|

|

|

|

|||||

|

|

Rio Tinto Group RIO announced that it has inked a binding agreement with Corporación Nacional Del Cobre de Chile (Codelco) to form a joint venture (JV) for a lithium project in Chile's Salar de Maricunga. This move aims to strengthen Rio Tinto and Chile's roles as key suppliers of materials driving the global energy transition.

The Salar de Maricunga project boasts a significant lithium resource with high-grade lithium content, which offers the joint venture a potential for large-scale, long-term and cost-effective production.

Rio Tinto and Codelco will develop and operate the project under the terms of the JV.

RIO will acquire a 49.99% stake in the Salar de Maricunga project by funding development costs. The investment includes $350 million for studies and resource analysis to reach a final investment decision. It will invest $500 million in construction costs when the project gets approval. RIO will pay an additional $50 million if the JV delivers the first lithium by the end of 2030.

If additional funds are required, the partners will share the requirements proportionally based on their ownership stakes in the JV.

Rio Tinto and Codelco’s joint venture will use Direct Lithium Extraction technology and gain from the former’s expertise as a leading producer of lithium for the global market. The JV will deliver further value-adding growth in RIO’s portfolio of critical minerals essential for the energy transition.

The companies will prioritize strong local community engagement and support infrastructure development (including power and roads). The JV aims to utilize advanced technologies for extraction, processing, and re-injection to maximize mineral recovery while minimizing environmental impact.

The deal is expected to be closed by the end of the first quarter of 2026, subject to customary closing conditions.

Lithium is a critical element necessary for a wide spectrum of applications. Its prices have declined 31% in a year due to an oversupplied market. Given that lithium is expected to play a crucial role in the transition to a low-carbon, clean-energy economy, demand for the metal is anticipated to increase in the years to come. Rio Tinto is expanding its lithium portfolio to capitalize on the expected surge in demand.

In 2022, RIO acquired the Rincon lithium project in Argentina, and in December 2024, it announced a $2.5 billion investment in the project. Rincon has the capacity to produce 60,000 tons of battery-grade lithium carbonate per year, including a 3,000-ton starter plant and a 57,000-ton expansion plant. The mine's ore reserves are 60% higher than what the company projected at the time of acquisition. This mine is expected to operate in the lowest quartile of the cost curve and has an expected mine life of around 40 years. First production is expected in 2028, followed by a three-year ramp-up to full capacity.

Rio Tinto also owns the Jadar project in Serbia. The project was put on hold due to environmental protests. However, Serbia’s top court lifted the ban in July 2024. The Jadar Project will now be subject to stringent environmental requirements in compliance with Serbian and EU regulations, including having to progress through an extended phase of legal, EIA and permitting procedures, as well as public consultation and business assessments before a final investment decision is made on its construction. The Jadar project has the potential to be a world-class lithium-borates asset.

In March 2025, Rio Tinto completed its previously announced acquisition of Arcadium Lithium for $6.7 billion. This will position Rio Tinto as a major lithium producer with one of the world’s largest lithium resource bases. RIO aims to grow the capacity of its Tier 1 assets to more than 200,000 tons of lithium carbonate equivalent (LCE) per annum by 2028.

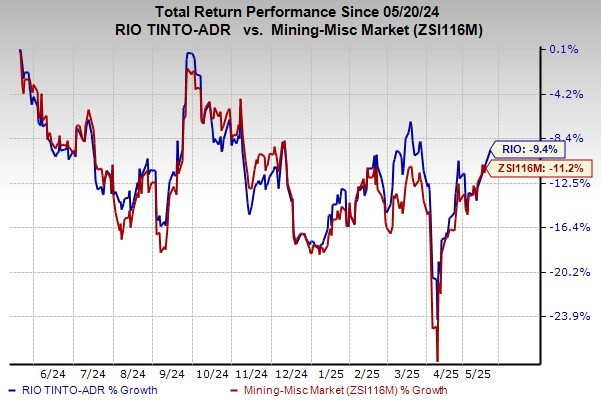

In the past year, shares of Rio Tinto have lost 9.4% compared with the industry’s 11.2% decline.

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, SSR Mining Inc. SSRM, and Idaho Strategic Resources IDR. Carpenter Technology currently sports a Zacks Rank #1 (Strong Buy), while SSR Mining and Idaho Strategic Resources carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has a trailing four-quarter average earnings surprise of 11.1%. The Zacks Consensus Estimate for CRS’ 2025 earnings is pegged at $7.20 per share, which indicates year-over-year growth of 51.9%. Carpenter Technology’s shares have gained 111% in the past year.

SSR Mining has an average trailing four-quarter earnings surprise of 58.8%. The Zacks Consensus Estimate for SSRM’s 2025 earnings is pegged at $1.14 per share, implying year-over-year growth of 307%. SSR Mining stock has soared 88.6% in the past year.

Idaho Strategic Resources has an average trailing four-quarter earnings surprise of 21.7%. The Zacks Consensus Estimate for Idaho Strategic’s 2025 earnings is pegged at 78 cents per share, indicating year-over-year growth of 16.4%. IDR’s shares have jumped 24.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Mining Stocks Face Big Expectations Ahead Of Earnings, As Gold And Silver Sink

SSRM -7.83%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite