|

|

|

|

|||||

|

|

United Natural Foods, Inc.’s UNFI shares have gained 18.2% in the past month, outperforming the industry’s decline of 2.6% and the broader S&P 500 index’s growth of 8.9%. With United Natural Foods’ massive rise in the past month, investors now face a key decision: Should they hold on to the stock or book a profit?

Closing at $28.41 yesterday, UNFI is trading above the 50 and 200-day simple moving averages of $26.26 and $23.40, respectively. This upward trajectory highlights the stock’s strong momentum and price stability, signaling positive investor sentiment.

United Natural Foods’ natural and organic business continues to exhibit impressive growth, driven by heightened consumer demand for healthier and more sustainable products. This aligns with broader consumer trends favoring “better-for-you” products, which have proven resilient and increasingly popular. UNFI’s ability to deliver value-added services, insights and differentiated offerings has reinforced its position as a trusted partner to retailers operating in this high-growth segment.

UNFI has been making meaningful progress in optimizing its distribution network to enhance efficiency and support long-term growth. In mid-February, the company consolidated its distribution center in Fort Wayne, IN, redirecting volume to more modern centers nearby. The previously closed Billings DC is under contract, with the sale expected to close in the fourth quarter of fiscal 2025. Proceeds will help reduce net debt. These strategic moves reflect UNFI’s focus on driving operational efficiency and financial flexibility.

Lean management has become a cornerstone of UNFI’s operational strategy, enabling cost savings and efficiency improvements across the organization. In the second quarter of fiscal 2025, operating expenses declined to 12.6% of net sales from 13% in the prior-year quarter. This reduction highlights the company’s disciplined execution and focus on continuous improvement.

This operational efficiency, combined with steady revenue growth, has translated into stronger financial performance. In the fiscal second quarter, adjusted EBITDA rose nearly 13.3% year over year to approximately $145 million. Additional gains from below-the-line items further boosted profitability, with adjusted earnings per share increasing 214.3% to 22 cents from 7 cents in the prior-year quarter.

UNFI continues to face persistent headwinds in its retail segment. In the second quarter of fiscal 2025, total retail sales declined 3.3% year over year, primarily due to the closure of five stores over the past 12 months. Same-store sales (ID) fell by approximately 40 basis points, indicating stable performance at remaining locations but underscoring broader challenges in maintaining growth and customer loyalty. UNFI’s retail segment may continue to struggle in a tough market filled with strong discount and specialty retailers unless it can put a more effective turnaround plan in place.

Profitability also came under pressure, with the company’s gross margin narrowing to 13.1% in the fiscal second quarter, down from 13.3% in the prior-year period. This 20-basis-point decline was mainly caused by a weaker wholesale margin rate and an ongoing shift in the business mix toward wholesale.

While UNFI has taken steps to mitigate margin pressures through cost-saving initiatives, such as improving operational efficiency, implementing supplier programs and reducing shrinkage, these efforts have not fully offset the broader margin contraction. Continued margin erosion, particularly amid rising operational costs and heightened competitive pricing, poses a risk to sustained profitability and may limit the company’s ability to invest in growth initiatives.

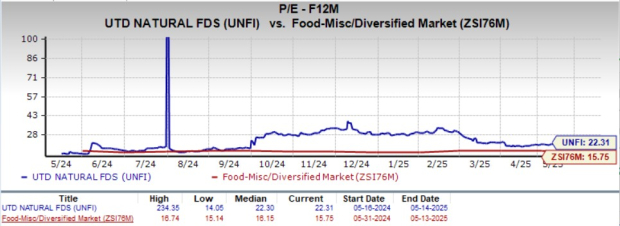

From a valuation perspective, United Natural Foods is trading at a premium compared with industry benchmarks. The company’s forward 12-month price-to-earnings multiple of 22.31X remains above the industry average of 15.75X, indicating potential overvaluation relative to its fundamentals.

United Natural Foods’ recent stock rally reflects investor confidence driven by solid operational execution, efficiency gains and strong momentum in its high-growth natural and organic segment. However, lingering challenges in retail, ongoing margin pressure and a relatively high valuation suggest that the stock may be priced for near-term perfection. All said, current investors are likely to benefit from holding, while new investors might want to wait for clear signs of stabilization before initiating a position. At present, UNFI carries a Zacks Rank #3 (Hold).

Nomad Foods Limited NOMD manufactures, markets and distributes a range of frozen food products in the United Kingdom and internationally. It currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods' current fiscal-year sales and earnings implies growth of 6% and 7.3%, respectively, from the prior-year levels. NOMD delivered a trailing four-quarter earnings surprise of 3.2%, on average.

Mondelez International, Inc. MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa and Europe. It presently carries a Zacks Rank of 2 (Buy). MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 4.9% from the year-ago numbers.

Oatly Group AB OTLY, an oatmilk company, provides a range of plant-based dairy products made from oats. It presently carries a Zacks Rank of 2. OTLY delivered a trailing four-quarter earnings surprise of 25.1%, on average.

The consensus estimate for Oatly Group’s current fiscal-year sales and earnings implies growth of 2.7% and 56.6%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 10 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite