|

|

|

|

|||||

|

|

In the rapidly evolving landscape of entertainment streaming, Netflix NFLX and Paramount Global PARA represent two distinct approaches to capturing audience attention and market share. Netflix, the pioneer that transformed how we consume content, has evolved into a global powerhouse with more than 300 million paid households. Paramount Global, born from the merger of ViacomCBS, combines traditional media assets with streaming ambitions through Paramount+.

Both companies are navigating similar challenges: intensifying competition, evolving consumer preferences, and the need to balance content investments with profitability. As streaming becomes the dominant form of entertainment consumption, investors are increasingly scrutinizing which media companies can deliver sustainable growth and returns in this new paradigm.

Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Netflix has demonstrated remarkable resilience and innovation in the first quarter of 2025, posting impressive results that highlight its dominant position in the streaming wars. Revenues grew 13% year over year to $10.5 billion, while operating income surged 27% to $3.3 billion. This strong performance reflects Netflix's successful execution of its strategic priorities, which include improving content offerings and growing its advertising business.

The company's content strategy continues to deliver results, with breakthrough originals like Adolescence, which became the third most popular English-language series ever with 124 million views. Netflix's international expansion is equally impressive, with significant investments in local content production across 50 countries. This global approach has paid dividends, as evidenced by the company's U.K. success, where it has captured 9% of TV viewing time, trailing only BBC and ITV.

Netflix's upcoming content pipeline further strengthens its investment case. The second quarter features high-profile films like Nonnas starring Vince Vaughn, Straw with Taraji P. Henson and Havoc featuring Tom Hardy. The highly anticipated final season of Squid Game, Netflix's most popular series ever, debuts on Jun. 27, 2025, accompanied by updates to the related games experience, showcasing Netflix's cross-platform content monetization strategy.

Netflix's financial discipline stands out as a particular strength. The company generated $2.6 billion in free cash flow for the first quarter, demonstrating its ability to convert growth into tangible returns for shareholders. Management has also set ambitious but achievable targets, including doubling revenues by 2030 and achieving $9 billion in annual advertising revenues by the same year. The company's advertising business represents a significant growth opportunity, with the successful launch of Netflix's Ad Suite in the United States on April 1 and international expansion planned for this quarter. Management expects advertising revenues to double in 2025, creating a new revenue stream that complements its successful subscription model.

The Zacks Consensus Estimate for 2025 revenues is pegged at $44.47 billion, indicating 14.01% year-over-year growth. The Zacks Consensus Estimate for 2025 earnings is pegged at $25.33 per share, indicating 27.74% growth year over year.

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Paramount Global has been struggling to transform itself amid significant challenges. While the company posted revenues of $7.2 billion in the first quarter of 2025, this represented a 6% decline year over year, even when excluding the impact of the prior year's Super Bowl broadcast. The company's TV Media segment, which still accounts for the largest portion of revenues, saw a concerning 13% decrease.

Despite reaching 79 million Paramount+ subscribers, the Direct-to-Consumer segment continues to operate at a loss of $109 million. Although this represents an improvement of $177 million year over year, it pales in comparison to Netflix's profitability and scale. Additionally, Paramount+ faces subscriber growth challenges, with management warning about expected subscriber declines in the second quarter due to content seasonality and the termination of an international hard bundle partnership.

Paramount Global's content strategy appears unfocused compared with Netflix, spreading investments across traditional broadcast, cable networks, film, and streaming. While the company celebrates shows like Landman and 1923, it lacks the consistent hit ratio of Netflix. The company also faces monetization challenges with Pluto TV, its free ad-supported service, where increased supply in digital video has pressured advertising revenues.

The uncertain Skydance merger further complicates Paramount Global's investment case. Though management confirmed the transactions are expected to close in the first half of 2025, this pending deal creates uncertainty about future strategic direction. Questions also remain about the treatment of voting shareholders in the transaction, as highlighted by recent legal challenges from GAMCO Investors.

The Zacks Consensus Estimate for PARA’s 2025 earnings is pegged at $1.32 per share, indicating a 14.29% decrease year over year. The consensus estimate for 2025 revenues is pinned at $28.43 billion, suggesting a year-over-year decline of 2.67%.

Paramount Global price-consensus-chart | Paramount Global Quote

Netflix currently trades at a premium valuation compared to Paramount Global, but the disparity appears justified given the companies' divergent financial trajectories. Netflix's price-to-earnings ratio of 43.21x reflects investors' confidence in its sustainable growth model, robust free cash flow generation, and clear path to increased profitability. In contrast, PARA's lower valuation multiple of 7.48x signals market skepticism about its ability to successfully navigate the transition to streaming.

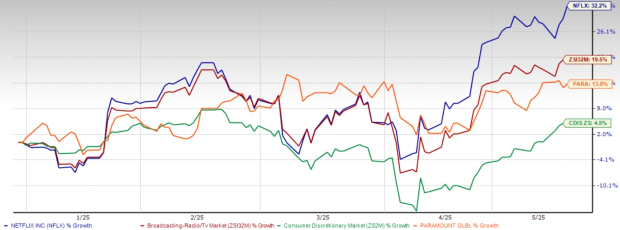

Stock performance tells a similar story. Netflix shares have shown strong momentum, trading near all-time highs and significantly outperforming both the broader market and the entertainment sector. Paramount Global shares, meanwhile, have underperformed, weighed down by concerns about linear TV decline, streaming profitability challenges and transaction uncertainty.

Shares of NFLX have surged 32.2% in the year-to-date period, outperforming PARA and the broader Zacks Consumer Discretionary sector.

Netflix's solid balance sheet, with $7.2 billion in cash and cash equivalents, provides flexibility for content investments and shareholder returns. Paramount Global, despite generating $123 million in free cash flow in the first quarter, faces greater financial constraints and uncertainty about future capital allocation priorities.

Netflix emerges as the superior investment choice in the streaming wars based on its robust financial performance, strategic clarity, and execution capabilities. While Paramount struggles with declining legacy businesses and unprofitable streaming operations, Netflix continues to innovate and expand its dominance globally. NFLX's superior content strategy, successful advertising initiatives, and impressive cash flow generation create a compelling investment case. Investors should consider buying Netflix for its long-term growth prospects and potential for increased shareholder returns, while approaching Paramount Global with caution given its structural challenges and uncertain future. In the battle for streaming supremacy, Netflix has established itself as the safer and more promising investment bet. NFLX currently carries a Zacks Rank #2 (Buy), whereas PARA has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

How Blockbuster Films and Bingeworthy Streaming Hits Slipped Into Our Showers

NFLX

The Wall Street Journal

|

| Feb-15 | |

| Feb-15 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite