|

|

|

|

|||||

|

|

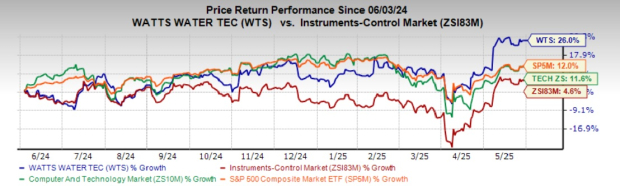

Watts Water Technologies, Inc. WTS continues to benefit from robust acquisitions, aggressive cost-reduction actions and a strong balance sheet. The company’s shares have proved to be resilient amid a volatile market environment with a 26% gain in the past year, outperforming its Instruments Control industry, the Zacks Computer and Technology sector and the S&P 500 composite’s growth of 4.6%, 11.6% and 12%, respectively. The stock has risen 13.3% in the past month.

Shares of WTS are currently trading near their 52-week high, reflecting strong investor confidence and positive market sentiment. The stock closed the last trading session at $242.12, slightly below its 52-week high of $248.17. This proximity to the peak suggests momentum but also calls for a careful evaluation.

Let’s take a closer look at the key advantages and potential risks associated with WTS to determine the most appropriate strategy for your portfolio.

Watts Water continues to expand through new product development and geographic reach. In October 2024, it launched Nexa—an intelligent water management solution combining smart hardware, software and plumbing expertise—targeting commercial buildings like hotels and campuses. Offered via subscription, Nexa enhances service revenues and complements equipment sales. Positive customer feedback and a growing pipeline support its go-to-market expansion. In 2025, Watts plans to scale its digital ecosystem further.

The company’s margin performance is also benefiting from aggressive cost reduction actions. For the second quarter of 2025, the company projects the adjusted operating margin to be between 19.1% and 19.7%, implying growth of 30-90 basis points (bps) year over year. For 2025, the company anticipates the adjusted operating margin to be between 17.7% and 18.3%, implying a 0-60 bps improvement year over year.

Watts Water is accelerating its top-line growth through strategic acquisitions. In January 2025, WTS acquired I-CON Systems, a top provider of plumbing control solutions catering primarily to the corrections market, to enhance digital offerings and expand into the institutional segment. The company reported a positive contribution from the I-CON acquisition, which added $5 million to the Americas’ organic sales in the first quarter. It is encouraged by the ongoing integration progress, with teams from both organizations working collaboratively to realize synergies. The acquisition is expected to be accretive to adjusted EBITDA margins and adjusted EPS in 2025. For the second quarter, Watts Water anticipates around $7 million in incremental sales in the Americas, driven by acquisitions.

In January 2024, WTS completed the acquisition of Josam Company. Josam’s complementary sales networks and channel relationships are expected to drive future growth and provide cross-selling opportunities for Watts Water. The company acquired Bradley Corporation for $303 million in October 2023 and Enware Australia in April 2023 to expand globally. Bradley and Josam acquisitions added $23 million to the Americas’ sales in the fourth quarter of 2024, contributing 6% growth. Moreover, the company is implementing 80/20 strategic initiatives in the Americas and Europe.

Watts Water Technologies, Inc. price-consensus-chart | Watts Water Technologies, Inc. Quote

For the second quarter of 2025, the company’s sales are expected to record an increase of 1-4%, and organic sales are expected to remain flat to increase 3%.

For 2025, the company updated its guidance for reported sales. It expects sales to range from a decline of 2% to an increase of 3% compared with the earlier guidance of a decrease of 3% to a rise of 2%. It still expects organic sales to range from a decline of 3% to an increase of 2%.

Headwinds

Though WTS reported better-than-anticipated first-quarter 2025 the company’s quarterly net sales declined 2% year over year. Organic sales declined, primarily due to fewer shipping days across all regions, resulting in an estimated 3% fall. Ongoing market weakness and inventory destocking in Europe further hurt performance. Unfavorable foreign exchange rates also reduced sales by 1%. Nonetheless, incremental acquisition sales in the Americas added $5 million, contributing 1% to the reported growth.

Watts Water continues to grapple with prolonged softness in its Europe segment. In first-quarter 2025, net sales declined mainly due to a 12% decrease in Europe, driven by lower volumes from fewer shipping days and continued destocking in heat pump and wholesale channels. The company anticipates ongoing softness in Europe due to a slowdown in new construction and persistent economic challenges across the region. For the second quarter, sales in Europe are expected to decline between 11% and 7%. For 2025, sales in Europe are expected to decrease between 9% and 3%, owing to continued destocking.

Moreover, the company faces potential margin pressure from tariffs and a weaker global economy in 2025. Elevated interest rates may dampen construction activity. To offset risks, WTS is raising prices, enhancing global sourcing and accelerating onshoring. Despite these actions, tariff changes and economic uncertainty remain concerns.

WTS is benefiting from strategic acquisitions, product innovation and disciplined cost-cutting. However, potential tariff impact and weakness in the Europe segment keep us on the sidelines. Consequently, it might not be prudent to bet on the stock at the moment.

At present, WTS carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology space are Juniper Networks, Inc. JNPR, Ubiquiti Inc. UI and InterDigital, Inc. IDCC. JNPR presently sports a Zacks Rank #1 (Strong Buy), whereas UI and IDCC carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the last reported quarter, JNPR delivered an earnings surprise of 4.88%. Juniper Networks’ long-term earnings growth rate is 12.4%. Its shares have inched up 1.3% in the past six months.

UI’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 29.93%. In the last reported quarter, Ubiquiti delivered an earnings surprise of 61.29%. Its shares have surged 169.2% in the past year.

IDCC earnings beat the Zacks Consensus Estimate in three of the trailing four quarters while missing in one, with the average surprise being 160.15%. InterDigital’s long-term earnings growth rate is 15%. Its shares have jumped 89.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite