|

|

|

|

|||||

|

|

CoreWeave, Inc. CRWV and Nebius Group N.V. NBIS are emerging AI-focused cloud infrastructure providers positioning themselves as agile alternatives to traditional hyperscalers like Amazon Web Services and Azure, aiming to capitalize on the growing demand for AI cloud solutions.

The rapid proliferation of AI is transforming the entire tech scene, and AI infrastructure has become a high-stakes battleground for tech companies. Per an IDC report, spending on AI infrastructure is expected to top $200 billion by 2028. This uptrend in spending benefits both CoreWeave and Nebius, but not equally. So, if an investor wants to make a smart buy in the AI infrastructure space, which stock stands out?

Let us delve a little deeper into the companies’ strengths and weaknesses to see which is the better stock pick?

CoreWeave is an AI-focused hyperscaler company, and its cloud platform has been developed to scale, support, and accelerate GenAI. Businesses have been increasing spending on AI inference/fine-tuning, AI workload monitoring, and training infrastructure, including training compute, AI servers, AI storage, cloud workloads and networking. This increasing demand for AI cloud platforms, including integrated software and infrastructure, bodes well for CRWV. In the last reported quarter, revenues of $981.6 million beat the Zacks Consensus Estimate by 15.2% and jumped 420% year over year.

In the first quarter earnings call, CRWV highlighted that AI is forecasted to have a global economic impact of $20 trillion by 2030, while the total addressable market is anticipated to increase to $400 billion by 2028. It recently unveiled the next generation of its CoreWeave AI object storage. This is purpose-built for training and inference, offering a production-ready, scalable solution integrated with Kubernetes. Apart from scaling capacity and getting adequate financing for infrastructure, CRWV is also expanding its go-to-market capabilities. Moreover, the buyout of the Weights and Biases acquisition has added 1,400 AI labs and enterprises as clients for CoreWeave.

CoreWeave now has a data center network with 33 data centers across the United States and Europe, supported by 420 megawatts of active power. CRWV also works with NVIDIA Corporation NVDA to implement the latter’s GPU technologies at scale. CoreWeave was one of the first cloud providers to deliver NVIDIA H100, H200, and GH200 clusters into production for AI workloads. The company's cloud services are also optimized for NVIDIA GB200 NVL72 rack-scale systems.

Nonetheless, management’s commentary surrounding higher capital expenditures and high interest expenses is likely to have unnerved investors. CRWV expects capex to be between $20 billion and $23 billion for 2025 due to accelerated investment in the platform to meet customer demand. Higher capex can be a concern if revenue does not keep up the required pace to sustain such high capital intensity. High interest expenses could weigh on profitability. In the first quarter, interest expense came in at $264 million, topping expectations. The company now guides interest expense to remain elevated, at $260-$300 million in the current quarter.

CoreWeave’s 77% of total revenues in 2024 came from the top two customers. This intense customer concentration is a major risk, especially if the client migrates, the revenue impact could be material. Apart from this evolving trade policy, macro uncertainty and volatility remain additional headwinds.

Nebius posted 385% year-over-year revenue growth in the first quarter of 2025, driven by accelerating demand for its AI infrastructure services. NBIS is focusing on technical enhancements that increase reliability and reduce downtime to boost customer retention.

In the first quarter, Nebius significantly upgraded its AI cloud infrastructure through improvements to its Slurm-based cluster. These enhancements included automatic recovery for failed nodes and proactive system health checks designed to identify issues before they impact jobs. This directly lowers downtime and boosts capacity availability. According to the company, these changes led to an estimated 5% improvement in the availability of nodes for commercial use.

Nebius is making substantial investments in improving its object storage capabilities, and the upgraded storage system ensures that big data sets can be easily accessed and saved quickly during model training, directly lowering time-to-result for end users. NBIS successfully graduated multiple platform services like MLflow and JupyterLab Notebook from beta to general availability. Nebius expanded integrations with external AI platforms like Metaflow, D Stack and SkyPilot, enabling customers to migrate tools with nominal friction.

Nebius is focusing on building a global footprint, with capacity in the United States, Europe, and the Middle East. It added three new regions, including a strategic data center in Israel, in the last reported quarter. Like CoreWeave, NBIS’ partnership with NVDA (also an investor in the company) is another plus. Nebius will be one of the first AI cloud infrastructure platform to offer the NVIDIA Blackwell Ultra AI Factory Platform and become a launch partner for NVIDIA Dynamo.

Nonetheless, the intense competition from behemoths remains a concern, along with profitability issues. Despite its exceptional top-line growth, NBIS remains unprofitable, with management reaffirming that adjusted EBITDA will be negative for the full year 2025. Though it added that adjusted EBITDA will turn positive at “some point in the second half of 2025.” Like CoreWeave, NBIS has also raised its 2025 capital expenditure forecast to approximately $2 billion from the previous estimate of $1.5 billion, primarily due to some planned fourth-quarter spending shifting into early first quarter.

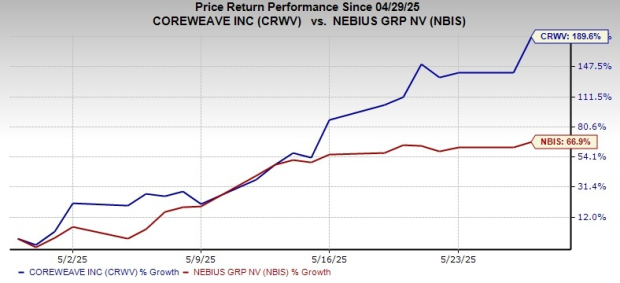

In the past month, CRWV has skyrocketed 189.6% while NBIS has surged 66.9%.

Currently, the stocks carry a Zacks Rank #3 (Hold) each.

While both CoreWeave and Nebius are aggressively scaling to capture the surging demand for AI infrastructure, NBIS appears to be the more compelling investment opportunity at this stage. Despite its ongoing investments and negative EBITDA in the near term, NBIS’s full-stack AI cloud platform and expanding global footprint position it well for growth. NBIS is relatively better placed than CRWV, although both appear to be on a level playing field in terms of Zacks Rank. Consequently, NBIS seems to be a better pick at the moment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite