|

|

|

|

|||||

|

|

Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Illumina (NASDAQ:ILMN) and its peers.

The life sciences tools and services sector supports the research, development, and commercialization of biotechnology and pharmaceutical products. These companies offer a broad range of tools, from lab consumables and testing equipment to data analytics platforms and clinical trial support. There is recurring revenue potential from long-term contracts, high margins from specialized products, and the growing demand for precision medicine and data-driven insights. However, challenges include dependence on research and development budgets from large pharmaceutical companies and the boom and bust nature of smaller biotech companies. Looking forward, the life sciences tools and services sector is expected to benefit from strong tailwinds, including advancements in genomics and the rising focus on personalized medicine. Ongoing adoption of artificial intelligence in research and drug discovery, along with the growing need for regulatory compliance and data analytics, should provide longer-term demand support. However, headwinds such as the uncertainty around healthcare and research funding as well as pricing pressures from cost-conscious customers may feed into uncertainty in the sector.

The 20 life sciences tools & services stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was 0.9% above.

While some life sciences tools & services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.7% since the latest earnings results.

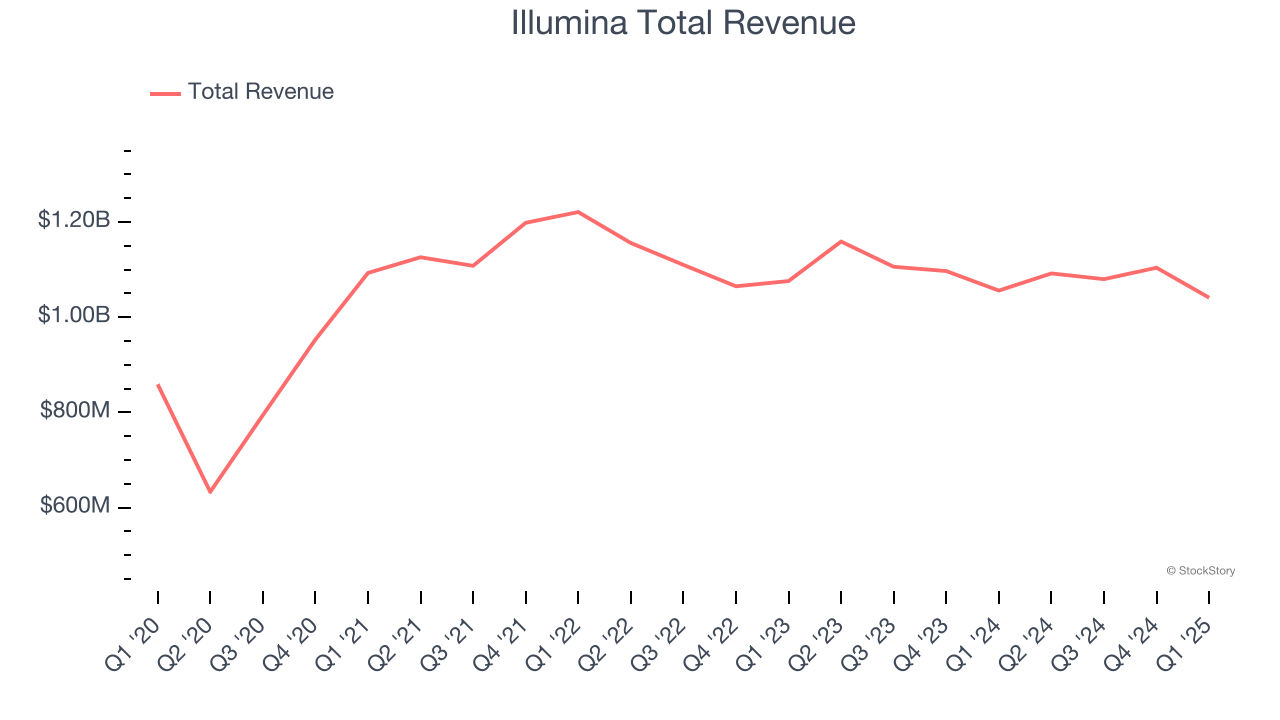

Pioneering the ability to read the human genome at unprecedented speed and affordability, Illumina (NASDAQ:ILMN) develops and sells advanced DNA sequencing and microarray technologies that allow researchers and clinicians to analyze genetic variations and functions.

Illumina reported revenues of $1.04 billion, down 1.4% year on year. This print exceeded analysts’ expectations by 0.5%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EPS guidance for next quarter estimates.

The stock is up 1.8% since reporting and currently trades at $81.

Is now the time to buy Illumina? Access our full analysis of the earnings results here, it’s free.

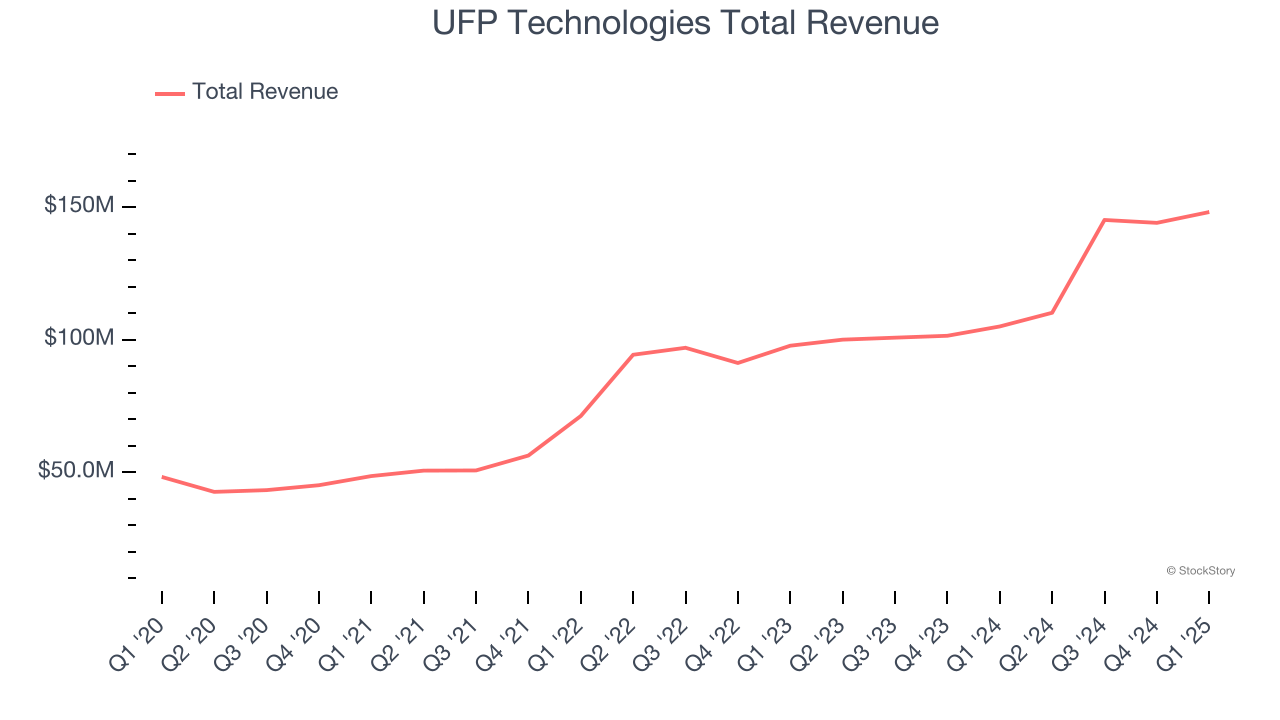

With expertise dating back to 1963 in specialized materials and precision manufacturing, UFP Technologies (NASDAQ:UFPT) designs and manufactures custom solutions for medical devices, sterile packaging, and other highly engineered products for healthcare and industrial applications.

UFP Technologies reported revenues of $148.1 million, up 41.1% year on year, outperforming analysts’ expectations by 5.9%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates.

UFP Technologies delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 19.5% since reporting. It currently trades at $235.61.

Is now the time to buy UFP Technologies? Access our full analysis of the earnings results here, it’s free.

With roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE:AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries.

Avantor reported revenues of $1.58 billion, down 5.9% year on year, falling short of analysts’ expectations by 1.6%. It was a softer quarter as it posted a miss of analysts’ organic revenue estimates.

Avantor delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 17.6% since the results and currently trades at $12.75.

Read our full analysis of Avantor’s results here.

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ:PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

PacBio reported revenues of $37.15 million, down 4.3% year on year. This number surpassed analysts’ expectations by 5.2%. Overall, it was a stunning quarter as it also produced an impressive beat of analysts’ EPS estimates.

The stock is down 22.7% since reporting and currently trades at $0.92.

Read our full, actionable report on PacBio here, it’s free.

Serving as the guardian of some of medicine's most valuable materials, Azenta (NASDAQ:AZTA) provides biological sample management, storage, and genomic services that help pharmaceutical and biotechnology companies preserve and analyze critical research materials.

Azenta reported revenues of $143.4 million, up 5.2% year on year. This print topped analysts’ expectations by 2%. More broadly, it was a slower quarter as it produced a significant miss of analysts’ EPS estimates.

The stock is up 7.2% since reporting and currently trades at $27.26.

Read our full, actionable report on Azenta here, it’s free.

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-09 | |

| Feb-09 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite