|

|

|

|

|||||

|

|

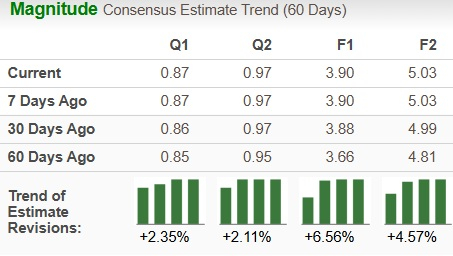

Wingstop Inc.’s WING earnings estimates for fiscal 2025 and 2026 have trended upward in the past 30 days by 0.5% to $3.90 per share and 0.8% to $5.03 per share, respectively. The estimated figures for fiscal 2025 and 2026 reflect 6.6% and 29% year-over-year growth, respectively.

Analysts’ sentiments are likely to have been bullish on the incremental benefits the company is realizing and will realize from the new kitchen operating platform, Wingstop Smart Kitchen. Furthermore, other strategic business growth efforts like menu innovation, digital enhancements, marketing strategies and delivery channel expansion offer WING’s prospects a support system.

Owing to the robust trends, WING stock has soared 50.2% in the past three months, significantly outperforming the Zacks Retail - Restaurants industry, the broader Retail-Wholesale sector and the S&P 500 index. The detailed share price performance can be studied from the chart given below.

Notably, Wingstop has also outshone a few of its industry peers, including McDonald's Corporation MCD, Restaurant Brands International Inc. QSR and Yum China Holdings, Inc. YUMC during the past three months. During the said time frame, the share performance of McDonald's and Restaurant Brands has gained 1.6% and 7.6%, respectively, while that of Yum China has tumbled 14%.

Let’s delve deeper into understanding the factors driving WING’s momentum.

Wingstop has unveiled its new kitchen operating platform, Wingstop Smart Kitchen, at the beginning of 2025. This strategic investment is aimed at improving guest visits and enhancing delivery time, which will reflect in the long-term growth trends of its same-store sales. The Smart Kitchen is an effective interaction between software and hardware, housing three key elements, including an AI-driven demand forecasting technology, a gamified, highly visual kitchen display system and a customer-facing status tracking, order-ready screen.

Upon deploying Smart Kitchen, Wingstop has witnessed consistent order times that have been cut to half of its standard quote time. With such a robust outcome on the first go, the company aims to unlock new dayparts and increase order consistency to deliver an order with a 10-minute average ticket time. As of the first quarter of fiscal 2025, WING has deployed this new kitchen system in more than 200 restaurants. Continuing on this path, Wingstop believes this new technological transformation will help it attain the target of $3 million in AUVs in the long term, which now stands at $2.14 million.

As of March 29, 2025, Wingstop had 2,689 system-wide restaurants, including 2,301 restaurants in the United States and 388 franchised restaurants in international markets, including U.S. territories. To ensure that its brand awareness is maintained in the global market, with competitors like McDonald's, Restaurant Brands and Yum China serving the market, WING resorts to a diversified bunch of strategic growth initiatives.

The company consistently focuses on driving menu innovation, expanding its delivery channels, data-driven marketing and enhancing its digital transformation. These tailwinds, coupled with new restaurant openings, are fueling WING’s brand awareness and guest traffic in domestic and international markets. Recently, Wingstop opened a very first pop-up bar in Brooklyn, entirely dedicated to chicken tenders, and garnered impressive feedback and witnessed incremental growth in guest traffic. Its partnership with the NBA also bodes well, with its new crispy chicken tenders, available in 12 distinct flavors, being the fan favorite during the NBA games this season. Currently, the company is anticipating its debut in the Australian market, with the first opening expected in the second quarter of fiscal 2025 and more than 100 restaurants in the upcoming years.

Apart from focusing on building its profitability and ensuring business growth, the company also ensures to satisfy its shareholders through dividend payments and share repurchases. It effectively uses its free cash, toggling between business investments and returning it to its shareholders. In August 2023, Wingstop brought in its share repurchase program, and since then, it has repurchased and retired 2,196,768 shares of its common stock at an average price of $258.58 per share.

On April 29, 2025, the company’s board of directors declared a regular quarterly dividend of 27 cents per share, totaling approximately $7.5 million. It is to be paid on June 6, 2025, to shareholders as of May 16. Furthermore, during the first quarter of fiscal 2025, WING repurchased and retired 512,810 of its common shares at an average price of $233.54 per share. As of March 29, it had $191.3 million available under its current share repurchase program.

Technical indicators suggest a continued strong performance for Wingstop. From the graphical representation given below, it can be observed that WING stock is riding above both the 50-day simple moving average (SMA) and the 200-day SMA, signaling a bullish trend. The technical strength underscores positive market sentiment and confidence in WING’s financial health and prospects.

50 & 200-Day Moving Averages

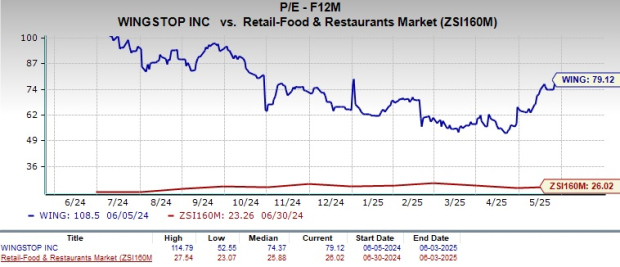

Wingstop is currently trading at a premium compared with its industry peers on a forward 12-month price-to-earnings (P/E) ratio basis. The premium valuation indicates that the stock is trading above its industry peers, making it difficult for investors to figure out a suitable entry point.

However, the overvaluation of WING stock compared with its industry peers indicates its strong potential in the market, given the favorable trends backing it up.

As discussed above, the recent rollout of the Smart Kitchen, which is now available in more than 200 of its restaurants, has proven incremental for Wingstop’s sales growth and profitability. This tailwind, alongside the other in-house strategic efforts, is expected to shield the company from the ongoing macro uncertainties and offer a great deal of competitive advantage.

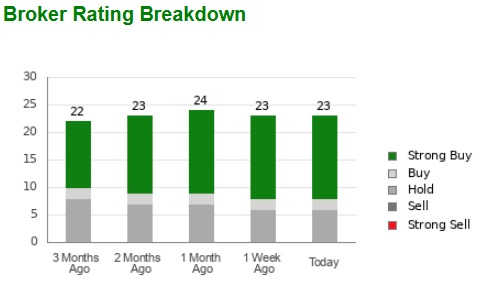

Analysts’ optimism regarding WING stock is reflected in 15 of the 23 recommendations pointing at a "Strong Buy”, with two indicating a “Buy”. This represents 65.2% and 8.7% of all recommendations, respectively.

Thus, based on the above discussion and trends of the technical indicators, this Zacks Rank #2 (Buy) stock is a decent choice to be added to the portfolio for now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 51 min | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Sinks As EU Makes Trump Tariff Move; IBM Dives On This AI Threat (Live Coverage)

MCD

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

Business People: Minnesota Black Chamber names Yoland Pierson president and CEO

MCD

Pioneer Press, St. Paul, Minn.

|

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite