|

|

|

|

|||||

|

|

Glaukos Corporation GKOS is well-poised for growth on the back of favorable clinical trial results and a robust product pipeline. However, stiff competition is a concern.

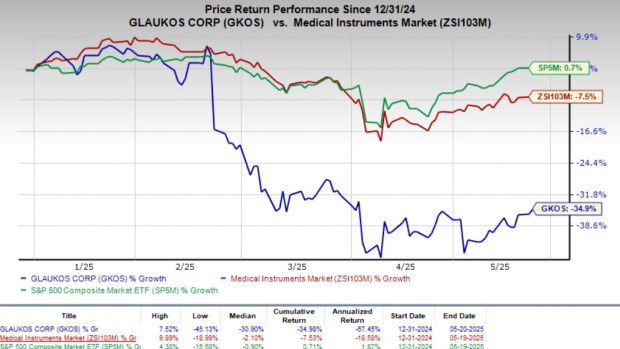

Shares of this Zacks Rank #3 (Hold) company have lost 34.9% so far this year compared with the industry’s 7.5% decline. The S&P 500 Index has increased 0.7% in the same time frame.

Glaukos, with a market capitalization of $5.48 billion, is a leading ophthalmic medical technology and pharmaceutical company. The company has a trailing four-quarter average earnings surprise of 21.62%.

Strong Product Demand: Glaukos' rising share price is largely driven by the success of its flagship product, iStent. The company delivered a robust performance in 2024 and maintains a favorable business outlook, thereby strengthening investors’ confidence. Additionally, the high demand for Glaukos' international glaucoma and Corneal Health products continues to fuel investors’ optimism.

During its fourth-quarter earnings call, Glaukos highlighted the increasing adoption of iStent Infinite for glaucoma patients, particularly those who are unresponsive to other treatments. This growth has been fueled by enhanced clinical education and improved market access. Furthermore, five out of seven Medicare Administrative Contractors have released draft local coverage determinations for iStent Infinite. This is anticipated to expand patient access.

Glaukos’ revenues surpassed estimates in the first quarter of 2025. The figure improved 24.6% year over year on the back of high demand for the company's products.The company expects full-year 2025 revenues of $475-$485 million. The company’s 2025 sales and earnings are likely to improve 25.5% and 53.4%, respectively.

Expanding Product Portfolio: GKOS’ top line in the first quarter was driven significantly by the strong adoption of its innovative iDose TR product. The U.S. glaucoma segment saw 41% year-over-year growth, with iDose TR continuing to gain traction due to its ability to deliver continuous therapy for up to three years. The company also emphasized the strategic rollout of iDose TR, with efforts focused on expanding surgeon training, payer access and clinical validation. Progress in Medicare Administrative Contractors like Noridian, Novitas, and First Coast has helped streamline reimbursement, boosting procedural volumes and commercial confidence.

Beyond iDose TR, Glaukos is making notable headway in product innovation and pipeline development. Key highlights include the FDA’s acceptance of the NDA for Epioxa, a next-gen, non-invasive corneal cross-linking therapy for keratoconus, targeting an October 2025 PDUFA date. Additionally, the company initiated a pivotal study for the PRESERFLO MicroShunt and continues to progress on multiple clinical fronts, including the iStent Infinite trial, third-generation iLink therapy, GLK-401 for wet AMD, and iDose TREX, the next-generation iDose variant. Glaukos also deepened its collaboration with Radius XR and Topcon Healthcare to enhance glaucoma diagnostics and care efficiency through digital tools.

Internationally, Glaukos is focused on expanding its footprint. The company sells its products through subsidiaries in 17 countries and independent distributors in other markets. Glaukos' international glaucoma franchise reported record sales of $29 million in the first quarter, reflecting 18.7% year-over-year operational growth. Sales were up 5.8% sequentially. This global expansion is expected to continue supporting the company's long-term growth trajectory.

GKOS currently depends on a limited number of third-party suppliers, including some sole suppliers, for components of the iStent, iStent inject models and other pipeline products. If any of these suppliers fail to provide sufficient quantities of components or drugs in a timely manner or on acceptable terms, Glaukos would need to seek alternative sources.

Glaukos faced headwinds from restrictive Medicare Local Coverage Determinations (LCDs) that impacted the use of multiple glaucoma surgical devices in the same procedure. This policy led to a mid-single-digit decline in the U.S. stent business despite iDose growth. Management acknowledged this challenge and is working on generating supporting clinical evidence and potential advocacy efforts to influence future policy changes. These LCD restrictions are expected to continue weighing on stent performance throughout 2025.

Glaukos Corporation price | Glaukos Corporation Quote

The bottom-line estimate for GKOS is pegged at a loss of 87 cents (for 2025), which narrowed 8.4% in the past 30 days. The Zacks Consensus Estimate for 2025 revenues is pinned at $480 million.

Some better-ranked stocks from the same medical industry are GENEDX HOLDINGS WGS, CVS Health CVS and Cencora COR.

GENEDX, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated growth rate of 336% for 2025. You can see the complete list of today’s Zacks #1 Rank stocks here.

WGS’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 145.82%. WGS’ shares have declined 6.1% so far this year.

CVS Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 12.2% for 2025.

CVS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 18.08%. CVS’ shares have risen 42% year to date.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 16.7% for 2025.

COR’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 6.00%. Its shares have gained 30.4% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite