|

|

|

|

|||||

|

|

American Eagle Outfitters, Inc. AEO is scheduled to report first-quarter fiscal 2025 results on May 29, after the opening bell.

The Zacks Consensus Estimate for AEO’s fiscal first-quarter revenues is pegged at $1.1 billion, suggesting a 4.6% decline from the year-ago quarter. For fiscal first-quarter earnings, the consensus mark is pegged at a loss of 25 cents per share, implying a 174% decline from earnings of 34 cents reported in the year-ago quarter. The consensus estimate for loss per share implies further narrowing from the loss of 19 cents predicted seven days ago.

In the last reported quarter, American Eagle's earnings beat the consensus estimate by 8%. Moreover, AEO has delivered an earnings surprise of 9.1%, on average, in the trailing four quarters.

American Eagle Outfitters, Inc. price-consensus-eps-surprise-chart | American Eagle Outfitters, Inc. Quote

Our proven model does not conclusively predict an earnings beat for American Eagle this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

American Eagle has an Earnings ESP of 0.00% and a Zacks Rank of 3 at present.

American Eagle’s first-quarter fiscal 2025 results are likely to be significantly impacted by persistent macroeconomic pressures that weigh on consumer discretionary spending. Elevated household debt, inflationary headwinds and ongoing uncertainty around employment are dampening consumer confidence, particularly among its core demographic of younger, price-sensitive shoppers. As a result, spending on non-essential categories like apparel is expected to remain subdued, affecting traffic and conversion both in stores and online.

In a recent preliminary release, management stated that it is disappointed with the execution of the company’s first-quarter fiscal 2025 results. It further noted that merchandising actions did not work as expected, instead leading to increased promotions and excess inventory. Consequently, the company made an inventory charge write-down on spring and summer goods.

AEO withdrew its earlier-issued guidance for fiscal 2025, citing macro volatility. Management issued bleak preliminary first-quarter fiscal 2025 results. For first-quarter fiscal 2025, revenues are likely to be $1.1 billion, which indicates a drop of almost 5% compared with the year-ago quarter. Comparable sales, which are a crucial indicator of the retailers’ health, are expected to decline nearly 3%, with American Eagle decreasing 2% and Aerie falling 4%.

The adjusted operating loss includes greater-than-planned promotional activity and an inventory charge of almost $75 million with respect to a write-down of spring and summer merchandise. Management now expects a GAAP operating loss of about $85 million and an adjusted operating loss of $68 million for the first quarter. The GAAP operating loss reflects an additional asset impairment and restructuring charge of roughly $17 million, mainly associated with the closing of two fulfillment centers in the context of its supply-chain network optimization project.

However, American Eagle remains focused on long-term value creation through its Powering Profitable Growth plan, which emphasizes brand amplification, operational optimization and strong financial discipline. Despite the near-term challenges, the company is taking proactive steps to stabilize margins and enhance profitability by streamlining expenses and improving overall efficiency across its operations.

From a valuation perspective, American Eagle’s shares present an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 9.4X, below the five-year median of 12.25X and the Retail-Apparel & Shoes industry’s average of 17.68X, the stock offers compelling value for investors seeking exposure to the sector.

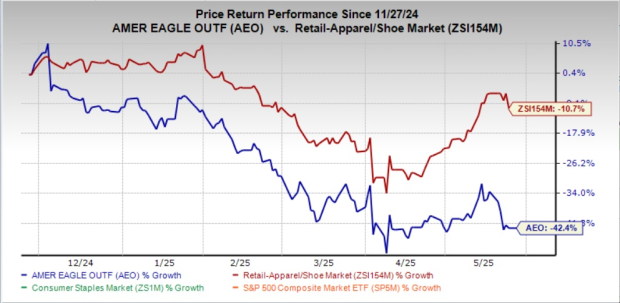

The recent market movements show that American Eagle’s shares have lost 42.4% in the past six months compared with the industry's decline of 10.7%.

DICK'S Sporting Goods, Inc. DKS currently has an Earnings ESP of +1.00% and a Zacks Rank of 3. DKS is expected to report growth in its top and bottom lines when it reports first-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.12 billion, which indicates a 3.4% increase from the figure reported in the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for DICK'S fiscal first-quarter earnings is pegged at $3.34 per share, up 1.2% from the year-ago quarter. The consensus mark for earnings has remained stable in the past 30 days. DKS has delivered a trailing four-quarter earnings surprise of 8.6%, on average.

Gap GAP has an Earnings ESP of +3.03% and a Zacks Rank of 3 at present. GAP is likely to register top-line growth when it releases first-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.42 billion, which implies growth of 0.9% from the figure reported in the year-ago quarter.

The consensus estimate for GAP’s quarterly earnings has increased by a penny in the past 30 days to 44 cents per share, implying growth of 7.3% from the year-ago quarter’s number. GAP delivered an earnings surprise of 77.5%, on average, in the trailing four quarters.

Burlington Stores BURL has an Earnings ESP of +3.45% and currently carries a Zacks Rank of 3. BURL’s top line is anticipated to advance year over year when it reports first-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.53 billion, which suggests a 7.3% rise from the figure reported in the year-ago quarter.

The consensus estimate for Burlington Stores’ first-quarter earnings is pegged at $1.42 per share, which has increased by 3 cents in the last 30 days. BURL has a trailing four-quarter earnings surprise of 17.9% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite