|

|

|

|

|||||

|

|

Pure Storage, Inc. PSTG recently teamed up with SK hynix Inc., a pioneer in the artificial intelligence (AI) memory industry, aiming to deliver state-of-the-art QLC flash storage solutions purpose-built for data-intensive hyperscale environments.

Modern data centers require storage solutions that deliver high density without compromising performance or energy efficiency. Data bottlenecks can significantly hurt productivity and drive up energy costs, ultimately affecting overall business performance. Traditional storage technologies, such as hard disk drives (HDDs), are becoming increasingly inadequate for meeting the high-capacity, data-intensive demands of hyperscale data centers, particularly in the AI-driven era.

The collaboration between Pure Storage and SK hynix aims to transform the hyperscaler storage landscape. By integrating SK hynix’s advanced QLC NAND technology with PSTG’s DirectFlash architecture, the partners are co-developing high-capacity, energy-efficient flash storage modules optimized for AI and hyperscale workloads.

At the core of this initiative is the integration of Pure Storage’s robust, host-based flash management architecture with SK hynix’s advanced QLC NAND flash. The outcome is a high-speed, low-latency and reliable storage solution optimized for exascale, data-intensive workloads.

One of the most pressing challenges in hyperscale data centers today is power availability. Rising energy costs and environmental mandates are pushing hyperscalers to seek energy conservation without sacrificing capability. This new offering promises to reduce energy usage, enabling customers to address power limitations, cut operating expenses and ultimately shrink their overall carbon footprint.

As workloads and data sets grow, storage must scale effortlessly. Standard HDDs fall short in space efficiency, performance scaling and maintenance overhead. The new QLC flash modules are likely to offer higher rack density than HDD-based systems, effortless scale-out capabilities and lower long-term TCO through increased lifespan and reduced energy usage.

With these improvements, hyperscalers can scale seamlessly without constantly reinvesting in new infrastructure. This creates significant advantages for CapEx and OpEx. With data growing faster than ever due to AI, IoT, 5G and edge computing, the need for advanced storage solutions is more important than ever. The partnership provides not just a product but a plan for building sustainable and future-ready technology in the hyperscale age.

As enterprises and hyperscalers continue to scale data operations, Pure Storage’s innovations are driving efficiency, sustainability and cost savings, accelerating the shift from traditional HDD storage. The company made significant strides in the hyperscale storage market in the fiscal fourth quarter. It secured a major design win with a top-four hyperscaler, enabling it to challenge traditional HDD-dominated environments with its DirectFlash software.

The integration of Pure’s DirectFlash software into large-scale environments demonstrates its ability to provide better efficiency, lower latency and higher performance than HDDs. It further strengthened its position in the hyperscale space by partnering with leading semiconductor companies Kioxia and Micron Technology. These collaborations aim to enhance high-capacity, energy-efficient solutions, meeting the increasing demand for sustainable, cost-effective storage.

The company launched several key solutions designed to modernize enterprise storage, increase operational efficiency and improve cloud strategies. The second-generation Pure Fusion release marked a major advancement, allowing customers to operate storage environments as enterprise data clouds. With enterprises accelerating cloud adoption, it introduced seamless VMware-to-Azure migration solutions, providing greater flexibility in hybrid cloud strategies. Also, it significantly enhanced the Portworx platform, which has gained traction among enterprises transitioning from traditional virtualization to cloud-native applications and AI/ML workloads.

Nonetheless, stiff competition, uncertain macro environment and tariff troubles remain concerns. PSTG expects geopolitical uncertainty to weigh on the macro environment, at least through the current year. It considers the IT spending environment to be similar to the fiscal 2025 level.

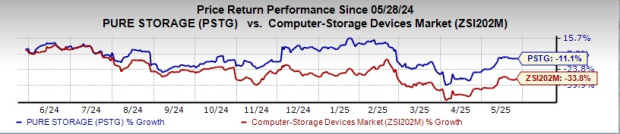

Pure Storage currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 11.1% in the past year compared with the Computer- Storage Devices industry's decline of 33.8%.

Some better-ranked stocks from the broader technology space are Juniper Networks, Inc. JNPR, InterDigital, Inc. IDCC and Ubiquiti Inc. UI. JNPR presently sports a Zacks Rank #1(Strong Buy), while IDCC & UI carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence. Juniper also introduced new features within the AI-driven enterprise portfolio that enable customers to simplify the rollout of their campus wired and wireless networks while bringing greater insight to network operators. In the last reported quarter, it delivered an earnings surprise of 4.88%.

IDCC is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular as well as wireless 3G, 4G and IEEE 802-related products and networks. It has a long-term growth expectation of 15%.

Ubiquiti’s effective management of its strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques. In the last reported quarter, Ubiquiti delivered an earnings surprise of 33.3%. Its highly flexible global business model remains well-suited to adapt to the changing market dynamics to overcome challenges while maximizing growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Cloud Hardware Maker Eyes Buy Point Following Stock Surge On Earnings Beat

UI

Investor's Business Daily

|

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite