|

|

|

|

|||||

|

|

On May 14, 2025, Azul S.A. (AZUL) reported lower-than-expected first-quarter 2025 results, wherein the company’s bottom line and top line lagged the Zacks Consensus Estimate.

AZUL shares have plunged 9.3% following its May 14 earnings release.

The lower-than-expected results naturally raise the question: Should investors buy AZUL stock now following the dip in share price? A more in-depth analysis is needed to make that determination. Before diving into AZUL’s investment prospects, let’s take a glance at its quarterly numbers.

Azulincurred a loss of $2.18 per share in the first quarter of 2025, in contrast to the Zacks Consensus Estimate of earnings of 4 cents per share. Loss per share was 57 cents in the first quarter of 2024.

Total revenues of $920 million lagged the Zacks Consensus Estimate of $925 million. AZUL’s first-quarter 2025 revenues benefit from a healthy demand environment, robust ancillary revenues and the outstanding performance of its business units. With more people taking to the skies, Azul’s passenger revenues, contributing 93% to the top line, grew 15.2% year over year.

Cargo revenues and other grew 17.3% year over year, driven by improved performance and the recovery of AZUL’s international operations. In first-quarter 2025, international cargo revenues reported solid 62% year-over-year growth, with a healthy EBITDA that more than doubled year over year.

Consolidated traffic, measured in revenue passenger kilometers (RPKs), rose 19.4% (up 14.7% domestic and 38.3% on the international front) year over year. Consolidated available seat kilometers (ASK), measuring an airline's passenger-carrying capacity, increased 15.6% from the year-ago quarter, with a 10.2% rise in domestic capacity and a 39.2% surge in international capacity. Since traffic outpaced the capacity expansion, load factor (percentage of seats filled with passengers) grew 2.6 percentage points to 81.5%.

Azul’s total revenues per ASK or RASK were R$42.14 cents, down 0.2% year over year. Passenger revenues per ASK or PRASK decreased 0.4% year over year.

Azul made significant improvements in the overall travel experience, which led to a customer satisfaction scores recovery of more than 30 points in March 2025 compared to December 2024. As a result, AZUL’s exceptional customer service has helped it attain the position of the best airline in Brazil as per ANAC’s customer satisfaction rankings for the third consecutive year.

AZUL witnessed remarkable growth in its business units, accounting for 23% of RASK and 35% of EBITDA. AZUL’s loyalty program, Azul Fidelidade, now has almost 19 million members, with active users at all-time highs, up 12% year-over-year. Its vacation business, Azul Viagens, increased gross bookings by 57% year over year, owing to strong demand in leisure markets supported by Azul’s dedicated vacations network.

Its logistics business, Azul Cargo, resumed its solid growth, with total revenue increasing 18% year over year, mostly driven by a 62% increase in international revenues. The robust demand environment and high performance of Azul’s business units allowed it to increase capacity by 16%, mostly driven by a 39% increase in international operations. In the first quarter of 2025, Azul transported nearly 8 million passengers, up 9.8% from the year-ago quarter.

Despite being hurt by macroeconomic factors, Azul’s cost reduction initiatives and productivity improvements have paid off. In first-quarter 2025, productivity measured in ASKs per full-time equivalent increased 19% year over year. Further, Azul’s investment in next-generation aircraft has significantly contributed to improved fuel efficiency, with consumption per ASK dropping by 2.5% from the year-ago quarter.

Through its unique fleet and network combination, Azul serves as the only carrier on 82% of its routes, connecting more than 150 destinations, many of which are in the fastest-growing regions of Brazil.

From a valuation perspective, AZUL is trading at a discount compared to the industry, going by its forward 12-month price-to-sales ratio. The reading is also below its median over the last five years. The company has a Value Score of A.

The northward movement in operating expenses is hurting AZUL’s bottom line and challenging its financial stability. Operating expenses of R$4.82 billion grew 24.4% year over year in first-quarter 2025, due to the 15.6% increase in total capacity, an 18% depreciation of the Brazilian real against the US dollar and a 3% increase in fuel price. These were offset by higher productivity and cost-reduction initiatives.

Cost per ASK (CASK) grew 7.6% from the first-quarter 2024 reported figure. The upside was due to the 18% average depreciation of the Brazilian real against the U.S. dollar, 5.5% inflation over the last 12 months, an increase in the company’s international operations (which have higher airport fees and distribution costs) and growth of its fleet (which increased depreciation). These were partially offset by several cost-reduction initiatives related to productivity, as well as lower fuel burn from the next-generation aircraft in AZUL’s fleet.

CASK, excluding fuel, grew 11.5% year over year.

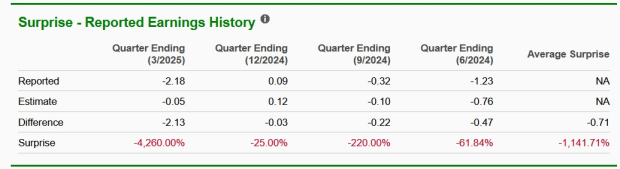

Further, AZUL has a disappointing earnings surprise history. The company’s earnings lagged the Zacks Consensus Estimate in each of the last four quarters, delivering an average miss of more than 100%.

Driven by this downbeat earnings performance, AZUL’s shares have plunged 66.5% so far this year, underperforming the Zacks Airline industry. Additionally, the company’s price performance compares unfavorably with that of other airline operators like Copa Holdings, S.A. (CPA) and Ryanair Holdings RYAAY in the same time frame.

It is understood that AZUL stock is attractively valued, and upbeat air travel demand is contributing to AZUL’s top-line growth. Despite being hurt by macroeconomic factors, Azul’s cost reduction initiatives and productivity improvements have paid off. Azul remains focused on emerging opportunities in both domestic and international markets.

However, investors should refrain from rushing to buy the dip in AZUL now. For long-term investors, a single quarter’s results are not so important as they would rather base their investment decision on the underlying fundamentals.

AZUL faces quite a few headwinds as highlighted above. In our view, investors should monitor the company’s developments closely for a more appropriate entry point. For those who already own the stock, it will be prudent to stay invested. The stock’s Zacks Rank #3 (Hold) supports our thesis. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite