

Under Armour is one of the leading designers, marketers and distributors of authentic athletic footwear, apparel and accessories for a wide variety of sports and fitness activities in the United States and internationally. It has a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for UAA’s fiscal 2024 sales and earnings indicates declines of 9.8% and 44.4%, respectively, from the year-ago reported figures. Under Armour delivered an earnings surprise of 98.6% in the trailing four quarters, on average.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands and private label brands. It carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for GIII’s fiscal 2025 earnings and revenues implies declines of 4.5% and 1.2%, respectively, from the year-ago actuals. GIII delivered a trailing four-quarter average earnings surprise of 117.8%.

Duluth Holdings, a casual wear, workwear and accessories dealer, currently carries a Zacks Rank #2. Duluth Holdings has a trailing four-quarter earnings surprise of 37.2%, on average.

The Zacks Consensus Estimate for DLTH’s current financial-year EPS indicates growth of 5.6% from the year-ago figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-19 | |

| Feb-18 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite