|

|

|

|

|||||

|

|

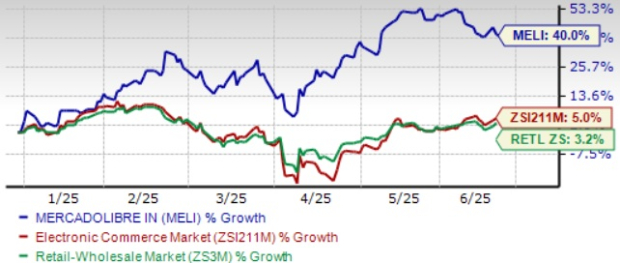

MercadoLibre MELI shares have returned 40% in the year-to-date (YTD) period, outperforming the Zacks Retail-Wholesale sector and the Zacks Internet-Commerce industry’s growth of 3.2% and 5%, respectively.

The Latin American company is efficiently tapping into the underpenetrated market in the region, taking advantage of the changing ways people buy and sell. It is actively investing in its value proposition to make the online buying experience more attractive than offline, which led to brand preference scores reaching all-time highs in Brazil, Mexico, Argentina and Chile in the first quarter of 2025.

Even in fintech, its monthly active users continue to rise. However, there are a few key headwinds that should caution investors for now, despite MELI’s strong growth. Let’s take a closer look at the factors that are both helping and hurting MercadoLibre to understand why the stock is a hold for now.

MELI’s fintech arm, Mercado Pago, has been playing a central role in driving overall platform growth. A key strength lies in its low-cost-to-serve model, which enables profitable growth even while offering users attractive yields on deposits. These rates often match or exceed local benchmarks and allow instant liquidity, encouraging users to bring in funds, which, in turn, increases engagement with other services across the ecosystem.

These efforts have been especially effective in markets like Brazil, Mexico and Chile, where user growth has outpaced the overall average. As a result, Mercado Pago reached 64 million monthly active users in the first quarter of 2025, marking a 31% year-over-year increase. Fintech revenues for the quarter hit $1.49 billion, accounting for 34.4% of total revenues and growing 43% year over year.

MercadoLibre has been strengthening its logistics network to support long-term e-commerce growth. In March, fulfillment penetration in Brazil surpassed 60% for the first time. Efficiency initiatives have helped reduce fulfillment costs year over year in local currency across Brazil, Mexico and Chile. This allows for continued investment in features like free shipping to boost purchase frequency.

Meanwhile, the supermarket category is gaining traction. Improved navigation, repeat purchase options and targeted promotions led to a 65% year-over-year increase in items sold in the first quarter, making it MELI’s fastest-growing category and driving broader user engagement.

The Zacks Consensus Estimate for 2025 earnings is pegged at $47.75 per share, which has been revised downward by 0.35% over the past 30 days, indicating 26.69% year-over-year growth.

The consensus mark for 2025 revenues is pegged at $27.35 billion, suggesting 31.66% year-over-year growth.

MercadoLibre’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with the average surprise of 22.59%.

MercadoLibre, Inc. price-consensus-chart | MercadoLibre, Inc. Quote

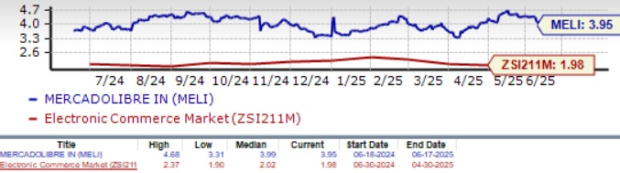

MELI is trading at a premium compared to the broader Zacks Internet – Commerce industry. As of the latest data, MELI’s forward 12-month Price/Sales ratio hovers around 3.95X, above the industry’s 1.98X. This suggests MELI is not a great pick for a value investor.

The Value Score of D further reinforces an unattractive valuation for the stock at the moment.

While MercadoLibre reported strong overall growth, margins in Brazil and Mexico have been under pressure. The company continued to invest heavily in logistics infrastructure and the expansion of its credit card business, both of which are critical to long-term strategy but are weighing on near-term profitability. In Brazil, additional cost pressure came from higher interest rates and currency depreciation. As a result, both countries saw their direct contribution margins decline by about 5 percentage points year over year in the first quarter.

MercadoLibre is facing rising pressure from well-funded international giants expanding across Latin America. Amazon AMZN is ramping up its regional operations, bringing its logistics and brand power to the region. Walmart WMT, with more than 3,000 stores in Mexico alone, continues to rely on its vast brick-and-mortar presence to strengthen its position in the region. Meanwhile, AliExpress, backed by Alibaba BABA, draws price-sensitive shoppers with ultra-cheap goods and a broad product variety.

Though MELI remains a dominant force in Latin American e-commerce, Amazon, Walmart, and Alibaba each pose serious competitive threats. If unchecked, they could erode MELI’s pricing power, retention and long-term profitability. Shares of Walmart and Alibaba have risen 4.4% and 35.7%, respectively, in the year-to-date period, while Amazon has lost 2%.

MercadoLibre remains a strong player in Latin America’s e-commerce and fintech markets, with solid growth in active users and expanding logistics. Its investments financial services are clearly paying off. However, the company is also navigating short-term challenges, including rising margin pressure in key markets and intensifying competition from global giants.

On top of that, valuation concerns and slight downward revisions in earnings estimates suggest the stock may not offer the best risk-reward balance at current levels. Given this mix, MELI is best kept as a hold for now.

MELI currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 min | |

| 13 min | |

| 49 min | |

| 49 min | |

| 54 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 5 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite