|

|

|

|

|||||

|

|

MP Materials MP reported first-quarter 2025 results on May 8, with revenues rising 25% year over year to $60.8 million. The company achieved record (neodymium and praseodymium) NdPr production and logged the second-highest quarterly output of rare earth oxides (REO). Despite this, shares fell 10% as MP Materials reported a loss of 12 cents per share. It was wider than the Zacks Consensus Estimate of a loss of 10 cents and the year-ago quarter’s loss of 4 cents on higher production costs.

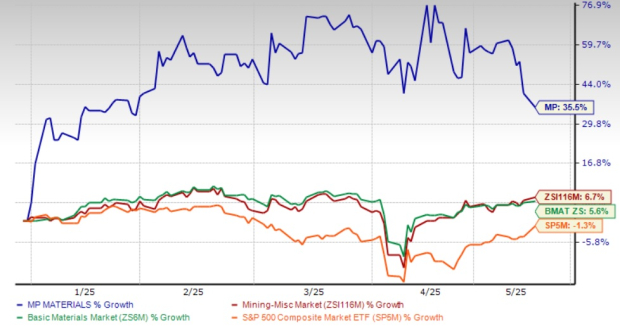

Despite the current dip, MP Materials shares have moved up 35.5% year to date, outperforming the Zacks Mining - Miscellaneous industry’s growth of 6.6%. In comparison, the Zacks Basic Materials sector has gained 5.6%, while the S&P 500 has dipped 1.3%.

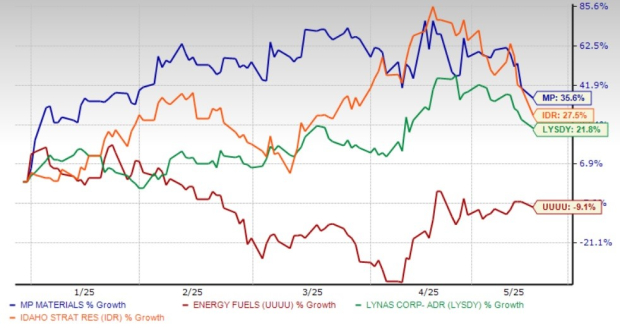

MP Materials has outperformed other names in the rare earths space like Idaho Strategic Resources IDR, Lynas LYSDY, which have advanced 27.5% and 21.8%, respectively. Energy Fuels UUUU, meanwhile, has declined 9.1% in the same timeframe.

Before addressing the critical question of how investors should position themselves regarding the stock, let us first review the company’s first-quarter results.

MP Materials reported record NdPr production of 563 metric tons in the first quarter, a 330% surge from the year-ago quarter. Sales volumes for NdPr were up 246% year over year to 464 metric tons, attributed to the shift to production of midstream products, mainly NdPr oxide. The Materials Segment’s revenues increased 14% to $55.6 million in the quarter as higher sales volumes were offset by a 16% decline in realized pricing.

REO production increased 10% year over year to 12,213 metric tons on higher recoveries from the continued implementation of Upstream 60K optimizations. Due to company’s ramp-up in midstream operations, a major part of the REO production was used to produce separated rare earth products rather than being sold as rare earth concentrate. Sales volumes thus plunged 33%, resulting in a $10 million decline in rare earth concentrate revenues.

The Magnetics segment made its first metal deliveries in March, generating revenues of $5.2 million for the quarter. MP Material’s total revenues of $60.8 million missed the Zacks Consensus Estimate of $64 million.

Cost of sales surged 37% due to higher production costs. Selling, general and administrative expenses were up 14% on higher employee headcount to support downstream expansion. Adjusted EBITDA was a loss of $2.7 million compared with a loss of $1.2 million in the year-ago quarter.

The company reported an adjusted loss of 12 cents due to higher cost of sales, general and administrative expenses as well as elevated interest expenses.

On April 17, 2025, MP Materials halted rare earth concentrate shipments to China in response to Chinese tariffs and export controls, cutting off a revenue stream. Historically, through its Materials segment, the company sold the majority of its rare earth concentrate to Shenghe under the terms of the Offtake Agreement. This sales accounted for approximately 50% of MP Materials’ revenues in the first quarter of 2025 and 70% of total revenues in 2024. While the Offtake Agreement with Shenghe remains active through January 2026, future shipments depend on policy changes.

MP is meanwhile focusing on ramping production and selling separated rare earth products to markets outside China, including Japan and South Korea.

As the company continues to produce and sell more separated products at Mountain Pass, it will lead to higher costs in 2025. This reflects higher production costs associated with separated rare earth products compared to rare earth concentrate. Its ramp-up of output of magnetic precursor products will also lead to higher costs.

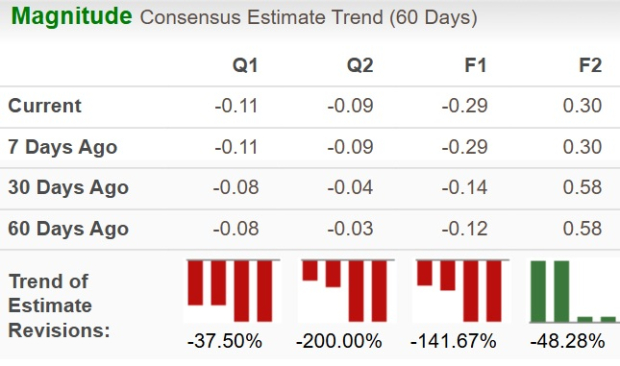

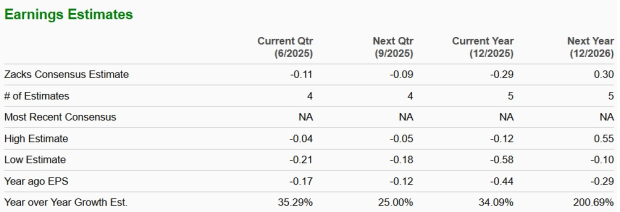

The Zacks Consensus Estimate for MP’s fiscal 2025 and 2026 earnings has moved south over the past 60 days.

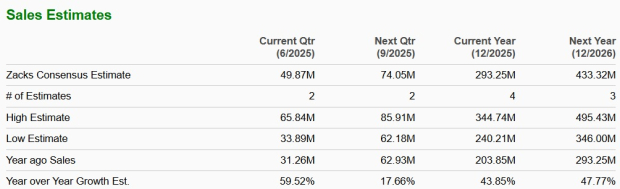

The Zacks Consensus Estimate for MP Materials’ revenues is projected to grow 43.85% in 2025 and a further 47.8% in 2026.

Despite the growth, the Zacks Consensus Estimate for 2025 is currently pegged at a loss of 29 cents. It, however, suggests an improvement from the loss of 44 cents incurred by MP Materials in 2024. A turnaround is anticipated in 2026, with projected earnings of 30 cents per share.

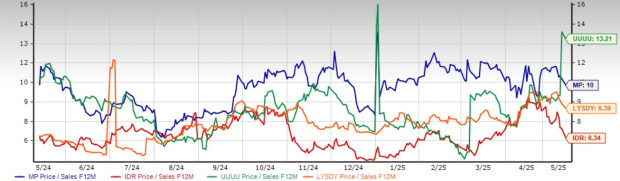

MP Materials stock is currently trading at a premium compared with its industry on a forward 12-month P/Sales basis. Its Value Score of F suggests that the stock is not so cheap and indicates a stretched valuation at this moment.

Energy Fuels is meanwhile trading higher, at 13.21. Idaho Strategic Resources and Lynas are comparatively cheaper options than MP, trading at 6.34 and 8.39 respectively.

MP Materials is the largest producer of rare earth materials in the Western Hemisphere. Headquartered in Las Vegas, NV, the company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility — the only rare earth mining and processing site of scale in North America. The company is also developing a rare earth metal, alloy and magnet manufacturing facility in Fort Worth, TX, where it produces and sells magnetic precursor products and anticipates manufacturing neodymium-iron-boron (NdFeB) permanent magnets by the end of 2025.

Rare earth products are critical inputs in hundreds of existing and emerging clean-tech applications, including electric vehicles and wind turbines, as well as robotics, drones and defense applications. The market is currently dominated by China, and there has been an increasing focus on developing domestic REE capabilities in the United States.

As of Dec. 31, 2024, MP Materials’ total proven and probable reserves were estimated at 2.04 million short tons of REO contained in 29.69 million short tons of ore at Mountain Pass, with an average ore grade of 5.97%. Based on this, combined with the production ramp-up of its midstream operations, the estimated mine life is 29 years. MP expects to extend this lifespan through further exploration and enhanced processing, which could lead to revisions in reserve estimates over time.

The company is making investments to boost its production capacity. Investors holding MP shares should retain the stock in their portfolio to benefit from the solid long-term fundamentals of rare earth products.

However, considering its premium valuation, loss of revenue stream and expected loss for the current year, accompanied by downward estimate revision activity, new investors can wait for a better entry point. MP Materials currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Rare-Earth Miner MP Materials to Invest More Than $1.25 Billion in New Texas Factory

MP

The Wall Street Journal

|

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite