|

|

|

|

|||||

|

|

Broadcom AVGO and Marvell Technology MRVL are key providers of semiconductor solutions for end markets, including AI-powered data centers and cloud service providers. Both offer custom AI accelerators (XPUs) that power AI deployment. The Semiconductor Industry Association (SIA) expects a double-digit growth rate in 2025, with semiconductor sales surging 19.1% to $627.6 billion in 2024. This offers significant growth opportunities for both Broadcom and Marvell.

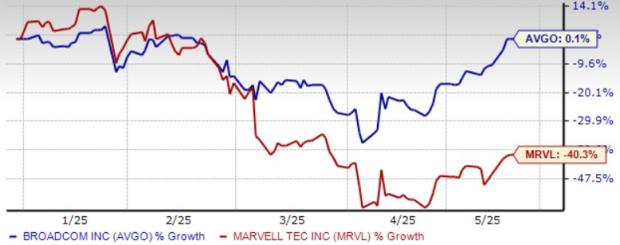

However, both AVGO and MRVL have suffered from challenging macroeconomic conditions amid tariff-related uncertainties. While Broadcom shares have climbed a modest 0.1% year to date, Marvell shares plunged 40.3%.

So, Broadcom or Marvell, which is a better buy amid the challenging macroeconomic backdrop? Let’s find out.

Strong demand for Broadcom’s application-specific integrated chips (ASICs), designed to support AI and machine learning and make these tasks more efficient, aids top-line growth. Custom AI accelerators (XPUs), which are a type of ASICs, are necessary to train Gen AI models, and they require complex integration of compute, memory, and I/O capabilities to achieve the necessary performance at lower power consumption and cost.

AVGO’s next-generation 3-nanometer XPUs are the first of their kind to market in that process node. Broadcom is on track for volume shipment to hyperscale customers in the second half of fiscal 2025. AVGO is now planning to develop the industry’s first 2-nanometer AI XPU packaging 3.5D and targets scaling clusters of 500,000 accelerators for hyperscale customers.

AVGO believes that by 2027, each of its three hyperscalers plans to deploy 1 million XPU clusters across a single fabric. Serviceable Addressable Market for XPUs and networks is expected to be between $60 billion and $90 billion in fiscal 2027 alone. Broadcom’s rich partner base, including NVIDIA, Arista Networks, DELL, Juniper and Supermicro, has been a key catalyst.

AVGO expects second-quarter fiscal 2025 AI revenues to jump 44% year over year to $4.4 billion. Semiconductor revenues are expected to surge 17% year over year to $14.9 billion.

Marvell’s custom AI silicon and electro-optics solutions have enabled it to become a leading player in the high-performance computing space. The company is benefiting from hyperscalers’ ramping up their use of custom silicon for AI workloads. In fiscal 2025, AI-based revenues crossed its $1.5 billion target, and Marvell expects to “very significantly” surpass its $2.5 billion AI revenue target in fiscal 2026. Marvell’s management is confident that revenues from its custom XPU solutions will continue expanding in fiscal 2027 and beyond.

As AI workloads grow, data centers need enhanced networking and interconnect products. MRVL is capitalizing on this shift with its high-speed optical interconnects, including 800G PAM, 400ZR DCI, and its industry-first 1.6T PAM DSP (digital signal processor), which cuts down on optical module power usage by 20%.

Furthermore, the shift from copper to optical connectivity in AI infrastructure represents a massive growth opportunity for the company. MRVL’s Co-Packaged Optics technology and its development of the industry's first 2nm silicon IP for cloud and AI workloads solidify its position in the next-generation networking space.

The Zacks Consensus Estimate for AVGO’s fiscal 2025 earnings is pegged at $6.60 per share, unchanged over the past 30 days, indicating a 35.52% increase over fiscal 2024’s reported figure.

Broadcom Inc. price-consensus-chart | Broadcom Inc. Quote

However, the consensus mark for Marvell’s fiscal 2026 earnings has declined by a penny to $2.76 per share over the past 30 days, suggesting 75.16% growth over fiscal 2025.

Marvell Technology, Inc. price-consensus-chart | Marvell Technology, Inc. Quote

Both AVGO’s and MRVL’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. However, Marvell’s average surprise of 4.25% is better than AVGO’s surprise of 3.44%, reflecting a good quality of earnings beat on a consistent basis.

Both Marvell and Broadcom are overvalued, as suggested by the Value Score of D.

However, in terms of forward 12-month Price/Sales, Marvell shares are trading at 6.54X, lower than AVGO’s 16.12X.

Broadcom’s expanding AI portfolio, along with a rich partner base, reflects solid top-line growth potential. Marvell’s near-term prospects are dull, as customers are rescheduling orders to manage excess chip inventories. The U.S. government’s export restriction on certain Chinese customers is likely to continue to be an overhang on Marvell’s top line.

Currently, Broadcom has a Zacks Rank #2 (Buy), making the stock a must-pick compared with Marvell, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 5 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite