|

|

|

|

|||||

|

|

The Trade Desk, Inc. TTD recently extended its collaboration with North America's top grocery technology platform, Instacart CART. This partnership makes Instacart the first U.S. retail media network to fully integrate its grocery selection data with The Trade Desk platform, creating a seamless self-service experience for marketers. The initiative is poised to transform how retail media data is used for programmatic campaigns, enabling advertisers to unlock advanced audience targeting and closed-loop measurement at scale and in real-time on the open Internet.

Advertisers now gain self-service access to Instacart’s vast grocery catalog and can create custom audience segments directly within The Trade Desk platform. These segments can be based on specific product categories like beverages, snacks, or beauty and can be implemented seamlessly mid-flight into new or ongoing campaigns. This means insertion orders (IOs) are no longer a barrier.

Instead, approved brands and agencies can operate with greater agility, leveraging the intuitive and powerful tools within The Trade Desk's cutting-edge Kokai platform, which includes frequency capping, brand safety controls, direct publisher pricing and robust data privacy protections. Additionally, CPG brands can view real-time sales measurement data from Instacart directly within TTD’s platform.

The Trade Desk price-consensus-chart | The Trade Desk Quote

One of the significant advancements in this partnership is the integration of real-time sales signals from Instacart into The Trade Desk. Advertisers can see the impact through closed-loop measurement, including metrics like attributed sales and Return on Ad Spend (ROAS). This integration allows omnichannel media teams to optimize campaigns in real-time, modifying their strategy based on key parameters driving the product’s demand. Major players in the advertising industry are already seeing tangible benefits, and Omnicom’s Flywheel is one of them.

Danone, another early adopter, used the integrated setup to run its “Feel Planty Good” campaign for Silk, leveraging off-site audience data and optimizing creative assets in real-time. This approach made it much easier to reach target consumers and measure downstream impact.

TTD’s partnership expansion is a key catalyst in Instacart’s broader strategy to position itself as a full-funnel advertising solution. With more than 7,000 active CPG brand partners and 1,800 retail partners across the United States and Canada, Instacart is becoming a central hub for omnichannel campaign management.

Beyond the Instacart Marketplace, advertisers can already access Instacart retail data across more than 220 e-commerce grocery partner sites, in-store via smart Caper Carts, and through off-platform partnerships with major players like Google, Meta, NBCUniversal, Roku, and now a deeply integrated experience on The Trade Desk.

This ensures brands can engage shoppers on every device — mobile, streaming TV, or actively building a grocery cart. For The Trade Desk, the integration highlights its power to enhance the open Internet with advertisers gaining precision, speed and transparency in their campaigns without sacrificing control over their media strategies.

TTD continues to drive advancements in the advertising world with fresh launches and collaborations. Recently, it unveiled Deal Desk, an innovation within its Kokai platform designed to enhance how advertisers and publishers manage one-to-one deals and upfront commitments. With AI at its core, Deal Desk is poised to tackle the pressing issues of deal underperformance, lack of transparency and inefficient pacing in the programmatic advertising landscape.

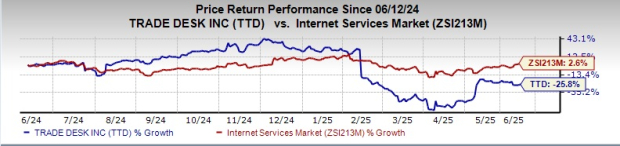

TTD currently carries a Zacks Rank #4 (Sell). Shares of the company have lost 25.8% in the past year against the Zacks Internet – Services industry's growth of 2.6%.

Some better-ranked stocks from the broader technology space are Juniper Networks, Inc. JNPR and Ubiquiti Inc. UI. JNPR presently sports a Zacks Rank #1 (Strong Buy), while UI carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence. Juniper also introduced new features within the AI-driven enterprise portfolio that enable customers to simplify the rollout of their campus wired and wireless networks while bringing greater insight to network operators. In the last reported quarter, it delivered an earnings surprise of 4.88%.

Ubiquiti’s effective management of its strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques. In the last reported quarter, Ubiquiti delivered an earnings surprise of 33.3%. Its highly flexible global business model remains well-suited to adapt to the changing market dynamics to overcome challenges while maximizing growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite