|

|

|

|

|||||

|

|

Boston Scientific BSX, a prominent global player in cardiovascular technology, is well-positioned to capitalize on the robust expansion of the cardiovascular devices market. According to a MarketsandMarkets report, this market was valued at $72.83 billion in 2023 and is expected to witness a strong CAGR of 7.3% between 2024 and 2029. With its portfolio of Cardiology and Peripheral Interventions products, Boston Scientific is set to benefit significantly from this upward trend.

The booming cardiovascular devices market, driven by aging demographics, minimally invasive procedures, and tech innovation, is propelling Boston Scientific’s top-line growth, product leadership and stronger profitability. These tailwinds were clearly reflected in the company’s robust first-quarter 2025 performance and raised full-year 2025 guidance.

In the past year, Boston Scientific’s shares have skyrocketed roughly 31.8%, outpacing the broader Medical Product industry and the S&P 500 benchmark, which have improved about 8.9% and 11.9%, respectively. During this time, Boston Scientific has also outpaced key peers such as Abbott Laboratories ABT and Medtronic MDT. While Abbott, known for its structural heart, cardiac rhythm management, and diagnostics products, gained 24.2%, Medtronic, known for heart valves and coronary stents, advanced 5.1%.

Strong Q1: In the first quarter of 2025, Boston Scientific’s revenues were up 22.2% on an operational basis (at a constant exchange rate or CER). The Cardiovascular segment sales were up 26.2% year over year. Within this, Cardiology and Peripheral Interventions businesses' sales grew 31.2% and 7.4%, respectively, year over year. U.S. revenues rose 31%, driven by double-digit growth in most business units. Japan and China also delivered strong results, particularly in EP.

Boston Scientific reported adjusted earnings per share (EPS) of $0.75, up 34% year over year. The company’s revenues and EPS rose due to exceptional top-line growth across key franchises, especially in EP and structural heart, combined with improved margin performance and disciplined cost management.

Cardiovascular Steals Spotlight: Boston Scientific’s Electrophysiology business is rapidly expanding its global market share, with first-quarter 2025 organic growth surging 145%, positioning BSX as the number two player in the space. This growth is largely driven by strong commercial adoption of FARAPULSE, the company’s flagship Pulsed Field Ablation (“PFA”) system, which is gaining traction through global demand, new account expansions, and ongoing clinical studies like AVANT GUARD and Elevate PF.

Meanwhile, Boston Scientific’s structural heart portfolio is also performing well, with WATCHMAN sales up 24% year over year, aided by DRG-enabled procedural growth. Next-gen versions — WATCHMAN FLX and FLX Pro — are accelerating adoption, while trials like CHAMPION-AF and OPTION A aim to expand the device’s global market potential.

For full-year 2025, Boston Scientific raised its organic revenue growth guidance to 12- 14% (from 10-12%) and now expects adjusted EPS of $2.87-$2.94, representing 14-17% year-over-year growth. Reported revenue growth is projected at 15-17%, including contributions from recent acquisitions like Axonics and Intera Oncology. Adjusted operating margin is expected to expand 50-75 basis points, driven by strong product mix, notably FARAPULSE and WATCHMAN, and cost efficiencies. Segmentally, Cardiology continues to lead growth, with Endoscopy and Neuromodulation expected to outperform markets and Urology affected modestly by supply constraints.

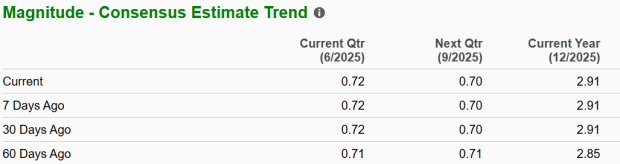

The Zacks Consensus Estimate for Boston Scientific’s 2025 sales and EPS implies a year-over-year improvement of 16.4% and 15.9%, respectively. The bottom-line estimates have moved northward in the past 60 days.

Boston Scientific continues to face a challenging business environment, thanks to industry-wide macroeconomic pressures, including geopolitical tensions, global supply-chain disruptions, and labor market instability. International conflicts and retaliatory trade actions have increased global risks, while volatile financial markets and fluctuating prices for goods and services are squeezing profitability.

Sustained macroeconomic pressures may make it more difficult for the company to manage operating expenses effectively. Tariffs are expected to have a $200 million impact in 2025, which, although planned to be offset through sales growth, cost controls and FX benefits, underscores the heightened complexity of the current environment.

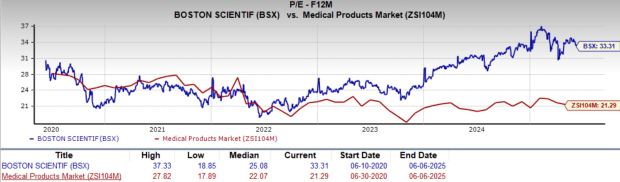

With a forward five-year price-to-earnings (P/E) of 33.31X, Boston Scientific’s shares are trading at a premium compared with the industry average of 21.29X. It has a Value Score of D at present.

Meanwhile, MDT’s five-year price-to-earnings (P/E) of 15.63X is lower than the industry average.

Considering Boston Scientific’s strong operational performance, leadership in fast-growing cardiovascular segments like Electrophysiology and Structural Heart, and promising pipeline of developments, the company is clearly executing well on both growth and profitability fronts. With projected double-digit revenue and earnings growth, BSX is poised to continue delivering shareholder value, even amid a complex macroeconomic backdrop and tariff headwinds.

The stock has excelled both the industry and its peers, and its estimates are likely to continue to trend upward in the near term. Henceforth, the current BSX shareholders may find it prudent to stay invested.

Boston Scientific carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite