|

|

|

|

|||||

|

|

Teva Pharmaceutical Industries Limited’s TEVA stock has risen 12.9% in a month. Teva’s stock mainly gained after it announced first-quarter 2025 results on May 7.

Teva’s first-quarter results were mixed as it beat estimates for earnings but missed the same for sales. Teva slightly lowered the higher end of its sales guidance for 2025 while increasing the lower end of its EPS range. Teva said that its guidance was based on the tariffs already in place and does not reflect any impact from potential tariffs on pharmaceutical imports.

The company stated that it expects U.S. tariffs to have an “immaterial impact” on its profits, which are already factored into its 2025 earnings outlook. Teva’s chief financial officer, Eli Kalif, said that Teva has a substantial U.S. manufacturing footprint and a very limited exposure to China and India from a sourcing perspective. He also said that the company is well-positioned to navigate the potential impact of the U.S. tariffs.

On the Q1 conference call, Teva also reaffirmed its targets for 2027. Teva expects an adjusted operating margin of 30% by 2027 to be achieved by cost savings and the continued growth of its branded drugs. Along with the earnings release, Teva announced that it expects approximately $700 million of net cost savings (after reinvestment in business) by 2027.

Teva’s positive comments about the tariff impact, the slightly increased earnings outlook for 2025, and the details on the planned cost savings seem to have impressed investors, despite the mixed first-quarter results and narrowed revenue outlook for the year.

The recent stock price increase has left investors wondering whether to buy, sell or hold the stock. Let's discuss the company’s strengths and weaknesses in detail to understand how to play TEVA.

The company is seeing continued market share growth of its two newest branded drugs, Austedo and Ajovy. Though Teva is seeing slightly slower growth of Ajovy in the U.S. market, it expects sales to benefit from continued patient growth and launches in additional countries in Europe and international markets. Ajovy sales rose 18% in 2024 and 26% in the first quarter of 2025.

For Austedo, Teva expects to achieve annual revenues of more than $2.5 billion by 2027. The Austedo franchise got a boost from the launch of Austedo XR, a new once-daily formulation of Austedo. Teva expects to launch Austedo in European markets in 2026. Austedo sales rose 34% in the United States in 2024 and 39% in the first quarter of 2025.

Uzedy (risperidone) extended-release injectable suspension, a long-acting subcutaneous atypical antipsychotic injection for the treatment of schizophrenia in adults, was launched in May 2023 in the United States. In 2024, Teva recorded Uzedy sales of approximately $117 million, more than its target of approximately $100 million. In 2025, Uzedy sales are expected to be approximately $160 million.

Teva has also made decent progress with its branded pipeline, which includes olanzapine, a long-acting subcutaneous injectable (LAI) for treating schizophrenia and duvakitug, its anti-TL1A therapy for inflammatory bowel diseases (“IBD”), ulcerative colitis (UC) and Crohn’s disease (CD). Teva has partnered with Sanofi SNY for duvakitug to maximize the value of the asset. Teva and Sanofi will equally share the development costs globally. In December, Teva and Sanofi’s phase IIb study on duvakitug for treating UC and CD met its primary endpoints. Teva and Sanofi plan to begin a phase III program on duvakitug in the second half of 2025. Teva expects to file a new drug application to seek approval for olanzapine in the second half.

In the past few quarters, Teva achieved several successful launches of biosimilars and other high-value complex generics, including Novo Nordisk’s Victoza, Roche’s cancer drugs Rituxan (Truxima) and Herceptin (Herzuma), AbbVie’s Humira (Simlandi), J&J’s JNJ Stelara (Selarsdi), Novartis’ Sandostatin LAR and AstraZeneca’s Soliris (Epysqli)

Teva has a decent pipeline of biosimilars, with some being developed in partnership with Alvotech, including high-value complex generics like Simlandi and Selarsdi. These are the first two biosimilars to be launched in the United States under the Teva and Alvotech strategic partnership, which includes five biosimilars.

Teva expects to launch seven (including Simlandi and Selarsdi) biosimilars in the United States and four in Europe between 2025 and 2027. Biosimilar versions of Amgen’s AMGN Prolia, Regeneron’s Eylea and J&J’s Simponi are under review in the United States, while those of Amgen’s Xgeva, Simponi and Prolia are also under review in the EU. A biosimilar of Novartis’ Xolair is in late-stage development.

Teva’s U.S. generics/biosimilars business looks stable now, much more than it has been in years. Teva’s U.S. generics/biosimilars business rose 15% in the United States in 2024, driven by new product launches. Teva expects continued growth in its U.S. generics business in 2025, driven by complex product launches like Victoza, Forteo and others, as well as upcoming launches of Symbicort, Saxenda and biosimilars Simlandi and Selarsdi.

Teva faces several lawsuits with cities, states and Native American tribes, which claim that it was one of the several companies whose opioid-based drugs were responsible for fueling the nationwide opioid epidemic.

In June 2023, Teva announced that it had fully resolved its nationwide settlement agreement related to opioid claims brought by all 50 U.S. states and more than 99% of the litigating subdivisions and special districts. As part of the settlement, Teva will pay up to $4.25 billion (including the already settled cases), spread over 13 years, including deliveries of up to $1.2 billion of its generic version of Narcan. In September 2024, Teva reached an agreement with the City of Baltimore to settle its opioid-related claims for a total of $80 million, thus settling with 100% of the litigating subdivisions and special districts. The settlement amount was, however, more than Teva’s initial expectations to pay around $2.6 billion to settle the lawsuits.

Teva’s stock has declined 23% so far this year compared with a decrease of 15.8% for the industry.

TEVA’s stock is trading at an attractive valuation relative to the industry. Going by the price/earnings ratio, the company shares currently trade at 6.51 on a forward 12-month basis, lower than 9.70 for the industry. However, the stock is trading above its 5-year mean of 4.10.

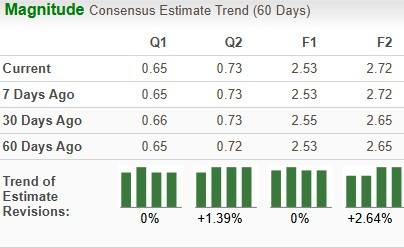

The Zacks Consensus Estimate for earnings has declined from $2.55 per share to $2.53 per share for 2025 but risen from $2.65 per share to $2.72 per share for 2026 over the past 30 days.

Teva’s revenues have suffered significantly since it lost exclusivity for key multiple sclerosis medicine, Copaxone, in 2015. Teva also faces competitive pressure for some of its key branded drugs. It also has a high debt load and faces some price-fixing charges. It will also face a potential revenue cliff for lenalidomide capsules (the generic version of Bristol-Myers’ Revlimid) in 2026, as well as headwinds in 2027 related to IRA Medicare Part D negotiation for Austedo.

However, its newer drugs, Austedo, Uzedy and Ajovy, and stable generics business are reviving top-line growth.

With the nationwide settlement for the costly opioid litigations, new product launches, stability of the generics segment with contribution from biosimilars, and a robust biosimilar and branded pipeline, the path for Teva’s long-term growth is becoming clearer. Teva is saving costs and improving margins through the optimization of operations for efficiency while also lowering the debt on its balance sheet.

Teva’s improving branded and biosimilar pipeline and the prospect of growth in sales and profits are good enough reasons for those who own this Zacks Rank #3 (Hold) stock to stay invested. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 16 hours | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

AMGN JNJ

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Novavax Stock Hits Over 1-Year High: Is Sanofis Flu-COVID Shot The Post-Pandemic Growth Driver?

SNY

New feeds test provider finance

|

| Feb-27 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite