|

|

|

|

|||||

|

|

Recursion Pharmaceuticals RXRX shares have plunged 21.6% so far in May. This considerable decline in the stock was observed after the company reported weaker-than-expected first-quarter 2025 results, as both earnings and revenues missed estimates, last week. In the absence of an approved product, RXRX only recognizes collaboration and grant revenues from its partners.

The decline was further aggravated after Recursion Pharmaceuticals discontinued the development of its lead candidate, REC-994, for treating symptomatic cerebral cavernous malformation (CCM) and the development of REC-2282 for the neurofibromatosis type II indication (NF2). The decision was part of the company’s strategic pipeline reprioritization efforts, following unfavorable efficacy results from separate mid-stage studies of these candidates.

RXRX also discontinued the mid-stage study on REC-3964 for treating clostridioides difficile infection to focus on other areas with greater unmet need. The company is currently looking to out-license the development rights to REC-3964. These setbacks have narrowed its basket of pipeline candidates.

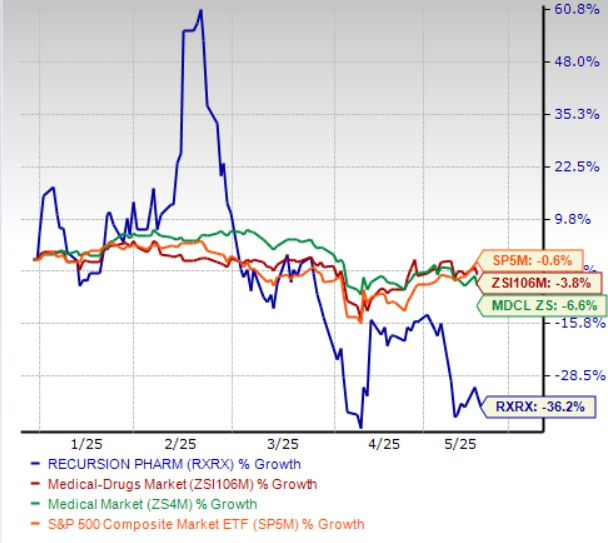

Year to date, RXRX stock has plummeted 36.2% compared with the industry’s 3.8% decline. The company has also underperformed in the sector and the S&P 500 during the same time frame, as seen in the chart below. The stock is currently trading below both its 50-day and 200-day moving averages.

However, Recursion Pharmaceuticals’ solid fundamentals and the promising potential of its AI-driven drug discovery platform, Recursion OS, developed in collaboration with NVIDIA Corporation, lead us to believe the stock could deliver multi-bagger returns in the future. Recently, RXRX acquired Exscientia, which added several clinical and preclinical candidates to the latter’s portfolio. Let’s dig deeper and understand the company’s strengths and weaknesses in greater detail to understand how to play the stock after the recent price drop.

Recursion Pharmaceuticals aims to shift the paradigm of drug discovery and development, which has historically been complex, costly, and prone to failure. Traditional biotech companies rely on a “trial-and-error” approach, leading to significant cash burn during early research and development. The high failure rates and funding challenges often result in financial instability or bankruptcy, hindering progress in the sector.

In contrast, RXRX leverages AI-powered models to test clinical compounds against a virtual library of human biology, hoping to identify promising candidates with higher probabilities of success in clinical development. This approach could reduce research costs, improve efficiency, and allow the company to deliver breakthrough therapies at lower prices. Additionally, it can generate incremental revenues by licensing its AI platform to other drug makers, as demonstrated by its collaborations with Bayer BAYRY, Sanofi SNY and Roche RHHBY. Even when candidates fail in clinical studies, Recursion Pharmaceuticals could use the resulting data to refine and enhance its AI models, improving accuracy and long-term outcomes.

As part of its strategic pipeline reprioritization efforts, Recursion Pharmaceuticals has shifted its focus and resources to the development of other candidates in its clinical pipeline. Such candidates include REC-4881, which is being developed for familial adenomatous polyposis in a phase Ib/II TUPELO study. The company recently reported encouraging preliminary data from this study. In the phase II open-label portion of the TUPELO study, REC-4881 showed a preliminary median 43% reduction in polyp burden by week 13. Additional data from the TUPELO study is expected in the second half of 2025.

Recursion Pharmaceuticals is also evaluating REC-1245, a new chemical entity for the treatment of biomarker-enriched solid tumors and lymphoma, in the phase I/II DAHLIA study. Data readout from the phase I portion of the DAHLIA study is expected in the first half of 2026. Other candidates in early-stage development include REC-617 (advanced solid tumors) and REC-3565 (B-cell malignancies) in separate early-stage studies. The company ended first-quarter 2025 with a cash balance of $509 million, which is expected to fuel operations into mid-2027 based on its current business plan.

Additionally, RXRX has ongoing collaboration agreements with pharma giants like Roche, Bayer, Merck and Sanofi to develop candidates for several oncology indications with differentiated mechanisms of action. The company recently received $7 million in collaboration revenues from Sanofi, following the achievement of a significant discovery milestone.

Recursion Pharmaceuticals faces intense competition from biotech firms, tech-driven drug discovery companies, and pharmaceutical giants, all leveraging computational tools and scalable platforms. Rivalry from companies like Relay Therapeutics, Isomorphic Labs, and even tech giants like Alphabet and Microsoft could challenge RXRX’s ability to differentiate itself and sustain its competitive edge.

Investors are also apprehensive of the company’s pipeline potential as its investigational candidates are still in the early stages of development and far from commercialization. There are chances that it will not have a product in the market for at least three to four years. Recently, the company faced a massive setback when it discontinued the development of REC-994 for CCM and REC-2282 for NF2.

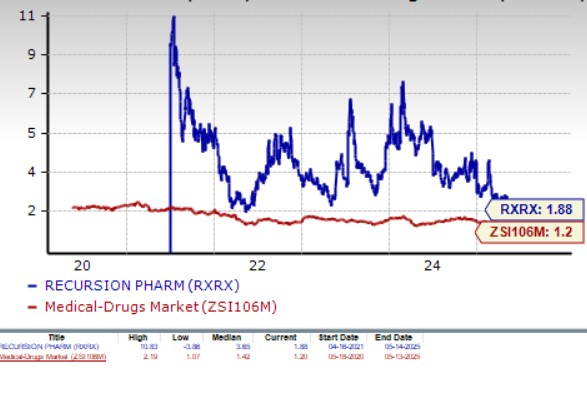

Recursion Pharmaceuticals is trading at a premium to the industry, as seen in the chart below. Going by the price/book value ratio, the company’s shares currently trade at 1.88, which is more than 1.20 for the industry. However, the stock is trading below its five-year mean of 3.65.

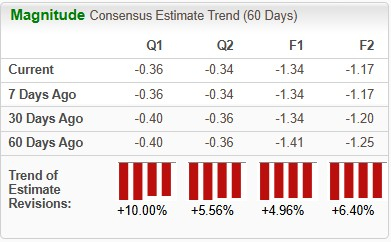

Loss estimates for 2025 have remained constant at $1.34 per share over the past 30 days. During the same time frame, RXRX’s 2026 loss per share estimates have narrowed from $1.20 to $1.17.

Recursion Pharmaceuticals, currently carrying a Zacks Rank #3 (Hold), has a first-mover advantage in AI-driven drug discovery, which positions it as a leader in the space, with a strong pipeline focused on Precision Oncology and Rare Diseases. The successful development and approval of its pipeline candidates would validate its AI platform and significantly enhance shareholder value. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We believe that the recent pipeline setbacks are a temporary affair. As clinical studies of its reprioritized portfolio of candidates advance successfully, existing investors may benefit from holding RXRX for potential multi-bagger returns in the future. The recent decline in stock price could also present an attractive entry point for new investors looking to capitalize on its long-term growth potential. However, given the stock’s volatility and dependence on external partnerships, investors with a low appetite for risk may find it prudent to avoid exposure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite