|

|

|

|

|||||

|

|

Vivani Medical, Inc. VANI recently announced the filing of a Form 10 registration statement with the U.S. Securities and Exchange Commission (“SEC”), marking the first formal step toward spinning off its neuromodulation subsidiary, Cortigent, Inc. Cortigent is developing the Orion Visual Cortical Prosthesis System to provide meaningful visual perception to people who are blind, along with a Stroke Recovery System designed to improve arm and hand movement recovery in individuals who have experienced paralysis due to stroke.

The proposed spin-off will establish Cortigent as an independent, publicly traded company, enabling it to pursue specialized research and clinical trials while unlocking greater strategic and financial flexibility for both entities. Vivani views this spin-off as a key milestone in its long-term growth strategy and a step toward maximizing shareholder value.

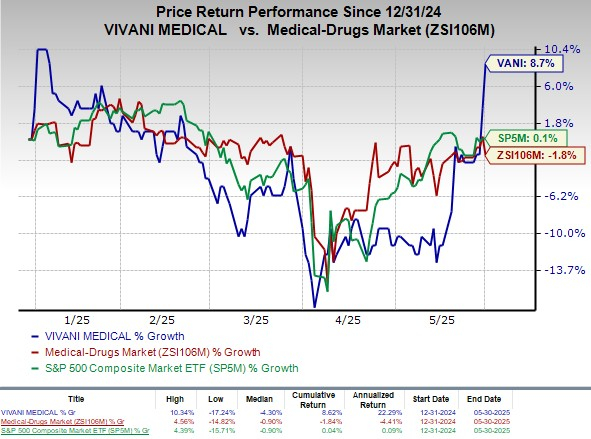

Following the announcement, shares of the company moved 5% north and closed at $1.26 on Friday’s closing. Shares of the company have gained 8.7% in the year-to-date period against the industry’s 1.8% decline. The S&P 500 has gained 0.1% in the same time frame.

The spin-off of Cortigent allows Vivani to sharpen its focus on its core drug and device combination products while enabling Cortigent to independently attract funding, accelerate clinical development, and pursue strategic partnerships in the neuromodulation space. This separation is likely to enhance operational efficiency, unlock hidden value, and potentially increase investor confidence in Vivani’s streamlined vision, ultimately supporting stronger long-term growth for both companies.

VANI currently has a market capitalization of $49.59 billion. It has an earnings yield of 8.1%, which is higher than the industry’s 5.3%. In the last reported quarter, VANI delivered an earnings surprise of 2.1%.

Cortigent focuses on developing brain implant devices to restore lost neurological functions, including the Orion Visual Cortical Prosthesis for blindness and a Stroke Recovery System for post-stroke paralysis. With Orion’s six-year feasibility study completed and prior success with the FDA-authorized Argus II, Cortigent is positioned to advance toward clinical trials and commercialization.

The spin-off is expected to be completed in the third quarter of 2025, subject to regulatory approvals, final board consent, and favorable tax treatment. Once completed, Cortigent will become an independent, publicly traded company listed on the Nasdaq, allowing it to pursue its clinical and commercial objectives with greater agility and autonomy.

The spin-off enables Vivani to fully focus on its core biopharmaceutical mission, the development of miniature and ultra-long-acting drug implants using its proprietary NanoPortal technology. These implants are being designed for annual or bi-annual dosing in the treatment of chronic diseases such as type 2 diabetes and obesity through GLP-1 therapies. By narrowing its operational scope, Vivani expects to gain both scientific and strategic clarity, positioning itself as a leaner and more targeted player in the drug delivery market.

In addition to operational streamlining, the transaction offers financial and strategic advantages. With Cortigent managing its own funding and development plans post-spin-off, Vivani can allocate capital more efficiently toward advancing its GLP-1 pipeline and other NanoPortal-based products. Ultimately, the move is intended to create long-term value by unlocking the potential of two focused, innovation-driven companies.

Currently, VANI carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space that have announced quarterly results are CVS Health Corporation CVS, Integer Holdings Corporation ITGR and AngioDynamics ANGO.

CVS Health, carrying a Zacks Rank of 2, reported first-quarter 2025 adjusted earnings per share (EPS) of $2.25, beating the Zacks Consensus Estimate by 31.6%. Revenues of $94.59 billion outpaced the consensus mark by 1.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CVS Health has a long-term estimated growth rate of 11.4%. CVS’s earnings surpassed estimates in each of the trailing four quarters, with an average surprise of 18.1%.

Integer Holdings reported first-quarter 2025 adjusted EPS of $1.31, beating the Zacks Consensus Estimate by 3.2%. Revenues of $437.4 million surpassed the Zacks Consensus Estimate by 1.3%. It currently sports a Zacks Rank #1.

Integer Holdings has a long-term estimated growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

AngioDynamics, currently sporting a Zacks Rank #1, reported a third-quarter fiscal 2025 adjusted EPS of 3 cents against the Zacks Consensus Estimate of a 13-cent loss. Revenues of $72 million beat the Zacks Consensus Estimate by 2%.

ANGO has an estimated fiscal 2026 earnings growth rate of 27.8% compared with the S&P 500 Composite’s 10.5% growth. The company surpassed earnings estimates in each of the trailing four quarters, with the average surprise being 70.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 7 hours | |

| 8 hours |

CVS Health's Aetna to Pay $117.7 Million to Resolve False Claims Act Allegations

CVS

The Wall Street Journal

|

| 13 hours | |

| Mar-10 | |

| Mar-10 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite