|

|

|

|

|||||

|

|

Advanced Micro Devices AMD and Semtech SMTC are major players in the semiconductor industry. AMD is primarily known for producing CPUs, GPUs, and other integrated circuits, while Semtech focuses on analog and mixed-signal solutions crucial for IoT, data centers, and 5G infrastructure.

The semiconductor industry is expected to continue its growth trajectory in 2025, driven by strong demand for AI and data center technologies. Per Mordor Intelligence report, the Semiconductor Industry is expected to grow from $631.01 billion in 2025 to $958.93 billion by 2030, at a CAGR of 8.73% during the forecast period from 2025-2030. AMD and SMTC are likely to benefit from the significant growth opportunity highlighted by the rapid pace of growth.

The market growth is further underscored by shipment volume forecasts. In terms of shipment volume, the market is expected to grow from 1.40 trillion units in 2025 to 2.29 trillion units by 2030, at a CAGR of 10.32% during the forecast period from 2025 to 2030, per Mordor Intelligence report.

AMD or SMTC — Which of these semiconductor stocks has the greater upside potential? Let’s find out.

AMD is benefiting from its strong presence in the data center market, driven by the widespread adoption of its EPYC processors. In the first quarter of 2025, data center revenues surged 57.2% year over year to $3.674 billion, accounting for 49.4% of total revenues.

The company’s strong adoption of fifth-gen EPYC Turin processors and expanding Instinct AI accelerator deployments across hyperscalers and enterprises have also been major growth drivers for its success.

AMD’s expanding EPYC portfolio has been a key catalyst. In the first quarter of 2025, leading hyperscalers such as Oracle Cloud Infrastructure and Google Cloud expanded their use of AMD EPYC CPUs. OCI Compute E6 shapes offered cost-to-performance gains, while Google Cloud launched C4D and H4D virtual machines for enhanced performance, scalability, and efficiency in general-purpose and HPC workloads.

In May 2025, AMD announced the launch of the AMD EPYC 4005 Series processors, delivering enterprise-class performance and efficiency tailored for small and medium businesses and hosted IT service providers.

Semtech is benefiting from robust performance in the datacenter market. Data center revenues hit a record $51.6 million in the first quarter of fiscal 2026, up 3% sequentially and 143% year over year.

Growth can be attributed to the strong demand for CopperEdge and FiberEdge products. In the first quarter of fiscal 2026, the CopperEdge solution was a major driver, offering more than 90% power savings and longer reach than traditional cables.

Building on this momentum in April 2025, Semtech launched its CopperEdge portfolio of active copper cable and on-board equalization solutions, including the GN8214, GN8224, and GN8234. These low-power, high-performance linear equalizer integrated circuits enable 800G and 1.6T connectivity for AI/ML data centers, offering longer reach and reduced power consumption compared to traditional Active Electrical Cables.

The company has also strengthened its technical collaborations with leading cloud service providers and cable manufacturers, ensuring it remains a key player in next-generation data center infrastructure. With hyperscalers like Meta adopting the Catalina platform, powered by Semtech’s CopperEdge-enabled ACCs, the company is well-positioned to capture market share as AI workloads expand.

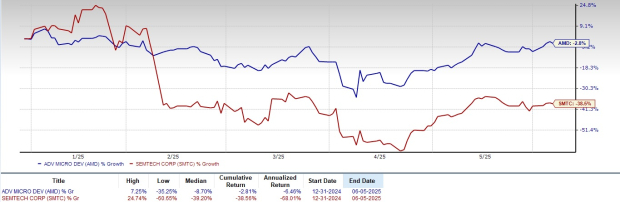

Year to date, shares of AMD and SMTC have lost 2.8% and 38.5%, respectively. The dip in AMD and SMTC share prices can be attributed to the challenging macroeconomic environment. A broader market weakness in the tech sector and persistent fear over mounting tariffs have added to the pressure.

Valuation-wise, AMD and SMTC shares are currently overvalued, as suggested by a Value Score of D.

In terms of forward 12-month Price/Sales, AMD shares are trading at 5.65X, higher than SMTC's 3.09X.

The Zacks Consensus Estimate for AMD's 2025 earnings is pegged at $4.02 per share, which has declined 4.96% over the past 30 days. This indicates a 21.45% increase year over year.

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

The Zacks Consensus Estimate for SMTC's fiscal 2026 earnings is pegged at $1.66 per share, which has declined 2.3% over the past 30 days. This indicates an 88.64% increase year over year.

Semtech Corporation price-consensus-chart | Semtech Corporation Quote

AMD earnings beat the Zacks Consensus Estimate in all the trailing four quarters, delivering an average surprise of 2.30%. SMTC earnings beat the Zacks Consensus Estimate in all the trailing four quarters, delivering an average surprise of 10.83%. The average surprise of SMTC is higher than that of AMD.

While both Advanced Micro Devices and Semtech show strong growth potential in the expanding semiconductor market, Semtech offers greater upside potential with its higher earnings surprise history and innovative data center solutions.

AMD’s expanding portfolio and rich partner base are expected to improve its top-line growth. However, AMD has been suffering from stiff competition, particularly from NVIDIA. Export controls on certain Instinct GPUs to China posed a regulatory challenge.

Currently, SMTC carries a Zacks Rank #2 (Buy), making the stock a stronger pick than AMD, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 8 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite