|

|

|

|

|||||

|

|

Fresenius Medical Care FMS recently unveiled its forward-looking “FME Reignite” strategy at the 2025 Capital Markets Day, aiming to achieve industry-leading profitability while optimizing capital structure and advancing innovation in renal care. This comprehensive plan builds on the momentum of its prior transformation initiatives and integrates a sharp focus on capital returns, technological leadership and organizational agility.

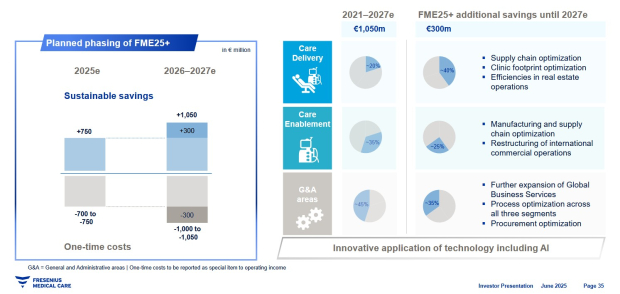

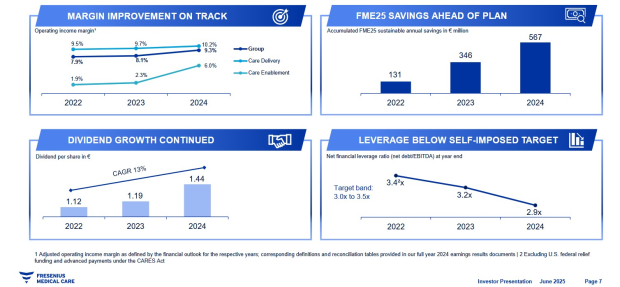

At the heart of the FME Reignite strategy lies an aggressive expansion of the existing FME25 program, now rebranded as FME25+, targeting €1.05 billion in sustainable cost savings by 2027. This €300 million increase over prior goals reflects the company’s focus on operational excellence and margin expansion. These savings are expected to be channeled directly into margin improvement, helping FMS achieve its mid-teens operating income margin target by 2030 across both its Care Delivery and Care Enablement segments.

By establishing Value-Based Care (“VBC”) as a standalone segment, Fresenius enhances transparency and strategic clarity. Having generated €1.8 billion in 2024 revenues, this business unit is built around long-term partnerships with both public and private payors in the United States, aiming to deliver better outcomes at lower costs. The VBC model aligns well with broader healthcare trends favoring preventive, personalized care and is expected to become a material contributor to Fresenius’ growth and resilience.

FME25+ not only supports profitability but also enhances scalability, standardization, and efficiency across clinics and manufacturing sites. As a vertically integrated player, Fresenius is well-positioned to leverage synergies across its operating arms to streamline service delivery while maintaining care quality.

A key pillar of the strategy is a new capital allocation framework designed to balance reinvestment and shareholder returns. Fresenius plans to allocate €800 million to €1 billion annually for capital expenditures through 2030, reinforcing its innovation pipeline and core operations. Simultaneously, it aims to reduce its net financial leverage to a more conservative 2.5X-3.0X range, down from the earlier 3.0X-3.5X target, demonstrating a prudent approach amid macroeconomic uncertainties.

To return value to shareholders, Fresenius will initiate a €1 billion share buyback program over two years beginning in 2025 and has committed to a dividend payout ratio of 30-40%. This dual-pronged return strategy underscores a clear intent to enhance investor confidence while maintaining financial flexibility.

Another cornerstone of the strategy is the upcoming U.S. commercial launch of the 5008X CAREsystem, Fresenius’s next-generation dialysis machine. The FDA-cleared 5008X enables high-volume hemodiafiltration (HVHDF), a modality that has demonstrated significant survival and quality-of-life benefits compared to conventional hemodialysis. Backed by the CONVINCE study, HVHDF showed a 4.4% mortality reduction over 2.5 years and promises lower hospitalization and improved treatment consistency.

Fresenius plans to replace all 2008T machines in its U.S. clinics with the 5008X by 2030, driving not only clinical outcomes but also operational efficiencies such as reduced clinic labor and drug use. With its market-leading installed base and exclusive FDA clearance, the company also expects to expand its market share in disposables tied to this platform.

Through FME Reignite, Fresenius Medical Care is repositioning itself as a financially disciplined, innovation-driven, and patient-centered leader in renal care. By combining cost control with growth investments, optimizing capital allocation, and advancing clinical standards, the company is set to unlock meaningful long-term value for patients and shareholders alike.

Baxter International BAX, DaVita Inc. DVA and Outset Medical OM are also navigating profitability and capital strategies through distinct lenses shaped by their business models and market positions.

Baxter, having divested its kidney care business, is now focused on rebuilding profitability across its hospital and digital health portfolios. The company has improved gross margins through cost controls and is deleveraging its balance sheet following recent spin-offs. Capital allocation remains disciplined,with a renewed focus on organic investments and debt reduction.

In contrast, DaVita, a pure-play dialysis provider, maintains stable operating margins through scale efficiencies and disciplined cost management. DVA’s profit sharing strategy depends heavily on share buybacks. The company recently issued senior notes worth $1 billion, reflecting a high-leverage model focused on returning capital to shareholders.

Meanwhile, Outset Medical, a younger player, is prioritizing margin improvement and cash burn reduction. While still unprofitable, OM has improved gross margins to ~37% and is narrowing its losses through cost discipline and operational streamlining. However, Outset Medical remains reliant on external funding, often through dilutive equity raises.

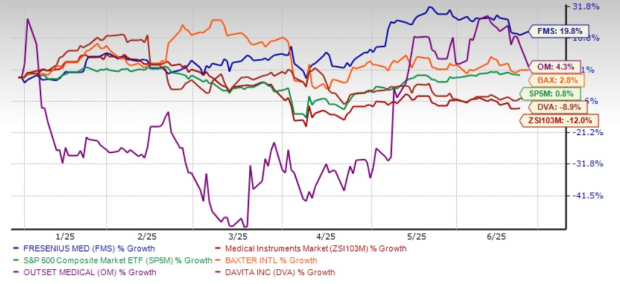

Shares of FMS have outperformed its industry as well as its peers. The company’s shares have risen 19.8% year to date against the industry’s decline of 12%. While shares of BAX and OM have gained 2.8% and 4.3%, respectively, in the same period, those of DVA have lost 8.9%. The S&P 500 Index has increased 0.8% in the same time frame.

YTD Performance Chart

Fresenius Medical currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite