|

|

|

|

|||||

|

|

After a sharp but short-lived pullback last month, US equity markets, particularly tech and AI-related names, are charging higher once again. The AI bull run appears to be back on track.

Though artificial intelligence has been the dominant market theme for over two years, the pace of innovation shows no signs of slowing. In fact, it’s accelerating. Just last week, major tech players including Microsoft, Alphabet and Nvidia hosted developer conferences packed with headline-making announcements: Google unveiled cutting-edge video generation tools, Microsoft showcased AI-powered scientific breakthroughs, and Nvidia laid out its vision for “AI factories.”

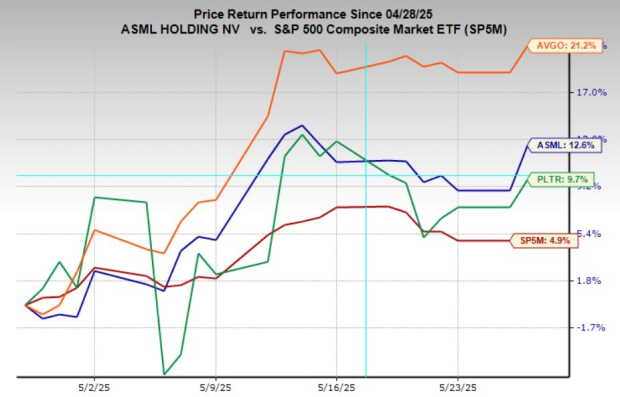

With momentum returning and investor excitement reignited, I’ve been watching three standout stocks with both strong technical momentum setups and pivotal roles in the AI value chain: ASML Holding (ASML), Palantir Technologies (PLTR), and Broadcom (AVGO).

ASML Holding is arguably the most critical company in the global semiconductor supply chain. Based in the Netherlands, ASML holds a near-monopoly on extreme ultraviolet (EUV) lithography machines—an essential technology for producing the most advanced chips used in AI, data centers, and high-performance computing. Without ASML’s machines, leading chipmakers like Nvidia, TSMC, and Intel wouldn’t be able to manufacture the cutting-edge semiconductors that power the AI revolution.

ASML currently holds a Zacks Rank #2 (Buy), reflecting upward earnings estimate revisions, while analysts forecast EPS to grow an impressive 18.9% annually over the next three to five years. Despite its dominant market position and critical role in enabling AI hardware, the stock is trading at just 27x forward earnings, which is well below its 10-year median of 31.8x. This valuation discount offers an attractive entry point for long-term investors who believe in the continued expansion of AI and semiconductor demand.

Technically, ASML has been consolidating in a broad base since last fall, as investors accumulate shares. Today, the stock broke out of a bull flag and is approaching the broader base resistance at $780. So long as the stock holds above the $740 breakout level, momentum should carry it higher.

Broadcom (AVGO) has quietly become one of the most important players in the AI value chain. While best known for its dominance in semiconductors used in networking, broadband, and wireless infrastructure, Broadcom also designs custom chips for hyperscalers, including AI accelerators and ASICs used in large-scale data centers.

Analysts expect Broadcom’s earnings to grow at an impressive 19.1% annually over the next three to five years, driven by strong demand for its AI-enabling hardware. Despite these long-term tailwinds, the stock currently holds a Zacks Rank #3 (Hold), as earnings estimate revisions have remained relatively flat in recent weeks.

From a technical perspective, AVGO stock is breaking out today from a tight bull flag pattern formed over the past couple of weeks. This type of continuation setup suggests that the stock is entering the next leg of its rally, fueled by renewed investor interest in AI. As long as Broadcom continues to trade above the $230 breakout level, the chart favors further upside.

Palantir Technologies has emerged as one of the market’s standout performers, riding the wave of AI adoption and growing demand for real-time, data-driven decision platforms. Originally built to serve government intelligence and defense agencies, Palantir has successfully expanded into the private sector with its AI-enabled Foundry platform, which helps companies across industries, from healthcare to logistics. Few companies sit more squarely at the center of applied AI than Palantir.

Analysts forecast Palantir’s earnings to grow at a notable 32% annually over the next three to five years, driven by surging demand for its AI platforms. That growth potential comes at a cost, however, as PLTR trades at over 200x forward earnings, an ultra-premium valuation that reflects its seemingly unique position in the market.

Today, the stock is breaking out of a bull flag pattern, signaling continued momentum in what has already been one of the best-performing tech stocks in the last year. If PLTR can hold above the $125 breakout level, the setup suggests to continued upside as investors chase AI leaders with both growth and narrative strength

Each of these companies plays a vital role in the expanding AI ecosystem, whether it's ASML powering the production of next-gen chips, Broadcom supplying AI infrastructure, or Palantir delivering advanced software solutions. With strong earnings growth forecasts, compelling technical setups, and renewed market momentum, all three appear well-positioned to benefit from the next bull run.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite