|

|

|

|

|||||

|

|

Mergers and acquisitions grabbed the spotlight in the biotech sector once again this week after BioMarin BMRN agreed to acquire Inozyme Pharma INZY. Meanwhile, other pipeline and regulatory updates were in focus.

BioMarin Pharmaceutical announced that it has entered into a definitive agreement to acquire all outstanding shares of the clinical-stage company Inozyme Pharma for $4.00 per share in cash, totaling nearly $270 million.

Shares of INZY soared on the news.

The deal, approved by the board of directors of both companies, is expected to be closed in the third quarter of 2025.

BioMarin will add Inozyme’s lead asset, INZ-701, to its pipeline, following the completion of this acquisition. This investigational enzyme replacement therapy (ERT) is currently being evaluated in a pivotal late-stage study for the treatment of a rare genetic disorder, ectonucleotide pyrophosphatase/phosphodiesterase 1 (ENPP1) deficiency, in children.

The deal is a strategic fit for BioMarin, which already markets five first-in-disease enzyme therapies, namely Aldurazyme, Brineura, Naglazyme, Palynziq and Vimizim. The addition of Inozyme’s lead candidate will expand BioMarin’s Enzyme Therapies portfolio and further diversify its revenue stream.

Novavax NVAX announced that the FDA approved its protein-based COVID-19 vaccine, Nuvaxovid.

Shares of the company surged on this long-awaited approval from the FDA, albeit with a narrower label than initially expected.

While the agency granted full approval to Nuvaxovid for use in older adults aged 65 and above, it restricted the vaccine’s use in individuals aged 12-64 with at least one underlying condition that puts them at high risk for severe outcomes from COVID-19.

Additionally, the agency requires Novavax to conduct a new Phase IV post-marketing study in individuals aged 50 to 64 without high-risk conditions for severe COVID-19.

The full approval is based on data from a pivotal late-stage study, which showed that Nuvaxovid was safe and effective for the prevention of COVID-19. Until now, the vaccine had been available for use under the FDA’s emergency use authorization.

With the full approval, Nuvaxovid is the only non-mRNA-based COVID-19 vaccine available in the country.

Moderna MRNA announced that it has voluntarily withdrawn a regulatory filing seeking the FDA’s approval for mRNA-1083, its investigational mRNA-based combination vaccine against influenza and COVID-19. Per the company, the decision was taken in consultation with the agency. The stock was down on the announcement.

This setback derailed the company’s initial plans to secure a potential FDA approval for the vaccine before this year’s end.

Moderna plans to resubmit this filing later this year after vaccine efficacy data from the ongoing phase III study on its investigational seasonal influenza vaccine, mRNA-1010, is available. Interim data from this study is expected this summer.

The initial FDA filing, which sought approval for use in older adults aged 50 years and above, was supported by data from a phase III study announced last year. Data from this study showed that mRNA-1083 elicited higher immune responses against influenza and COVID-19 compared with licensed standalone influenza and COVID-19 vaccines.

Moderna currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Prime Medicine, Inc. PRME announced a strategic restructuring of its business. Shares of the company declined on the news.

The restructuring includes the deprioritization of its Chronic Granulomatous Disease (“CGD”) programs, as well as a cost and workforce reduction to focus on its liver franchise and programs funded through external partnerships.

Prime Medicine is currently advancing in vivo programs to cure two of the largest genetic liver diseases, Wilson’s Disease and Alpha-1 Antitrypsin Deficiency (“AATD”). Initial clinical data from both programs are expected in 2027. An investigational new drug (IND) and/or clinical trial application (CTA) is expected to be filed for its Wilson’s Disease program in the first half of 2026 and for its AATD program in mid-2026. Initial data from both programs are expected in 2027.

Prime Medicine is exploring options for the continued clinical development of PM359 and ceasing further efforts in X-linked CGD.

In addition, PRME is reducing its headcount by approximately 25%. The headcount reduction, along with its cost reduction measures and other restructuring efforts, is expected to reduce operating expenses and cash burn, lowering anticipated cash needs by almost half through 2027.

Prime Medicine announced that it has recently engaged in binding arbitration proceedings with Beam Therapeutics, Inc. regarding its collaboration agreement.

Prime Medicine continues to expect that its cash, cash equivalents and investments, as of March 31, 2025, will be sufficient to fund its operations and capital expenditure requirements into the first half of 2026.

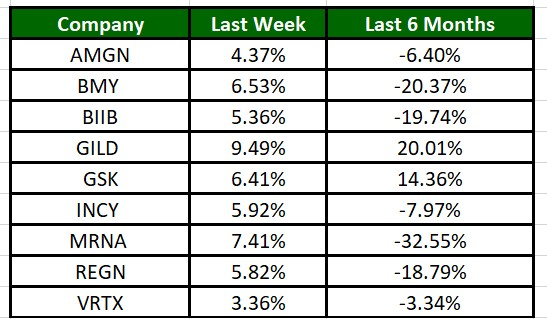

The Nasdaq Biotechnology Index has gained 4.56% in the past five trading sessions and GILD’s shares have gained 9.49%. In the past six months, shares of MRNA have plunged 32.55%. (See the last biotech stock roundup here: Biotech Stock Roundup: BMY Down on Study Data, Updates From REGN & More)

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Novavax Stock Hits Over 1-Year High: Is Sanofis Flu-COVID Shot The Post-Pandemic Growth Driver?

NVAX -9.38%

New feeds test provider finance

|

| Feb-27 | |

| Feb-27 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite