|

|

|

|

|||||

|

|

Arista Networks, Inc. ANET and Juniper Networks, Inc. JNPR are two of the leading players in the global networking industry. Arista offers one of the broadest product lines of data center and campus Ethernet switches and routers in the industry. It provides routing and switching platforms with industry-leading capacity, low latency, port density and power efficiency.

On the other hand, Juniper provides networking solutions and communication devices that help build network infrastructure. It offers routers, Ethernet switches and security products for intrusion detection, prevention and wide-area network optimization platforms. The company has also introduced new features within its AI-driven enterprise portfolio, enabling customers to simplify the rollout of their campus wired and wireless networks while providing greater insight to network operators.

With a diversified portfolio of advanced networking solutions for cloud data centers and enterprise environments, along with growing exposure to AI workloads and software-defined networking, both Arista and Juniper have the wherewithal to cater to the evolving demands of business enterprises. Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

Arista is witnessing solid demand trends among enterprise customers backed by its multi-domain modern software approach, which is built upon its unique and differentiating foundation, the single EOS (Extensible Operating System) and CloudVision stack. It has introduced new cognitive Wi-Fi software that delivers intelligent application identification, automated troubleshooting and location services. The versatility of Arista’s unified software stack across various use cases, including WAN routing and campus and data center infrastructure, sets it apart from other competitors in the industry.

In addition to high capacity and easy availability, its cloud networking solutions promise predictable performance and programmability, enabling integration with third-party applications for network management, automation and orchestration. The company boasts a comprehensive portfolio with the right network architecture for client-to-campus data center cloud and AI networking. The Arista 2.0 strategy is resonating well with customers, with its modern networking platforms being foundational for transformation from silos to centers of data. The strategy comprises three components that are likely to drive growth over the next few years. The first component is focused on plans to invest in core businesses by rolling out new solutions and improved AI offerings. Secondly, Arista aims to emphasize more on software-as-a-service for improved revenue visibility. Last but not least, the company plans to enter adjacent markets to target a broader customer base.

However, Arista remains plagued by high operating costs. Total operating expenses in first-quarter 2025 increased around 22.3% to to $417.3 million, owing to a rise in headcount, new product introduction costs and higher variable compensation expenditures. Moreover, the redesigning of products and their supply chain mechanism has eroded margins. Although the company is witnessing increased demand, there are lingering supply bottlenecks for advanced products. Therefore, it is increasing orders for these components and trying to build up inventory, which is blocking working capital.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence. It offers suites of products such as the T4000 core router, QFX data center platform, ACX and PTX packet/optical solution, among others. With the growing usage of smartphones and tablets, mobile data traffic has gone up. This has resulted in growing demand for advanced networking architecture, in turn leading service providers to spend more on routers and switches. Juniper is expected to benefit from the higher spending pattern among carriers to upgrade their networks and support the incremental growth in data traffic.

Juniper is taking significant steps to enhance the adoption of its AI-Native Networking Platform through the introduction of its Blueprint for AI-Native Acceleration. This comprehensive framework is designed to simplify and accelerate the deployment and utilization of AI-driven networking solutions, benefiting enterprises across various sectors. By leveraging Juniper's AI-Native Networking Platform, organizations can expect up to an 85% reduction in operational expenses and a 90% decrease in network trouble tickets. The platform's industry-leading AIOps technology is key to delivering these results, providing reliable, measurable and secure connections across all devices and applications. The Blueprint for AI-Native Acceleration further enhances these capabilities, enabling customers to achieve up to nine times faster deployments.

However, Juniper faces severe competition in each of its served markets, especially from industry leader Cisco Systems, Inc. CSCO, which has traditionally spearheaded innovation, charging higher prices for its premium branded products and expanding margins. It is worth mentioning that Cisco’s acquisition of cybersecurity solutions provider Sourcefire could be an added pressure on Juniper’s security business. Despite having a strong security portfolio (SRX Platform & Security Software, Screen OS and other Legacy products), Juniper has not been performing well for the past few quarters due to lower-than-expected demand for non-Junos-based security products. Poor performance by the Junos business prompted the company to sell off the mobile security unit.

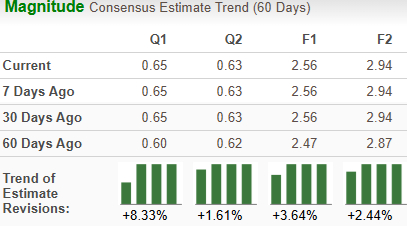

The Zacks Consensus Estimate for Arista’s 2025 sales and EPS implies year-over-year growth of 18.7% and 12.8%, respectively. EPS estimates have been trending northward over the past 60 days.

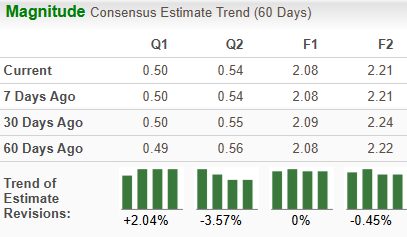

The Zacks Consensus Estimate for Juniper’s 2025 sales implies year-over-year growth of 6.9%, while that for EPS suggests an improvement of 20.9%. EPS estimates have remained static over the past 60 days.

Over the past year, Arista has gained 8.6% compared with the industry’s growth of 34.4%. Juniper has inched up 0.7% over the same period.

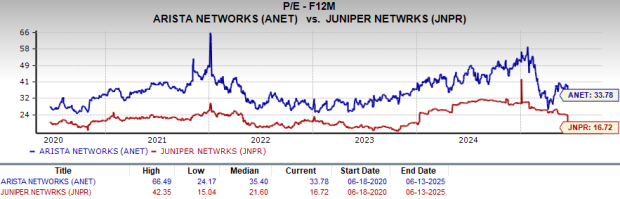

Juniper looks more attractive than Arista from a valuation standpoint. Going by the price/earnings ratio, Juniper’s shares currently trade at 16.72 forward earnings, significantly lower than 33.78 for Arista.

Arista carries a Zacks Rank #2 (Buy), while Juniper sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Both companies expect their sales and profits to improve in 2025. Arista has shown steady revenue and EPS growth for years, while Juniper has been facing a bumpy road. However, with a superior Zacks Rank and attractive valuation metrics, Juniper appears to hold a slight edge over Arista at the moment, making it a relatively better investment proposition between the two.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Stock Market Today: Dow Clings To A Gain After CPI Data; Power Name Hits New High (Live Coverage)

ANET

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Stock Market Today: Dow, S&P 500 Find Strength After CPI Data; Crypto Name Soars (Live Coverage)

ANET

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite