|

|

|

|

|||||

|

|

DexCom DXCM delivered robust first-quarter 2025 results, underpinned by strong category demand, record new patient growth and meaningful progress in its long-term strategic initiatives. As the year progresses, several key growth drivers are set to propel the business forward, even as the company faces operational and regulatory headwinds. Dexcom’s strong commercial execution, expanding access footprint and pipeline innovation position it well for long-term growth. Yet, execution in logistics, regulatory compliance, and payer strategy will be critical for converting these tailwinds into sustainable margin expansion.

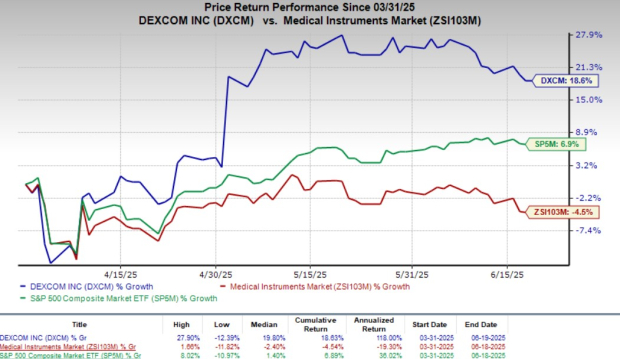

This Zacks Rank #3 (Hold) company’s shares have gained 18.6% quarter to date compared to the industry’s 4.5% decline. The S&P 500 Index has improved 6.9% in the same time frame.

DXCM, a renowned medical device company and provider of continuous glucose monitoring (CGM) systems, has a market capitalization of $31.76 billion. It projects a 23.1% growth rate over the next five years and anticipates maintaining a strong performance going forward.

DexCom’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, the average surprise being 0.47%.

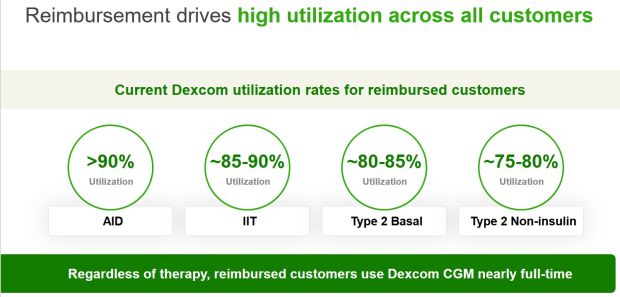

A major inflection point for Dexcom in 2025 is the significant expansion in reimbursement coverage for people with type 2 diabetes (T2D), particularly those who are not on insulin. As of summer 2025, Dexcom’s G7 continuous glucose monitor (CGM) will be covered by all three major pharmacy benefit managers (PBMs) for anyone with diabetes, unlocking access for nearly 6 million non-insulin users. Encouragingly, the first quarter already saw a material increase in new starts from this cohort, the highest in Dexcom’s history. Physician prescribing patterns are shifting in tandem with these policy changes, setting the stage for accelerating patient adoption in the back half of the year.

Simultaneously, Dexcom’s over-the-counter CGM, Stelo, is helping capture a broader audience, including patients with prediabetes and those interested in wellness and metabolic health. The company has rolled out app enhancements, launched on Amazon, and observed a rising subscription trend among early adopters. While still in early stages, Stelo adds a consumer-facing channel that complements the prescription-based G7 ecosystem.

The upcoming launch of the 15-Day G7 system marks a technological leap for Dexcom. With improved accuracy (MARD of 8.0%) and extended wear time, the device is expected to bolster gross margins and deepen product differentiation. Integration efforts with insulin pump partners and payer contracting are already underway to ensure a seamless rollout in the second half of 2025.

Additionally, Dexcom continues to benefit from operational leverage. Following a major sales force expansion in 2024, the company is now optimizing reach and productivity, especially in the basal and primary care segments. Internationally, momentum is building in markets like France and Japan, aided by Dexcom ONE’s growing presence and type 2 coverage wins.

Dexcom’s $2.7 billion cash position and the announcement of a $750 million share buyback reflect strong balance sheet health and confidence in long-term cash flow generation. Despite inflation and logistics cost headwinds, the company reaffirmed its full-year revenue and EBITDA margin guidance, highlighting effective cost control and prioritization.

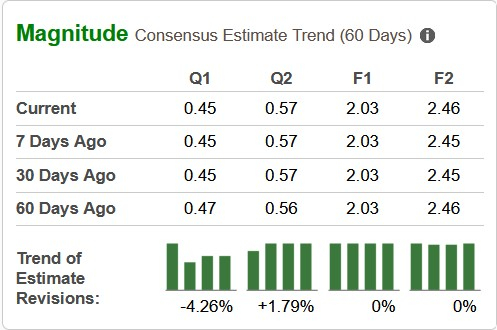

DexCom has witnessed a stable estimate revision trend for 2025. In the past 30 days, the Zacks Consensus Estimate for 2025 earnings per share has remained stable at $2.03.

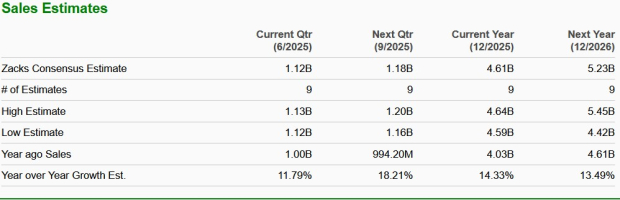

The consensus mark for the company’s second-quarter revenues is pegged at $1.12 billion, indicating an 11.8% improvement from the year-ago quarter’s reported number. The consensus estimate for earnings is pinned at 45 cents per share, implying an improvement of 4.7% year over year.

However, Dexcom is not without headwinds. Gross margin guidance for fiscal 2025 was revised down to nearly 62%, primarily due to supply-chain disruptions that began in late 2024. To maintain customer continuity, Dexcom resorted to costly chartered flights and now faces a prolonged inventory rebuild. These freight-related expenses, combined with nearly 50 bps of inflation from raw material tariffs and FX volatility, are expected to weigh on profitability through the third quarter.

Separately, Dexcom is addressing a warning letter from the FDA tied to 2024 inspections. While it does not restrict product approvals or sales, it demands ongoing resource allocation and operational focus. The company is cooperating with the agency and has begun implementing corrective measures.

Lastly, while Dexcom is advocating Medicare coverage for non-insulin T2D users, progress hinges on a randomized controlled trial set to report results in late 2025 or early 2026. A favorable outcome could unlock another major addressable market.

DexCom, Inc. price | DexCom, Inc. Quote

While Dexcom leads in sensor accuracy and access, its three listed rivals — Abbott Laboratories ABT, Medtronic MDT and Senseonics SENS — are rapidly innovating, creating a more competitive and segmented CGM market landscape in 2025 and beyond.

Abbott Laboratories continues to expand its CGM footprint with its FreeStyle Libre family and the recent launch of Libre Rio, an FDA-cleared OTC device targeting insulin-free Type 2 diabetes patients. Abbott Laboratories’ broad portfolio and consumer wellness push with Lingo directly challenge Dexcom’s Stelo strategy, especially in the growing OTC and metabolic health market.

Medtronic, while spinning off its diabetes unit, remains a strong force through its MiniMed 780G system. Its integration of CGM with insulin pumps competes directly with Dexcom’s G7-enabled automated delivery partnerships. The forthcoming spin-off could streamline Medtronic’s focus and reinvigorate innovation.

Senseonics, although smaller in scale, presents a differentiated offering with its implantable Eversense CGM. With sensor wear times of up to 365 days, it appeals to a niche segment prioritizing convenience and minimal maintenance, pressuring Dexcom to enhance G7’s longevity and user comfort. As adoption grows, Senseonics’ Eversense could influence payer and clinician preference dynamics, particularly among high-adherence, low-maintenance patient cohorts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite