|

|

|

|

|||||

|

|

In the competitive landscape of the financial market, companies distinguish themselves not only by scale but also by their strategic focus and client approach. Goldman Sachs GS and Moelis & Company MC represent two distinct models within the investment banking (IB) industry — one is a globally integrated financial giant with diversified services, and the other is a focused, advisory-driven boutique delivering high-impact solutions.

As investors evaluate opportunities in the financial sector, analyzing these two companies’ various factors provides valuable insights into their respective strengths, risks and long-term potential.

GS continues to maintain its leadership position in global investment banking, particularly in mergers and acquisitions (M&A) advisory, equity, and debt underwriting. In 2024, the firm posted a 24% increase in IB revenues, supported by a rebound in corporate financing activity.

However, that momentum has been reversed lately, with IB revenues falling 8% in the first quarter of 2025. While the near-term prospects are cloudy due to market turmoil and uncertainty over monetary policy, Goldman’s leading position in deal-making activities indicates enduring client trust. This, along with an increased backlog, will likely convert into higher IB revenues once the operating backdrop improves, giving GS a strategic edge over peers.

A key aspect of Goldman’s value proposition lies in its strategic overhaul. The firm is actively exiting lower-margin consumer finance businesses to refocus on high-return businesses like IB and the trading business. In sync with this, GS is exiting its consumer finance businesses, including ending its partnership with Apple on the Apple Card and Apple Savings account (may end before the contract runs out in 2030).

Additionally, Goldman Asset Management is targeting aggressive growth in private credit, aiming to scale its portfolio to $300 billion by 2030. The company’s global footprint and ambitions to expand private lending reinforce its long-term growth potential.

MC continues to reflect resilient performance, driven by its high-quality advisory platform and expanding global footprint. Despite revenue declines in 2019, 2022 and 2023 due to cyclical softness in M&A completions, the company achieved a robust 10% compound annual growth rate (CAGR) over the five years ending in 2024. That momentum carried into the first quarter of 2025, supported by higher average fees per deal and an ongoing surge in global restructuring activity as highly leveraged companies adapt to a changing rate environment.

Looking ahead, Moelis & Company is well-positioned to benefit from structural tailwinds in M&A and capital advisory. With elevated corporate debt levels driving demand for restructuring and increased regulatory complexity requiring strategic guidance, MC’s advisory-centric model is particularly well-suited for the current environment.

Moelis & Company’s business is significantly diversified across various sectors and geographically. The company also does not have any meaningful client concentration, with the top 10 transactions representing less than 25% of total revenues. Strategic alliances in Japan and Mexico, and a minority stake in Moelis Australia bolster its global relevance. With more than $5.1 trillion in advised transactions since inception, global expansion and diversification are expected to continue supporting its profitability.

In the past year, shares of Goldman and Moelis & Company have gained 38.7% and 7.5%, respectively, compared with the industry’s rise of 33.1%.

Price Performance

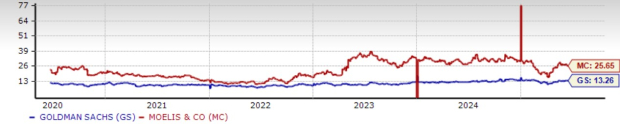

In terms of valuation, GS is currently trading at a 12-month forward price-to-earnings (P/E) of 13.26X, higher than its five-year median of 10.16X. Conversely, the MC stock is currently trading at a 12-month forward P/E of 25.65X, which is higher than its five-year median of 20.16X.

Price-to-Earnings F12M

Goldman is trading at a discount compared with the industry’s average of 13.51X, while MC stock is trading at a premium.

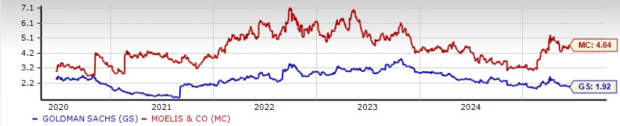

Both companies regularly pay dividends. GS has a dividend yield of 1.92%, and MC has a dividend yield of 4.64%. Further, both are higher than the industry’s average dividend yield of 1.19%. Here, Moelis & Company holds an edge over Goldman.

Dividend Yield

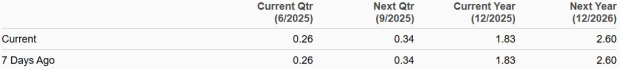

The Zacks Consensus Estimate for GS’s 2025 and 2026 revenues reflect a year-over-year rise of 3.8% and 5.1%, respectively. Likewise, the consensus estimate for 2025 and 2026 earnings indicates a rise of 9.6% and 13.1%, respectively. Earnings estimates for both years have been revised downward over the past week.

GS Estimate Revision Trend

The Zacks Consensus Estimate for MC’s 2025 and 2026 revenues reflects a year-over-year rise of 2.8% and 20.9%, respectively. Also, the consensus estimate for 2025 and 2026 earnings indicates 0.6% and 42.4% growth, respectively. Earnings estimates for both years have been unchanged over the past week.

MC Estimate Revision Trend

Moelis & Company offers a focused, advisory-driven model that is well-aligned with the rising demand for restructuring services amid elevated corporate debt and shifting monetary conditions. The company’s diversified client base and global expansion strategy reflect a scalable platform with significant long-term potential.

Moelis & Company also offers strong earnings growth prospects, with a projected 42.4% rise in 2026 earnings, outpacing Goldman’s estimates. Additionally, its higher dividend yield provides a strong income component, appealing to investors seeking both growth and yield.

Though MC trades at a premium valuation, this indicates the investors' confidence in its business model and profitability. With a market capitalization of just $4.4 billion compared with Goldman’s $188.3 billion, Moelis & Company has significantly more room to scale.

At present, GS carries a Zacks Rank #4 (Sell), while MC has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite