|

|

|

|

|||||

|

|

Viasat, Inc. VSAT recently announced that it is collaborating with Blue Origin, a Washington-based space technology company, to demonstrate the Viasat InRange launch telemetry relay service. The demonstration of Viasat’s new space-based launch communication system is set to be conducted by using Blue Origin’s new Glenn rocket. This venture is part of Viasat’s engagement with the National Aeronautics and Space Administration’s ("NASA") Communications Services Project (CSP), which is focused on advancing commercial alternatives to legacy government communications infrastructure.

Traditional launch vehicles face significant limitations due to their reliance on ground-based telemetry systems, which necessitate maintaining a direct line of sight with tracking stations. This limits launch flexibility, confines operations to specific geographic corridors, and can reduce overall launch efficiency. Managing and coordinating these ground assets also increases costs, adds operational complexity, and frequently results in scheduling delays.

Viasat’s InRange solution offers a cost-effective and flexible concept for rapid and responsive launch telemetry. The concept is engineered to provide a continuous relay connection between launch vehicles and ground systems via Viasat’s global L-band satellite network. This capability enables real-time transmission of launch data during flight, allowing mission controllers to monitor vehicle performance beyond the limits of ground-based systems. This development eliminates communication gaps, often referred to as blackouts, that occur when a launch vehicle passes through areas not covered by Earth-based communications infrastructure.

Through this partnership, Viasat will support NASA’s strategic transition away from the Tracking and Data Relay Satellite (TDRS) system toward commercial satellite communications solutions. Additionally, Viasat is aligning its InRange demonstration efforts with NASA’s Launch Services Program, which historically handled the reception and distribution of TDRS relayed telemetry data.

As part of this initiative, Viasat’s Space and Mission Systems team, part of the company’s Defense and Advanced Technologies segment, will work with Blue Origin across two planned launches using the New Glenn launch vehicle. The first New Glenn launch featuring Viasat’s InRange system is expected to take place later this year and will serve as the initial in-flight test of the service. This flight is also anticipated to mark the first demonstration of Viasat’s space-relay capabilities developed under the NASA CSP program, which includes a broader portfolio of multi-band relay services for low-Earth orbit missions and satellite constellations. The second mission, which will be a full InRange service demonstration, is currently planned for 2026.

Viasat has experienced soft demand trends in some end markets in the past few quarters. Its communication service business is plagued by fierce competition. However, Viasat is steadily expanding its portfolio of offerings to capitaliz emerging market trends.

As NASA phases out the TDRS system, demand for commercial alternatives will increase. A successful demonstration of the InRange launch telemetry relay service can give Viasat a competitive advantage in the industry. This will likely lead to higher revenues. An improved financial performance is likely to propel the stock upward.

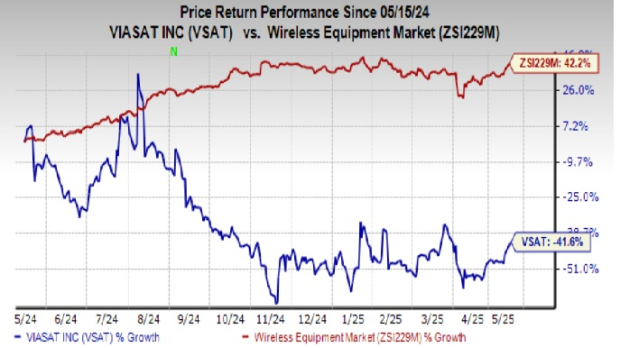

Shares of Viasat have plunged 41.6% over the past year against the industry’s growth of 42.2%.

Viasat currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader industry have been discussed below:

Juniper Networks, Inc. JNPR sports a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the last reported quarter, it delivered an earnings surprise of 4.88%. Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities within the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence. Juniper also introduced new features within the AI-driven enterprise portfolio that enable customers to simplify the rollout of their campus wired and wireless networks while bringing greater insight to network operators.

InterDigital IDCC carries a Zacks Rank #2 (Buy) at present. In the trailing four quarters, InterDigital delivered an earnings surprise of 160.15%. The company is a pioneer in advanced mobile technologies that enable wireless communications and capabilities.

InterDigital designs and develops a wide range of advanced technology solutions used in digital cellular, wireless 3G, 4G, and IEEE 802-related products and networks.

Arista Networks, Inc. ANET, carrying a Zacks Rank of 2 at present, supplies products to a prestigious set of customers, including Fortune 500 global companies in markets such as cloud titans, enterprises, financials and specialty cloud service providers.

Arista delivered a trailing four-quarter average earnings surprise of 11.82% and has a long-term growth expectation of 14.81%. Arista currently serves five verticals, namely – cloud titans (customers that deploy more than one million servers), cloud specialty providers, service providers, financial services and the rest of the enterprise.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite