|

|

|

|

|||||

|

|

CONMED Corporation CNMD is well poised for growth in the coming quarters, courtesy of its broad product spectrum. The optimism, led by the solid recurring revenue base and potential in General Surgery, is expected to contribute further. However, headwinds from supply-chain constraints and data security threats persist.

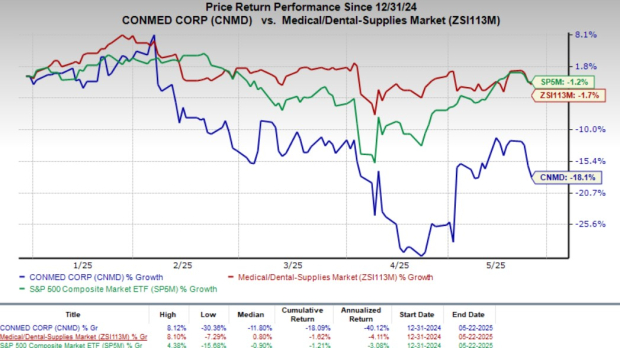

Shares of this Zacks Rank #3 (Hold) company have lost 18.1% so far this year compared with the industry’s 1.7% decline. The S&P 500 Index has decreased 1.2% in the same time frame.

CONMED, a renowned global medical products manufacturer specializing in surgical instruments and devices, has a market capitalization of $1.78 billion. The company projects 5.7% earnings growth for fiscal 2025 and expects to maintain its strong performance going forward.

Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 10.38%.

Factors Favoring CNMD Stock

Revenues Likely to Ride Macro Tailwinds: CONMED delivered better-than-expected first-quarter results, wherein earnings and revenues beat their respective Zacks Consensus Estimate. The company’s raised outlook for 2025 looks promising.

Orthopedics saw solid demand, particularly in foot and ankle products and BioBrace, the company’s innovative soft tissue repair solution. BioBrace’s clinical adoption continues to expand, and it is now being used in over 50 procedures. It has recently received FDA clearance for a new rotator cuff delivery device. General Surgery was driven by continued double-digit growth in AirSeal and smoke evacuation products.

CONMED remains optimistic about the rest of 2025, as hospital systems prioritize minimally invasive procedures, especially in laparoscopy and arthroscopy — areas where CONMED’s portfolio is well-positioned. Management is particularly bullish on the future of AirSeal, Buffalo Filter, BioBrace, and CONMED Foot & Ankle as growth drivers.

Supply-chain issues, which negatively impacted U.S. Orthopedics sales, are showing signs of improvement. The number of SKUs on backorder is declining, and the company anticipates achieving at least $20 million in annual savings through ongoing operational enhancements.

Expanding Margins Look Promising: Margin expansion was another highlight for the quarter, reflecting operational efficiencies and disciplined cost management by CNMD. The adjusted gross margin improved to 56.4%, marking an 80-basis-point (bps) increase from the previous year’s level. This can be attributed to a favorable product mix and strategic measures to optimize production. Gross margin is expected to trend upward through the year — from the mid-56% range in the second quarter to nearly 57% by the fourth quarter.

Additionally, adjusted selling, general, and administrative (SG&A) expenses were 38.7% of sales, flat year over year, underscoring the company's commitment to effectively managing expenses amid inflationary pressures. These not only contributed to profitability (operating margin improved 110 bps) but also bolstered CONMED’s capacity to sustain leveraged earnings growth, positioning CNMD for continued financial strength.

Solid Recurring Revenue Base: CONMED's performance is bolstered by its business model, with approximately 86% of revenues coming from recurring sales of single-use disposable products during the first quarter. These items are being increasingly favored by hospitals and clinics as they reduce sterilization costs, minimize infection risks and lower post-operative care expenses.

The remaining 14% of revenues came from capital equipment sales, such as surgical tools and imaging systems. This, in turn, drives the demand for complementary single-use products, further contributing to CONMED's sustained growth.

Downsides

Regulatory & Tariff Pressures: CONMED may face potential downsides due to regulatory scrutiny and compliance challenges associated with its classification as a manufacturer of Class II medical devices. The company is subject to inspections by the FDA and international regulatory bodies, which can lead to significant costs in response to compliance issues. These factors could negatively impact CNMD’s operations and financial performance. Regarding tariffs, CONMED estimates an unfavorable $5.5 million impact in 2025, with 85% stemming from China and 12% from Europe.

Data Security Threats: CONMED may be at risk due to its heavy reliance on information technology (IT) systems for managing sensitive business-related and customer data. The company faces significant cybersecurity threats that could jeopardize the security, confidentiality and integrity of its data. These factors could negatively impact CONMED's operational stability and financial performance, posing a downside for investors.

CONMED Corporation price | CONMED Corporation Quote

Estimate Trend

CONMED is witnessing an improving estimate revision trend for 2025. In the past 30 days, the Zacks Consensus Estimate for earnings has moved 1.4% northward to $4.41 per share.

The Zacks Consensus Estimate for second-quarter 2025 revenues and earnings per share is pegged at $339.1 million and $1.12, respectively, suggesting 2.1% and 14.3% growth from the year-ago reported numbers.

Stocks to Consider

Some better-ranked stocks from the same medical industry are GENEDX HOLDINGS WGS, CVS Health CVS and Cencora COR.

GENEDX, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated growth rate of 336% for 2025. You can see the complete list of today’s Zacks #1 Rank stocks here.

WGS’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 145.82%. WGS’ shares have lost 6.1% so far this year.

CVS Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 12.2% for 2025.

CVS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 18.08%. CVS’ shares have risen 42% year to date.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 16.7% for 2025.

COR’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 6.00%. Its shares have gained 30.4% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite