|

|

|

|

|||||

|

|

Caterpillar Inc. CAT and Volvo VLVLY are global leaders in the heavy machinery and construction equipment industry, offering a wide range of products including trucks, excavators, and industrial engines. They are key players in infrastructure development and are actively investing in electrification and autonomous technologies to shape the future of construction and transportation.

Caterpillar has a market capitalization of $171 billion, while Volvo has a market capitalization of $16.2 billion. With tariff tensions and weak demand weighing on the manufacturing sector at large, the question is which stock you should put your money on.

To find out, let us dive into the fundamentals, growth prospects and challenges of both Caterpillar and Volvo.

Caterpillar is the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company operates through its three primary segments - Construction Industries (machinery in infrastructure and building construction applications), Resource Industries (mining, heavy construction and quarry and aggregates) and Energy & Transportation (which supports oil and gas, power generation, marine, rail and industrial customers).

Caterpillar has been witnessing six consecutive quarters of volume declines. This was mainly attributed to weak demand in the Resource Industries and Construction Industries segments, due to subdued customer spending. Caterpillars’ revenues declined 3.4% in fiscal 2024 and 9.8% in the first quarter of 2025. Even though earnings had increased 3% in 2024, the same plunged 24% in the first quarter of 2025.

The Construction Industries segment has also been impacted by the downturn in China's real estate sector, particularly for 10-ton and larger excavators, which was once a key market for the company. Weak demand in Europe added to revenue pressures.

For 2025, weaker results in the Construction Industries and Resource Industries segments are expected to offset the slight improvement in the Energy & Transportation segment.

While high labor costs and potential tariffs remain risks, Caterpillar’s pricing and cost-control initiatives should help cushion the impacts. CAT has a significant production base in the United States, which will give it a competitive advantage over companies reliant on imports.

Looking ahead, Caterpillar stands to benefit from the surge in projects, driven by the United States Infrastructure Investment and Jobs Act. The shift toward clean energy will drive the demand for essential commodities, boosting the need for Caterpillar’s mining equipment. Meanwhile, given their efficiency and safety, CAT’s autonomous fleet are gaining momentum among miners.

As technology companies establish data centers globally to support their generative AI applications, Caterpillar is witnessing robust order levels for reciprocating engines for data centers. The company is planning to double its output with a multi-year capital investment. CAT’s efforts to grow its aftermarket parts and service-related revenues, which generate high margins, will also aid growth.

Volvo is one of the leading manufacturers of trucks, buses and construction equipment as well as marine and industrial engines. Its subsidiary, Volvo Construction Equipment (Volvo CE), produces a wide range of machinery for the construction, extraction, waste processing and materials handling sectors. It manufactures haulers, wheel loaders, excavators, road construction machines and compact equipment.

Since 2024, the demand for construction equipment has weakened across most regions. High interest rates and low confidence in Europe, and cooling demand in North America led Volvo CE to scale back production. In fiscal 2024, Volvo Construction Equipment’ net sales decreased 16%. Earnings were also negatively impacted by an unfavorable brand and market mix, and lower volumes.

This continued in the first quarter of fiscal 2025, with net sales of construction equipment down 8%. Increased uncertainty surrounding tariffs and their effect on global trade continues to weigh on results.

Despite the slowdown, the company continues to push innovation with the rollout of new products. The year 2024 marked Volvo CE’s largest product launch to date, with more than 80 new models. This included a modernized range of excavators and an extension of the wide range of electric machines, among them the first electric wheeled excavator. The rollout of Volvo Construction Equipment’s new conventional product range continued in the first quarter with the launch of the A50 articulated hauler for the North American market, along with several local launches of the new range of excavators in Asian markets.

With the need to expand and upgrade existing infrastructure in many countries across the globe, these investments will position Volvo CE for long-term growth.

Volvo Construction Equipment recently announced a strategic global investment in crawler excavator production at three key Volvo CE locations to meet growing demand and mitigate supply-chain risks through localized production.

Volvo is also advancing autonomy to boost safety and productivity. Volvo Autonomous Solutions recently surpassed 1 million tons of limestone hauled autonomously for a client in Norway, highlighting its leadership in mining automation.

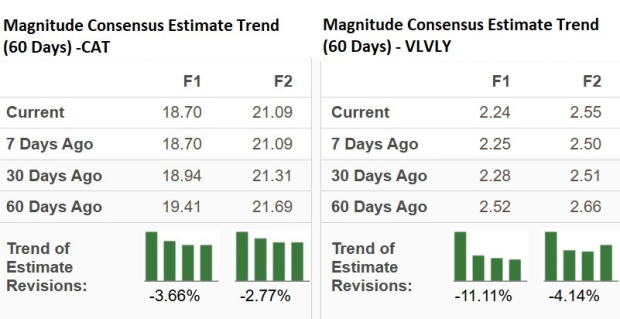

The Zacks Consensus Estimate for Caterpillar’s 2025 earnings is $18.70 per share, indicating a year-over-year decline of 14.6%. The estimate for 2026 of $21.09 indicates a rise of 12.8%. EPS estimates for both 2025 and 2026 have been trending south over the past 60 days.

The Zacks Consensus Estimate for Volvo’s fiscal 2025 earnings is $2.24 per share, indicating a year-over-year dip of 4.3%. The 2026 estimate of $2.55 implies growth of 13.7%. Both estimates have been trending south over the past 60 days.

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

Year to date, CAT stock has dipped 0.5%, whereas VLVLY has gained 16.3%. The Volvo stock has also outperformed the Industrial Products Sector and the S&P 500, as shown in the chart below.

Caterpillar is currently trading at a forward 12-month earnings multiple of 18.26, higher than its five-year median. Volvo stock is trading at a forward 12-month earnings multiple of 11.8X, higher than its five-year median. Both are trading at a discount to the sector average of 19.16X and the S&P 500’s 22.02X.

CAT’s return on equity of 53.77% is way higher than VLVLY’s 24.36%. CAT also outscores the sector’s 20.4% and the S&P 500’s 32.01%. This reflects Caterpillar’s efficient use of shareholder funds in generating profits.

Caterpillar and Volvo Construction Equipment are navigating near-term challenges, as evident from the recent results, the earnings estimate revision activity and the expected decline in the current fiscal-year results.

However, both are poised well for long-term growth underpinned by global infrastructure needs driven by GDP growth, urbanization, regionalization and e-commerce.

Despite a higher valuation, Caterpillar’s return on equity is significantly higher and it currently carries a Zacks Rank #3 (Hold). Volvo has a Zacks Rank #4 (Sell) at present. Investors looking for exposure to construction equipment might consider Caterpillar to be the more favorable option at this time.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 9 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite