|

|

|

|

|||||

|

|

Western Digital Corporation WDC is driving a new era of storage innovation by advancing infrastructure solutions tailored for artificial intelligence/machine learning (AI/ML), software-defined storage (SDS) and disaggregated storage. With a focus on hyperscale cloud service providers (CSPs), enterprises and Storage-as-a-Service (STaaS) vendors, the company’s Platforms Business delivers both high-capacity JBODs (Just a Bunch of Disks) and high-performance EBOF (Ethernet Bunch of Flash) NVMe-oF solutions to power intensive data workloads.

As AI and data-centric computing evolve, organizations are under increasing pressure to deploy scalable, efficient and sustainable storage systems. To address this demand, Western Digital has announced major enhancements to its Open Composable Compatibility Lab (OCCL), including the launch of OCCL 2.0, the Ultrastar Data102 ORv3 JBOD and the OpenFlex Data24 4100, which feature single-port SSDs and additional SSD qualifications for its OpenFlex Data24 NVMe-oF platform.

Western Digital Corporation price-consensus-chart | Western Digital Corporation Quote

At Computex, Western Digital introduced the OpenFlex Data24 4100 EBOF, designed for cloud environments using single-port SSDs and system-level mirroring. It joins the Data24 4000 series. The new Ultrastar Data102 3000 ORv3 JBOD, aligned with Open Rack v3 specifications, offers improved efficiency, airflow and manageability.

Located in Colorado Springs, the OCCL is a vendor-neutral innovation hub designed to accelerate industry-wide adoption of open, fabric-attached storage and SDS solutions. OCCL 2.0 introduces new capabilities such as comprehensive solutions architecture guidance for deploying disaggregated infrastructure, best practice frameworks for maximizing storage efficiency and benchmarking tools for evaluating SSD partner performance. With these updates, OCCL 2.0 aims to deepen collaboration with ecosystem partners while helping customers reduce deployment risks, improve interoperability and build future-ready infrastructure.

The lab continues to play a pivotal role in shaping the next generation of composable architectures, with a growing list of ecosystem collaborators that includes Arista Networks, Broadcom, DapuStor, Graid Technology, Ingrasys, Intel, Kioxia, MinIO, NVIDIA, OSNexus, PEAK:AIO, Phison, SanDisk, ScaleFlux, ThinkParQ/BeeGFS and Xinnor. As the industry moves away from proprietary models, Western Digital’s OCCL 2.0 strengthens its leadership in creating flexible, open ecosystems that meet the performance, efficiency and scale demands of modern data infrastructure.

Management expects the proliferation of generative AI-driven storage deployments to result in a client and consumer device refresh cycle and boost content growth in smartphone, gaming, PC and consumer in the long run. Increasing AI adoption is likely to drive increased storage demand across both HDD and Flash at the edge and core, thereby providing ample business opportunities.

As demand grows, high-bandwidth memory (HBM) becomes key for AI servers, while NAND flash remains vital for storage, powering SSDs for text, images and videos. Gen AI adoption is driving eSSD sales due to its speed, reliability and efficiency over HDDs. Growing AI data boosts demand, fueling eSSD market growth and reshaping storage.

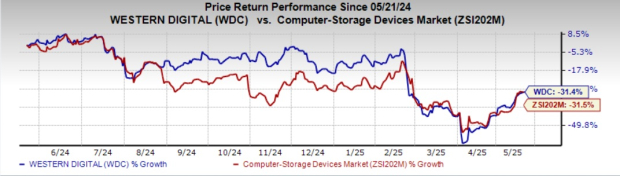

Western Digital currently carries a Zacks Rank #5 (Strong Sell). Shares of the company have lost 31.4% in the past year compared with the Zacks Computer- Storage Devices industry's decline of 31.5%. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Some better-ranked stocks from the broader technology space are TaskUs, Inc. TASK, SAP SAP and Teradata Corporation TDC. TASK sports a Zacks Rank #1 (Strong Buy) while SAP and TDC carry a Zacks Rank #2 (Buy).

TaskUs’ earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, with the average surprise being 6.39%. In the last reported quarter, TASK delivered an earnings surprise of 18.75%. Its shares have soared 11.8% in the past year.

SAP’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 10.14%. In the last reported quarter, SAP delivered an earnings surprise of 8.63%. The company’s long-term earnings growth rate is 10.2%. Its shares have surged 53.4% in the past year.

Teradata’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters with the average surprise being 24.63%. In the last reported quarter, TDC delivered an earnings surprise of 15.79%. Its shares have declined 31.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite