|

|

|

|

|||||

|

|

Nucor Corporation NUE and Steel Dynamics, Inc. STLD are two of the top steel producers in the United States, often regarded as bellwethers for the domestic steel industry. Both have strong domestic footprints and play crucial roles in supplying steel for construction, automotive and industrial markets. With their similar business models and exposure to U.S. steel demand, they are natural candidates for a head-to-head comparison. Especially with U.S. steel prices rebounding sharply this year after hitting lows in 2024 amid a global manufacturing slowdown, comparing these two leading players is particularly relevant for investors seeking exposure to the steel space.

U.S. steel prices saw a sharp decline in 2024 due to a slowdown in end-market demand after a strong run in late 2023 that extended into early last year. Benchmark hot-rolled coil (HRC) prices tumbled more than 40% last year to close near the $700 per short ton level from $1,200 per short ton at the beginning of 2024. The downside has been influenced by a combination of factors, including a pullback in steel mill lead times, an oversupply of steel exacerbated by increased imports, reduced demand from key industries, and economic uncertainties.

The steel mill price hikes and the Trump administration's imposition of a 25% tariff on all steel imports into the United States have led to an uptick in HRC prices to above $900 per short ton, translating into a more than 25% gain year to date. The tariffs would tighten supply by restricting imported steel while allowing domestic mills to raise prices. With end-market demand improving, steel prices will likely continue to climb, benefiting U.S. steelmakers with higher profit margins.

Let’s dive deep and closely compare the fundamentals of these two major U.S. steel producers to determine which one is a better investment option now.

Nucor, the largest steel producer in North America, remains committed to boosting production capacity, which should drive profitable growth and strengthen its position as a low-cost producer. The company has already commissioned some of its growth projects with Gallatin and Brandenburg mills, showing strong production and shipment performance. NUE is investing $6.5 billion in eight major growth projects through 2027. These include the Apple Grove, WV, sheet mill (the largest project), the Lexington, NC, rebar micro mill, and the galvanizing line at the Berkeley County sheet mill.

The company has been focusing on growth through strategic acquisitions over the past several years. The recent acquisition of Southwest Data Products expanded its growing portfolio of solutions for data center customers. The buyout of Rytec Corporation will also allow Nucor to further expand beyond core steelmaking businesses into related downstream businesses. Adding high-performance doors is expected to create cross-selling opportunities with other Nucor businesses and significantly expand its product portfolio for the commercial space.

Nucor is maximizing its returns to shareholders by leveraging its strong balance sheet and cash flows. It ended first-quarter 2025 with strong liquidity, including cash and cash equivalents and short-term investments of around $4 billion. The company amended and restated its revolving credit facility on March 11, 2025, to increase the borrowing capacity to $2.25 billion from $1.75 billion and to extend its maturity date to March 11, 2030. NUE returned around $2.7 billion to its shareholders through dividends and share repurchases last year and $429 million in the first quarter. The company, in December 2024, raised its quarterly dividend to 55 cents per share from 54 cents. Nucor has increased its regular dividend for 52 straight years since it started paying dividends in 1973. It remains committed to returning at least 40% of annual net earnings to its shareholders.

NUE offers a dividend yield of 2% at the current stock price. Its payout ratio is 36% (a ratio below 60% is a good indicator that the dividend will be sustainable), with a five-year annualized dividend growth rate of 7.9%.

Nucor is exposed to demand weakness in certain markets such as heavy equipment, rail cars, truck and trailer and agriculture. Heavy equipment, transportation and logistics and other accounted for around 28% of its total external shipments for 2024.

The company is seeing softness in heavy equipment since the second half of 2023, where it serves with plate steel products. High interest rates are impacting demand for earth-moving machinery, tractors and rail cars. As such, Nucor’s shipment volumes are expected to remain under pressure in these markets in the near term.

Steel Dynamics' customer-focused approach, along with market diversification and low-cost operating platforms, positions it for future growth opportunities. The company should also gain from its investments in beefing up capacity and upgrading facilities.

STLD is seeing strong customer order activity for flat-rolled steel. It is currently executing several projects that should add to its capacity and boost profitability. STLD is ramping up operations at its new state-of-the-art electric arc furnace flat-rolled steel mill in Sinton, TX. With a production capacity of roughly three million tons per year and the capability to make the latest generation of advanced high-strength steel products, it is expected to contribute significantly to revenues and profitability.

The value-added flat-rolled steel coating lines, consisting of two paint lines and two galvanizing lines, also enhance the annual value-added flat-rolled steel capacity. The company is ramping up volumes from these lines, which are expected to provide earnings benefits in 2025. It is also progressing with its aluminum flat-rolled products mill and plans to produce commercially viable products before mid-2025.

The company is poised to benefit from strong cash flow generation, allowing it to invest in organic growth and maximize shareholder value. It generated solid cash flow from operations of $1.8 billion in 2024. It also ended first-quarter 2025 with strong liquidity of around $2.6 billion, including cash and cash equivalents of around $1.2 billion. It has ample liquidity to meet its debt obligations.

Steel Dynamics also raised its quarterly dividend by 9% to 50 cents per share in the first quarter of 2025. The company paid dividends of $70 million and repurchased shares worth $250 million during the first quarter. STLD offers a dividend yield of 1.6% at the current stock price. It has a payout ratio of 26%, with a five-year annualized dividend growth rate of about 18.4%.

Automotive is a significant market for Steel Dynamics. A slowdown in global automotive production curtailed steel consumption in this key end market in 2024. Demand from this key sector slowed significantly in the second half of 2024. North American automotive build rates declined considerably during the second half. High interest rates, along with concerns over economic slowdown and tariffs, are likely to put pressure on the automotive market in 2025. Auto and auto part tariffs are likely to affect automotive production in North America this year. This may impact the company’s shipment volumes to this key market.

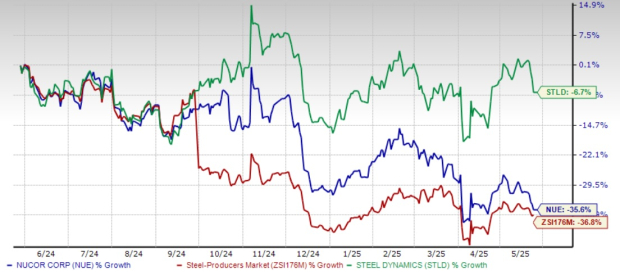

The NUE stock is down 35.6% over the past year, while STLD has lost 6.7% compared with the Zacks Steel Producers industry’s decline of 36.8%.

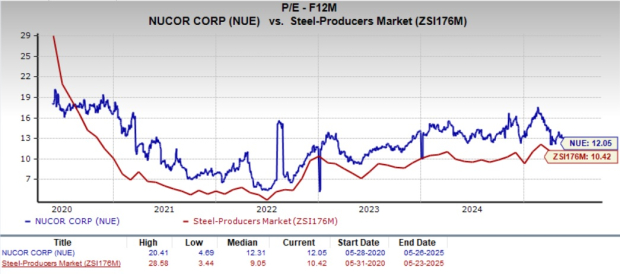

NUE is currently trading at a forward 12-month earnings multiple of 12.05. This represents a roughly 15.6% premium when stacked up with the industry average of 10.42X.

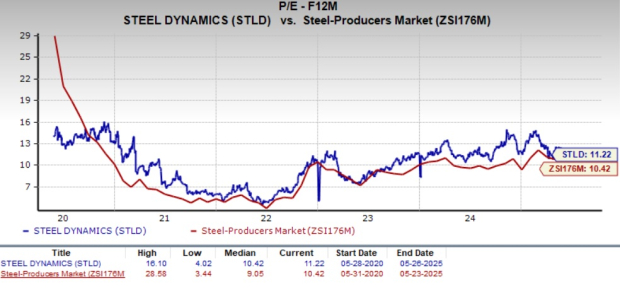

STLD is currently trading at a forward 12-month earnings multiple of 11.22, below NUE but above the industry.

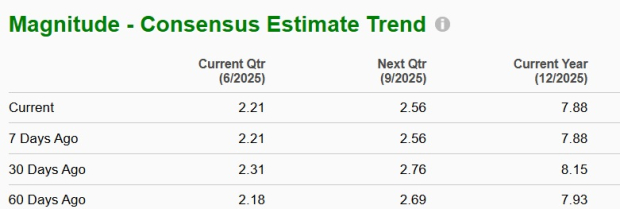

The Zacks Consensus Estimate for Nucor’s 2025 sales implies a year-over-year rise of 2.4%. The same for EPS suggests an 11.5% year-over-year decline. The EPS estimates for 2025 have been trending lower over the past 60 days.

The consensus estimate for Steel Dynamics’ 2025 sales and EPS implies a year-over-year rise of 3.4% and 3.5%, respectively. The EPS estimates for 2025 have been trending northward over the past 60 days.

(Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Both NUE and STLD currently have a Zacks Rank #3 (Hold), so picking one stock is not easy. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both Nucor and Steel Dynamics are well-positioned to benefit from the current upswing in steel prices and the protectionist trade policies. STLD appears to have a slight edge over NUE due to its more attractive valuation. In addition, STLD's higher earnings growth projections, rising estimates, and solid dividend growth rate suggest that it may offer better investment prospects in the current market environment. For investors looking to capitalize on the steel sector's rebound, STLD looks like the smarter bet.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite