|

|

|

|

|||||

|

|

Nebius Group N.V. NBIS is an upcoming player in the AI-infrastructure market, while Amazon AMZN is an established tech behemoth. NBIS is a GPU-focused cloud platform, while Amazon dominates the AI cloud space through Amazon Web Services or AWS, the world’s leading cloud provider, integrating AI capabilities at scale.

Per an IDC report, spending on AI infrastructure is expected to top $200 billion by 2028. This uptrend in spending benefits both Amazon and Nebius, but not equally. So, if an investor wants to make a smart buy in the AI infrastructure space, which stock stands out?

Let’s break down how each company is performing and which one looks like the better investment right now.

Amsterdam-based Nebius is positioning itself as a specialized AI infrastructure company. NBIS also builds full-stack infrastructure for AI, like large-scale GPU clusters, cloud platforms, and tools and services for developers. Collaboration with Saturn Cloud and deeper NVIDIA integration boosts bodes well.

NBIS is doubling down on AI infrastructure with an ambitious $2 billion capital expenditure plan for 2025, up from its earlier guidance of $1.5 billion. NBIS stated that the increase was primarily due to some planned fourth-quarter spending shifting into the early first quarter. Nebius is focusing on building a global footprint, with capacity in the United States, Europe and the Middle East amid accelerating demand for its AI-infrastructure services. It added three new regions, including a strategic data center in Israel, in the last reported quarter. In June 2025, NBIS announced private placement of $1 billion in convertible notes to capitalize on the AI-infrastructure boom and drive-up revenue opportunities in 2026.

It recently announced the general availability of NVIDIA GB200 Grace Blackwell Superchip capacity for its customers in Europe. NBIS plans to build a data-center infrastructure pipeline that can offer scalability to more than 1 gigawatt (“GW”) of capacity. With 1 GW of power, NBIS expects significantly higher revenues beyond its current guidance.

To gain a larger share of the AI cloud compute market, NBIS is focusing on technical enhancements that increase reliability and reduce downtime to boost customer retention. In the first quarter, Nebius significantly upgraded its AI cloud infrastructure through improvements to its Slurm-based cluster and its object storage capabilities. The upgraded storage system ensures that big data sets can be easily accessed and saved quickly during model training, directly lowering time-to-result for end users. NBIS successfully graduated multiple platform services like MLflow and JupyterLab Notebook from beta to general availability. Nebius expanded integrations with external AI platforms like Metaflow, D Stack and SkyPilot, enabling customers to migrate tools with nominal friction.

Nebius remains confident in achieving its full-year ARR guidance of $750 million to $1 billion. For 2025, the company also reaffirmed its overall revenue guidance of $500 million to $700 million. Nonetheless, the intense competition from behemoths remains a concern, along with profitability Management reaffirmed that adjusted EBITDA will be negative for the full year 2025. Though it added that adjusted EBITDA will turn positive at “some point in the second half of 2025.”

While NBIS is an early-stage player, Amazon is one of the dominant names in the AI cloud infrastructure space with its AWS platform. AWS revenues surged 17% year-over-year in the first quarter of 2025, with an annualized revenue run rate pegged at $117 billion. AWS backlog reached $189 billion with a 4.1-year weighted average life, offering forward revenue visibility.

In the last reported quarter, AWS signed new agreements with major companies, including Ericsson, Adobe, Uber Technologies, Nasdaq, Fujitsu and many others. Amazon highlighted that more than 85% of global IT spending is still on-premises, suggesting immense growth potential for AWS.

More significantly, Amazon's AI business segment now operates at a multi-billion-dollar annual revenue run rate with triple-digit percentage growth year over year. Amazon's strategy focuses on custom silicon development, particularly its Trainium 2 chips, which offer 30-40% better price performance compared to GPU-based instances. The company has also expanded its AI model offerings through Amazon Bedrock and introduced services like Amazon Nova foundation models. AMZN has added the latest foundation models in Amazon Bedrock, including Anthropic’s Claude 3.7 Sonnet, Meta’s Llama 4 family of models, DeepSeek’s R1 and Mistral AI’s Pixtral Large.

AMZN is ramping up investment to boost its AI market share. It recently announced it plans to invest up to $20 billion in Pennsylvania to expand its data center infrastructure for AI and cloud computing. Before that, it allocated $10 billion in investments to expand cloud computing infrastructure in North Carolina.

However, capacity constraints pose a challenge. Amazon has indicated that AI demand currently outstrips available capacity, suggesting the company could drive higher revenues with additional infrastructure. The intense competition from Microsoft’s Azure and Google Cloud is concerning. Heavy capex spend could strain margins if AI returns do not materialize.

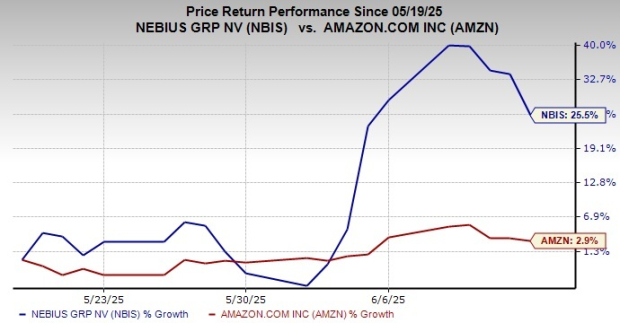

AMZN shares have gained 2.9% while NBIS’ stock has appreciated 25.5%.

Valuation-wise, both Amazon and Nebius are overvalued, as suggested by the Value Score of D and the Value Score of F, respectively.

In terms of Price/Book, NBIS shares are trading at 3.52X, lower than AMZN’s 7.36X.

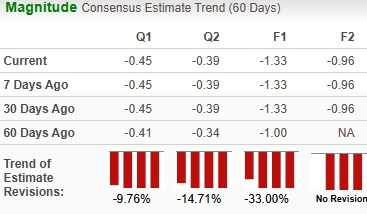

Analysts have significantly revised their earnings estimates downward for NBIS’ bottom line for the current year.

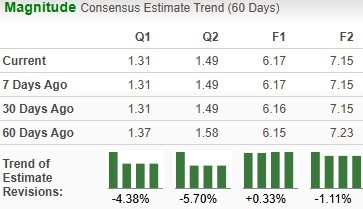

For AMZN, there is marginal upward revision.

NBIS and AMZN currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NBIS is carving out a niche for itself in the AI infrastructure space, while AMZN is a force to be reckoned with. If investors are seeking an AI infrastructure stock with long-term growth potential, Amazon is a better pick.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 min | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite