|

|

|

|

|||||

|

|

Applied Digital Corporation’s APLD shares have surged 69.4% over the past month after declining till mid-April. The decline in its share price was not due to micro-factors but industry-specific headwinds, as certain hyperscalers were cancelling their leases during the first quarter of 2025. However, calendar-year first-quarter earnings commentary by industry leaders, including Microsoft MSFT and Meta Platforms META, signaled accelerating demand across hyperscale, colocation and AI workloads despite macro uncertainty.

The stock has significantly outperformed the broader Finance sector’s growth of 2.6% as well as the S&P 500 Index’s 4.4% increase. The outperformance primarily reflects investors’ confidence in APLD’s prospects with major capital expenditure planned by hyperscalers.

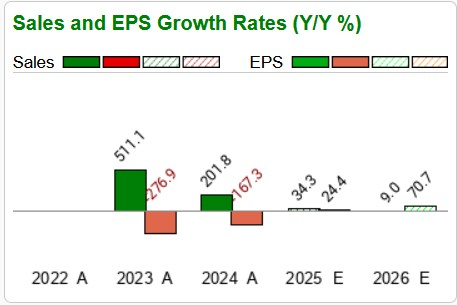

APLD registered a loss 16 cents per share for the first quarter against earnings of 52 cents a year ago despite robust sales growth during the quarter. The decline in earnings primarily reflected higher depreciation and amortization expenses as APLD continues to invest heavily in expanding its data center infrastructure.

Following the recent surge in APD’s share price, investors are likely to be tempted to add the stock to their portfolio. Let’s delve deeper to understand the factors aiding and hurting Applied Digital to determine how investors should play the stock.

One-Month Price Performance

AI Demand Outpacing Supply: Two top hyperscalers, Microsoft and Meta, have announced major investment plans to expand their AI services. Meta plans to invest $62.5 billion, while Microsoft’s capital expenditure may reach $80 billion in 2025. Other tech giants like Amazon, Alphabet, and Oracle are also increasing AI data center capacity to support cloud services. These investments suggest strong momentum for AI-focused data centers in 2025, which could benefit companies like Applied Digital. Although APLD’s Data Center Hosting sales declined 7% year over year in the first quarter, rising demand may help it secure its first hyperscaler customer at its Ellendale facility, significantly boosting future sales.

APLD’s Expansion Plans Look Promising: Applied Digital continues to build its infrastructure to support High-Performance Computing (“HPC”) Data Center Hosting business. The company has deployed nearly $1 billion in assets over the past year, the majority of which was allocated to the construction of data centers. It currently operates 286 megawatts of fully contracted data center hosting capacity, primarily for Bitcoin miners. Apart from this, APLD is constructing three buildings, which should increase the total capacity by 700 megawatts by 2027.

Recent Financial Deal Boosts Balance Sheet: APLD secured a $150 million equity facility, enabling it to raise funds in $25 million increments over 36 months to support its HPC infrastructure expansion. The company has faced substantial cash burn in recent quarters due to high capital expenditures. It ended the first quarter with $100 million in cash, down from $308 million the previous quarter. This new facility, along with financial arrangements with Macquarie Asset Management and Sumitomo Mitsui Bank Corporation, should support APLD’s ongoing expansion efforts.

Sales and EPS Growth Rates

APLD is facing rising costs, with higher depreciation expenses from new facilities expected to pressure its bottom line in the near term. Seasonal power cost fluctuations also weighed on margins in its Data Center Hosting segment during the fiscal first quarter. While overall revenues improved, the figure missed estimates due to a 35.7% sequential decline in Cloud Services revenues, caused by technical challenges in transitioning from single-tenant reserve contracts to a multi-tenant on-demand model. Of APLD’s six GPU clusters, four remain on reserve contracts, while two have shifted to the on-demand model. The issue has now been resolved, and the company expects revenues to normalize in the coming quarters.

Looking ahead, depreciation is likely to remain elevated as APLD plans to spend $30-$50 million per month on infrastructure expansion over the next 12-18 months. Although these investments could drive revenue growth as new facilities go live over the next two years, the company is yet to secure customers for its expanded capacity. The first major project, the 400-megawatt Ellendale campus, is expected to be operational by 2025. However, without revenue-generating leases in place, the new capacity could significantly weigh on gross margins in the short term.

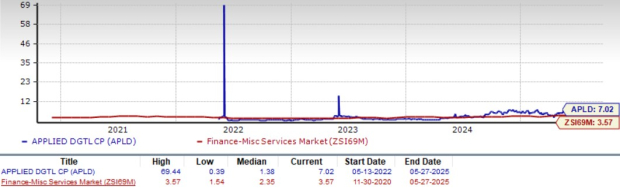

APLD stock is currently trading at a premium, as suggested by the Value Score of F. Following its recent surge in share price, the company trades at 7.02X forward 12-month price-to-earnings (P/S) ratio compared to 3.48X for the industry. APLD’s current valuation is also significantly above its 5-year median of 1.8X.

5-Year P/S F-12M Ratio

The surge in APLD’s share price in the past month has led to a significant increase in its valuation, making it an expensive choice currently. Although the company’s fundamentals look promising on the back of macro headwinds, the benefits may take time to get reflected in earnings results. Moreover, the margins are likely to remain under pressure. Meanwhile, APLD currently carries a Zacks Rank #3 (Hold) and a Zacks Style score of ‘D’. Based on these factors, we advise investors to steer clear of any bet at present and wait for a pullback. However, existing investors may retain the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 35 min | |

| 40 min | |

| 59 min |

AI Stocks At Crossroads As Nvidia, Snowflake, CoreWeave, Salesforce Step Into Spotlight

MSFT

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite