|

|

|

|

|||||

|

|

Sterling Infrastructure STRL and Quanta Services, Inc. PWR are engineering and construction companies that specialize in large-scale infrastructure projects in sectors such as transportation, energy and e-infrastructure. While vastly different in scale, both companies boast compelling growth stories.

Sterling focuses on civil construction and site development – from highways and bridges to large data-center complexes – through its E-Infrastructure, Transportation and Building segments. Quanta is a larger player specializing in utility and energy infrastructure, and it is one of North America’s top contractors in electric power transmission and distribution.

Given the nature of business, both these firms are witnessing strong market trends thanks to the increased federal and state infrastructure spending in the United States, especially from the $1.2 trillion bipartisan infrastructure bill, the Infrastructure Investment and Jobs Act (IIJA). Since the passing of this bill, the infrastructure investment has increased in the country for roads, bridges, public transportation, water and energy infrastructure, providing incremental benefits for the companies that offer related services.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

This Texas-based e-infrastructure solutions, building solutions and transportation solutions provider, with a market cap of about $5.54 billion, is having its growth fueled mainly by a strong e-infrastructure demand and its in-house initiatives. Given the current market scenario, the company is mainly focusing on ensuring a favorable price-cost mix and efficiently utilizing its free cash. Its transformation from a low-margin heavy civil contractor to a high-margin, diversified infrastructure solutions provider has driven record financial results.

Sterling began 2025 with strong momentum, reporting adjusted earnings per share (EPS) of $1.63, up 29% year over year, and adjusted EBITDA growth of 31% to $80 million. Revenues rose 7% on a pro forma basis to $430.9 million, beating estimates despite a JV accounting change. The gross margin improved 450 basis points to 22%, driven by operational efficiencies. Strong cash flow of $85 million and a $25 million acquisition of Drake Concrete highlight its solid financial position. Sterling continues to deliver robust growth, primarily fueled by its E-Infrastructure Solutions segment, which saw first-quarter 2025 revenues rise 18% and operating income jump 61%. This was largely driven by a 60% year-over-year surge in demand for data centers, now making up more than 65% of the segment’s backlog. With AI-related computing demand skyrocketing, Sterling’s execution strength and focus on complex, high-margin projects like hyperscale data centers led to a 618 basis-point margin expansion.

The company’s total backlog reached a record $2.13 billion, with $1.22 billion tied to E-Infrastructure and $750 million in future-phase opportunities, offering unmatched multiyear revenue visibility. Its Transportation Solutions backlog also grew 11%, aided by a strategic move away from low-bid highway work to more profitable aviation, rail and collaborative delivery models. Sterling’s disciplined project mix optimization and flexible pricing strategy are helping maintain margins despite commodity and labor cost volatility. Meanwhile, the acquisition of Drake Concrete expanded its Dallas-Fort Worth presence and provides a buffer against weakness in traditional residential construction. Future M&A will focus on Texas and adjacent capabilities to strengthen Sterling’s turnkey E-Infrastructure offering.

With a strong backlog position and efforts to minimize costs and increase cash flow, Sterling stands strong for 2025. Revenues are projected between $2.05 billion and $2.15 billion, indicating a flat growth rate at mid-point. The gross margin is expected to be about 22%, up from 20.1% reported in 2024. Adjusted EPS is projected to be between $8.40 to $8.90, indicating growth between 1.6% and 7.6% year over year. The adjusted EBITDA is forecasted between $410 and $432, indicating growth in the range of 10.8-16.8% from 2024.

With more than $20 billion in annual revenues and a diversified portfolio across electric power, underground utility and renewable infrastructure, Quanta is deeply embedded in the energy transition ecosystem. The company’s strength lies in its ability to deliver complex, large-scale projects such as power grid modernization, solar and wind farm buildouts and next-gen telecom networks.

Per its recent earnings report, the company seems to be strongly benefiting from its involvement in the advancement and implementation of technology solutions throughout the entire decarbonization spectrum. During the first quarter of 2025, Quanta highlighted the market strength across electric grids, power generation, technology expansion and energy infrastructure, thanks to the fundamental transformation across the energy and infrastructure landscape in the United States. These market tailwinds are reflected in the strong contributions across both its reportable segments, especially Electric Infrastructure Solutions. During the first quarter of 2025, revenues from this segment grew year over year by 26.4% to $4.94 billion, with the operating margin expanding 60 basis points (bps) to 8.3%. As of March 31, 2025, the segment’s 12-month backlog was $16.37 billion, up from $13.69 billion a year ago. The total backlog of $29.7 billion grew from $23.79 billion reported in the prior year quarter.

The meaningful increases in power demand across the United States, driven by the adoption of new technologies and related infrastructure, including data centers and Artificial Intelligence, are boding well for Quanta and are expected to bolster its prospects through the choppy macro environment. The current scenario regarding uncertainties surrounding the new tariff regime is a potent headwind, whose adverse impacts on the company’s cost structure are expected to reflect from the latter half of 2026, once implemented fully.

Nonetheless, with a total backlog of $35.25 billion and a 12-month backlog of $19.42 billion, as of March 31, 2025, Quanta remains optimistic about its 2025 prospects. For the year, the company expects revenues between $26.7 billion and $27.2 billion, up 13.8% at the midpoint from $23.67 billion reported in 2024. It forecasted adjusted EPS in the range of $10.05-$10.65, indicating 12-18.7% year-over-year growth. Adjusted EBITDA is projected to be between $2.68 billion and $2.81 billion, up from $2.33 billion in 2024.

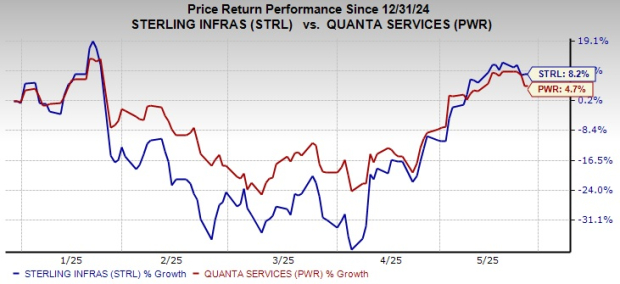

As witnessed from the chart below, year to date, Sterling’s share price performance stands above Quanta's. Furthermore, in the past month, STRL grew 24.9%, outperforming PWR’s 17.3% growth.

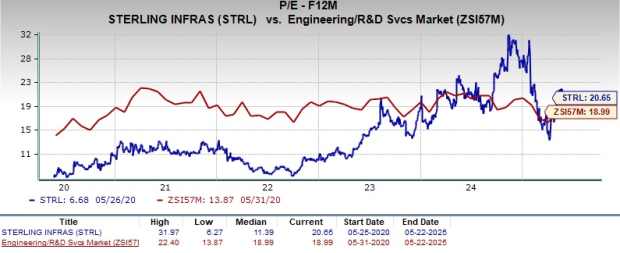

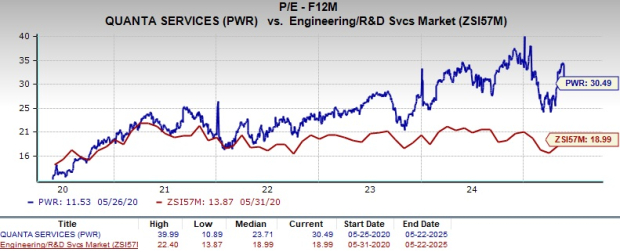

Considering valuation, over the last five years, both Sterling and Quanta are trading at a premium compared to the Engineering - R and D Services industry, which is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 18.99X.

However, when comparing the two companies, with a P/E ratio of 20.65X, STRL is observed to be less expensive than PWR, which has a P/E ratio of 30.49X, over the past five years.

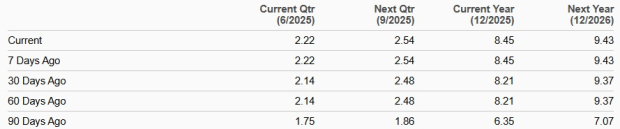

The Zacks Consensus Estimate for STRL’s 2025 EPS indicates 38.5% growth, while the 2026 estimate indicates a year-over-year increase of 11.6%. The 2025 and 2026 EPS estimates have trended upward over the past 30 days.

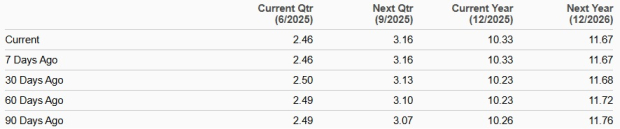

STRL's EPS Trend

The Zacks Consensus Estimate for PWR’s 2025 and 2026 bottom line implies year-over-year improvements of 15.2% and 13%, respectively. Quanta’s 2025 EPS estimates have trended upward over the past 30 days.

PWR's EPS Trend

Both Sterling and Quanta offer strong investment theses backed by durable industry trends. Quanta is a blue-chip infrastructure stock with diversified exposure, dependable cash flows and a clear role in the energy transition. However, its premium valuation is a concern.

Sterling, on the other hand, combines compelling growth in high-margin verticals like data center infrastructure with disciplined execution and favorable valuation. Its strong earnings momentum, expanding backlog and outsized exposure to AI-driven infrastructure demand give it a more dynamic growth profile.

While both stocks carry a Zacks Rank #2 (Buy), Sterling Infrastructure appears to offer the better upside potential for investors seeking growth at a reasonable price. For those willing to accept slightly higher execution risk in exchange for stronger returns, STRL could be a better buy in today’s infrastructure investment landscape. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 |

Boeing Holds In Buy Zone, Leads 5 Stocks To Watch In Short Trading Week

PWR

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite