|

|

|

|

|||||

|

|

EMCOR Group, Inc. EME seems to be incrementally benefiting from the growing infrastructural demand across the network and communications sector, mainly data centers, healthcare, water and wastewater market sectors. Its major contributing segment, the U.S. Construction segment, has been witnessing robust trends thanks to this favorable market movement.

Since its first-quarter 2025 earnings release, EME stock has risen 12.2%, outperforming the broader Construction sector and the S&P 500 index, but hovering below the Zacks Building Products - Heavy Construction industry. The detailed share price performance is shown in the chart below.

Owing to the robust market trends, in the recent earnings release, the company raised the lower range of its non-GAAP diluted EPS for 2025. This optimistic move, alongside EMCOR’s consistent efforts in expanding its operating margin, is an encouraging aspect for investors to look into. (read more: EMCOR's Q1 Earnings & Revenues Beat Estimates, RPOs Increase Y/Y)

Despite the ambiguity surrounding the new tariff regime and the associated risks and lingering inflation, EMCOR has been ensuring margin expansion through its in-house capabilities and leveraging the growing top line. Moreover, its balanced capital allocation approach, which aims to efficiently distribute free cash for both business growth and shareholder returns, acts as a growth catalyst.

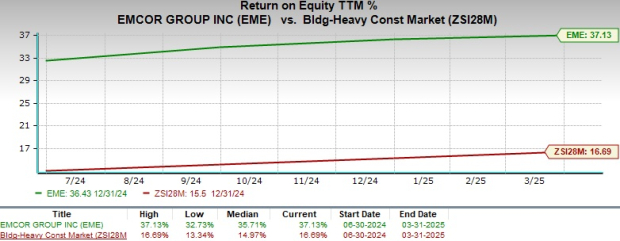

The company’s trailing 12-month return on equity (ROE) reflects its growth potential and focus on maintaining shareholder value. As evidenced by the chart below, EME’s ROE is significantly better than the industry. This indicates that the company is efficiently using its shareholders’ funds, along with generating profit with minimum capital usage.

In comparison to a few of its industry peers, including Quanta Services, Inc. PWR, Sterling Infrastructure STRL and MasTec, Inc. MTZ, EMCOR stands above when valuing shareholders’ returns. Quanta, Sterling and MasTec currently carry trailing 12-month ROE of 18.1%, 26.6% and 11.7%, respectively.

Robust Data Center Infrastructural Demand: EMCOR’s domestic construction segment is banking on increased activity across the network and communications sector, especially data centers. The boost in data center infrastructural demand is supported by the ongoing surge in Artificial Intelligence applications and the focus on digital transformation initiatives. Furthermore, the passing of the CHIPS and Science Act in 2022 acts as an underlying booster in this context. The CHIPS and Science Act was passed in favor of fostering investments in chip production, research and workforce development through increased public funding.

During the first quarter of 2025, the U.S. Construction segment contributed 68.8% to EMCOR’s total revenues and grew 21.3% year over year. As of March 31, 2025, Remaining Performance Obligations (combination of deferred revenue and backlog) or RPOs, within the company’s networking and communications sector, grew approximately 112% year over year and 28% sequentially to $3.6 billion. Going forward, EMCOR aims to leverage these robust data center demand trends, along with its proactive expansion strategies into new geographies, to boost its growth and profitability.

Efforts Toward Operational Efficiency: Apart from maintaining its growth streak, EMCOR also focuses on employing initiatives to reduce its cost structure and improve its operational performance. Amid an uncertain macro environment, the company is witnessing margin expansion thanks to its continuous focus on efficient project execution, ensuring a favorable mix of work and increasing top line.

Under the U.S. Construction segment, the company aims to continue fostering its operating margins by leveraging its prefabrication and virtual design and construction capabilities, effectively planning and managing labor, coordinating and executing large projects and concentrating on contract terms. Moreover, under the U.S. Building services segment, EME aims to expand its operational efficiency by leveraging the profitability across its portfolio of HVAC retrofits, building automation and controls projects, and repair service work orders. During the first quarter of 2025, EMCOR’s operating income grew year over year by 22.6%, with operating margin expanding 60 basis points (bps) to 8.2%.

Balanced Capital Allocation Approach: Amid favorable market trends, EMCOR’s efficient capital allocation approach acts as a catalyst in boosting further growth in the market. The company effectively allocates its free cash to reinvest in its business through acquisitions and capital expenditures (capex), and returns value to its shareholders through dividends and share repurchases.

From 2016 to 2025 to date, EME has allocated 42.4% of its free cash to acquisitions, 9.4% to capex, 4.6% to dividends and 43.6% to share repurchases. This implies that the company tries to maintain a 50-50 balance between business reinvestments and shareholder returns.

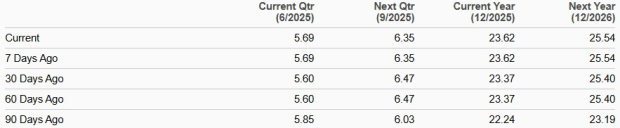

The favorable market fundamentals around data center demand and consistent efforts in improving operational efficiency are likely to have boosted the analysts’ expectations, leading to an upward revision of 2025 and 2026 earnings estimates in the past 30 days.

EPS Trend

Per the trends in the chart above, the earnings estimate for 2025 indicates 9.8% year-over-year growth, with 2026 implying an 8.1% rise. This trend validates its Growth Score of A.

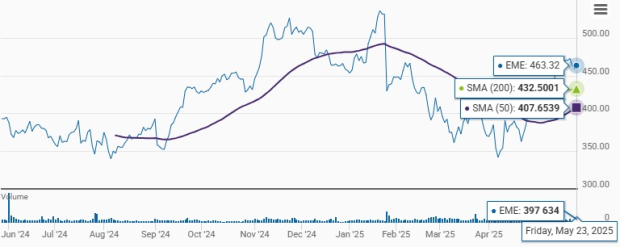

Technical indicators suggest a continued strong performance for EMCOR. From the graphical representation given below, it can be observed that EME stock is riding above both the 50-day simple moving average (SMA) and the 200-day SMA, signaling a bullish trend. The technical strength underscores positive market sentiment and confidence in EME’s financial health and prospects.

50 & 200-Day SMA

EMCOR is currently trading at a premium compared with its industry peers on a forward 12-month price-to-earnings (P/E) ratio basis. The premium valuation indicates that the stock is trading above its industry peers, making it difficult for investors to figure out a suitable entry point.

However, the overvaluation of EME stock compared with its industry peers indicates its strong potential in the market, given the favorable trends backing it up.

The ongoing incremental benefits from elevated data center infrastructure demand across its network and communications sector are favoring EMCOR’s growth to a great extent. These trends reflect an increased RPO position and space for expanding operating margins as well as ensuring shareholder value. Although the company needs to be cautious about the tariff-related uncertainties and lingering inflation, its in-house capabilities, combined with strong infrastructure market fundamentals, prove its underlying strength.

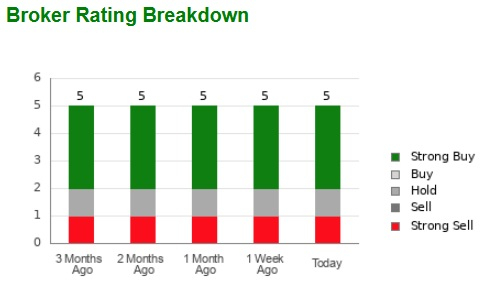

Analysts’ optimism regarding EME stock is reflected in three of the five recommendations pointing at a "Strong Buy."

Thus, based on the above discussion and trends of the technical indicators, this Zacks Rank #2 (Buy) stock is a decent choice to be added to the portfolio for now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

PWR

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite