|

|

|

|

|||||

|

|

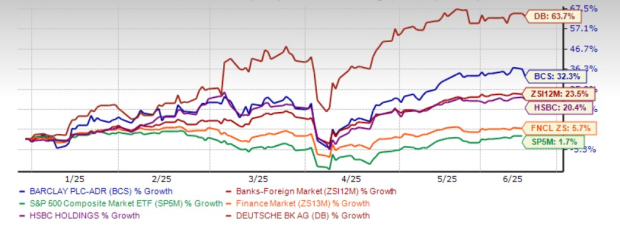

Year to date, shares of Barclays PLC BCS have risen 32.3%. The stock has outperformed the S&P 500 index, the Zacks Finance sector, and the industry. Meanwhile, it has underperformed its close peer, Deutsche Bank DB, while outperforming HSBC Holdings PLC HSBC.

Year-to-Date Price Performance

However, lingering uncertainty around tariff policies continues to pose risks. Given this backdrop, let’s assess whether Barclays stock is a lucrative bet or not.

Restructuring Efforts to Boost Profitability: Barclays has been taking steps to divest unprofitable/less profitable operations and save expenses through business streamlining, while deploying capital into higher revenue-generating areas.

In February 2025, Barclays sold its consumer finance business in Germany. Last year, the company transformed its operating divisions and divested its Italian mortgage portfolio and $1.1 billion in credit card receivables.

Through these efforts, Barclays recorded gross savings of £1 billion in 2024 and £150 million in the first quarter of 2025. The company aims to achieve gross efficiency savings of £0.5 billion this year. By 2026, management expects total gross efficiency savings to be £2 billion and the cost-to-income ratio to be in the high 50s. Its first-quarter 2025 cost-to-income ratio was 57%.

The company is investing these savings in high-growth businesses and markets. This April, Barclays entered into a collaboration with Brookfield Asset Management Ltd. to reshape its payment acceptance business with plans to inject roughly £400 million. In March, the bank had announced a capital injection of more than INR2,300 crore (£210 million) into its India operations, following an injection of almost INR3,000 crore (£300 million) in 2021. Last year, the company acquired Tesco’s retail banking business, which complements its existing business. In 2023, Barclays acquired Kensington Mortgage, which bolstered its mortgage business.

The redeployment of capital into higher-growth businesses and markets through improving efficiency is a multifaceted approach to boosting profitability. Barclays remains committed to this approach, which is likely to help improve profitability over time.

Encouraging Capital Distributions: As of March 31, 2025, Barclays' liquidity coverage ratio and net stable funding ratio were 175.3% and 136.2%, respectively, well above the regulatory requirements. This indicates a solid liquidity and funding profile. Thus, a solid balance sheet position supports its enhanced capital distributions.

The company has been paying dividends regularly and plans to keep the total dividend payout stable at the 2023 level, with progressive dividend growth.

Barclays plans to return at least £10 billion of capital to shareholders between 2024 and 2026 through dividends and share buybacks, with a continued preference for buybacks.

The bank has increased dividends six times in the past five years with an annualized growth rate of 45.04%. It has a dividend payout ratio of 28%.

Barclays Dividend Yield

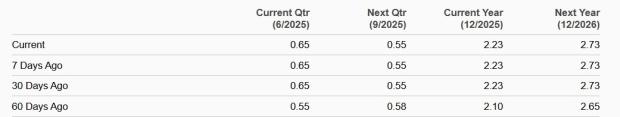

Over the past two months, the Zacks Consensus Estimate for 2025 earnings per share has been revised 6.2% and 3% upward to $2.23 and $2.73, respectively.

Estimate Revision Trend

The Zacks Consensus Estimate for Barclays’ 2025 and 2026 earnings implies year-over-year growth of 21.2% and 22.6%, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

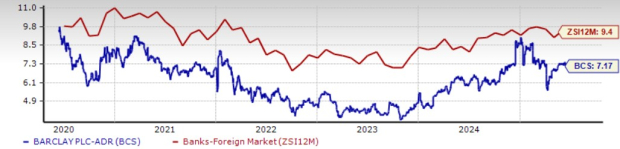

BCS stock is currently trading at a forward 12-month price/earnings (P/E) of 7.17X. This is below the industry’s 9.4X, reflecting an attractive valuation.

Price-to-Earnings F12M

On the other hand, Deutsche Bank and HSBC have a forward P/E of 8.31X and 8.64X, respectively. This reflects that Barclays is trading at a discount compared to its peers.

Entering 2025, a major rebound in mergers and acquisitions (M&As) was expected, with deal-making activities likely to grow in the mid-20s. This optimism stemmed from pent-up demand, stabilizing or declining interest rates, tightening credit spreads, and strong public market valuations. Also, the Trump administration was perceived as business-friendly, with an expected removal of stringent oversight that could mark the end of the prolonged regulatory scrutiny.

None of these has transpired till now. Deal-making activities have been muted as ambiguity over the tariff and ensuing trade war has resulted in extreme market volatility. These developments have led to economic uncertainty. Against such a backdrop, companies are rethinking their M&A plans despite stabilizing rates and having significant investible capital.

Barclays management expects investment banking risk-weighted assets (RWAs) to be 50% of the Group RWAs in 2026. Further, the delay in the M&A rebound will impact the IB business of other global banks, including HSBC and Deutsche Bank, impacting revenue growth to some extent.

Barclays' restructuring efforts to boost efficiency and redeployment of capital to higher revenue-generating businesses are likely to help the company’s financials. Further, a solid liquidity profile enables sustainable capital distributions. Bullish analyst sentiments and attractive valuations are other positives.

However, the bank’s core operating performance remains a concern. Net interest income (NII) and net fee, commission, and other income have been witnessing a volatile trend over the last several quarters owing to a tough operating backdrop. Though NII and net fee, commission, and other income rose in 2024 and in the first quarter of 2025, in light of structural hedges and Tesco bank buyout, the uncertainty about the performance of the capital markets might weigh on the company’s top line, which makes us apprehensive about its growth prospects.

Further, the likelihood of a significant IB rebound this year remains low amid concerns regarding tariff policies, making BCS stock a cautious bet.

Current shareholders may benefit from holding for strong long-term returns, while potential investors should wait for greater macroeconomic clarity before taking a position.

Barclays currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite