|

|

|

|

|||||

|

|

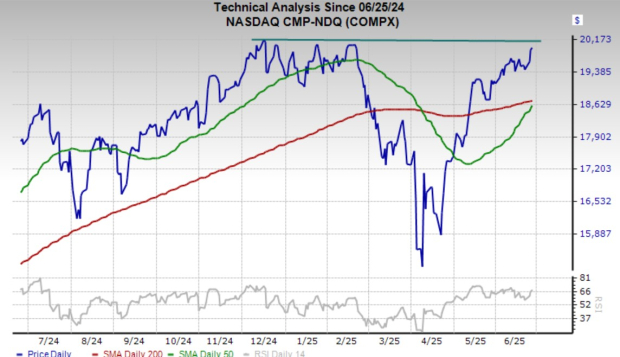

Nvidia stock hit all-time highs on Wednesday, helping the Nasdaq-100-tracking QQQ ETF reach fresh records. The broader S&P 500 and the Nasdaq are inching closer to their peaks as Wall Street celebrates cooling Middle East tensions.

Investors are betting that the President Trump-backed cease-fire agreement between Israel and Iran leads to a sustained peace.

Confident that a major conflict will be avoided, Wall Street finally sent market-moving technology stocks such as Nvidia to new highs, following the rally that began in early April.

Cooling inflation, trade deals, and the potential for strong second-quarter earnings provide a bullish backdrop heading into July.

Now it’s time for investors to buy strong technology stocks set to benefit from the artificial intelligence boom and other key trends heading into July.

Rockwell Automation, Inc. ROK is an industrial automation and digital transformation company helping drive the next generation of smart manufacturing. ROK provides a range of solutions, focusing on hardware, software, and services to optimize manufacturing and industrial processes across three core segments: Intelligent Devices, Software & Control, and Lifecycle Services.

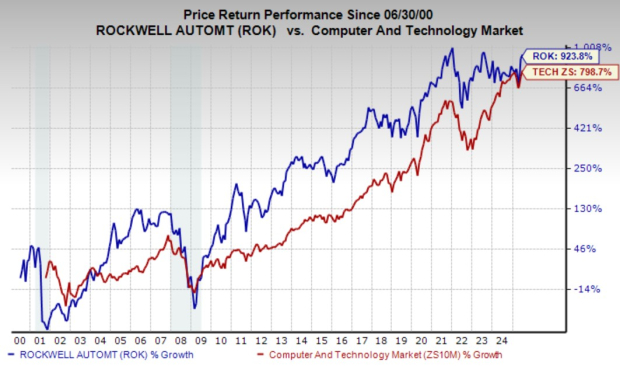

Rockwell is poised for long-term growth due to its leadership in industrial automation in an increasingly automated manufacturing economy. Rockwell is collaborating with Nvidia NVDA to integrate advanced AI and robotics technologies into its industrial automation solutions, enhancing manufacturing efficiency and enabling smarter, autonomous operations.

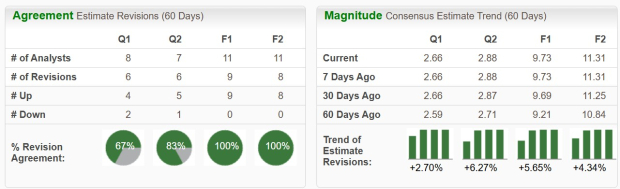

The Milwaukee, Wisconsin-based company topped our Q2 FY25 earnings estimate in early May and provided upbeat guidance in the face of tariff concerns. ROK’s upbeat EPS revisions earn it a Zacks Rank #1 (Strong Buy).

The company’s outlook signals that it is at the bottom of its current business cycle, with it projected to return to strong earnings and sales growth in the final quarter of its FY25. Rockwell is projected to boost its adjusted earnings by 16% in FY26 on 7% higher sales (following marginal projected EPS growth in FY25 and slightly lower sales).

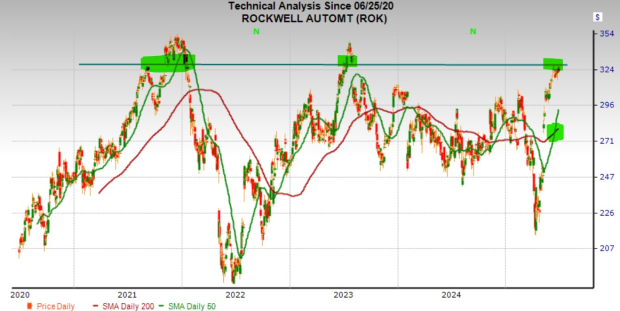

ROK has jumped 13% in 2025 to more than triple Tech. Its recent charge pushed it to the top end of the trading range it’s been stuck in for the past several years and helped it complete the bullish golden cross, where its shorter-dated 50-day moving average climbs above its 200-day. The stock also held its ground at its very long-term 50-month moving average.

It might be worth buying the dividend-paying tech stock ahead of a possible breakout, considering that Rockwell will benefit from tech onshoring, increasing automation, AI, and beyond.

Credo Technology Group CRDO designs high-speed connectivity solutions that are in high demand as technology titans invest heavily in artificial intelligence.

Credo designs and manufactures high-speed connectivity solutions, such as special cables and chips, that help data centers and AI systems send information at ultra-fast speeds while using less power.

The behind-the-scenes tech company’s products include integrated circuits and active electrical cables used across cloud computing and AI networks. Credo’s clients include the likes of Microsoft and other AI hyperscalers.

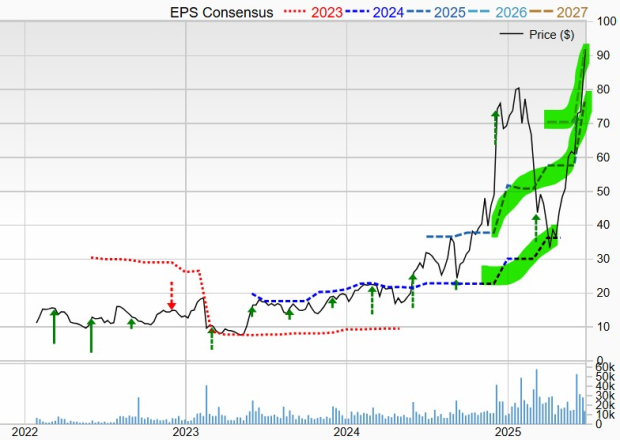

CRDO, which went public in early 2022, grew its fiscal 2025 revenue (period ended on May 3) by 126% to help send its adjusted earnings soaring from $0.09 to $0.70—it also critically jumped from a GAAP loss of -$0.18 a share to +$0.29.

Credo pointed to “growing demand for our solutions across hyperscaler customers to power advanced AI services” as a key reason for its bullish guidance. Its upbeat outlook sent its FY26 and FY27 earnings estimates soaring by 37% and 33%, respectively, to land it a Zacks Rank #1 (Strong Buy).

Credo is projected to grow its adjusted earnings by 111% in fiscal 2026 and 22% next year, on 86% and 22%, respective revenue expansion. CRDO’s critical AI-focused technology is set to see it jump from around $200 million in FY24 revenue to nearly $1 billion in FY27 ($987.2 million). Wall Street has taken notice, with nine of the 10 brokerage recommendations Zacks has at “Strong Buys.”

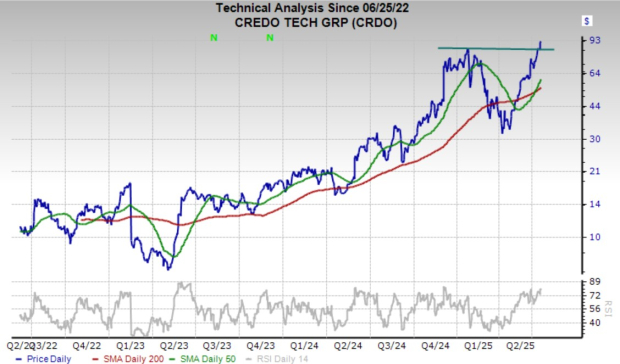

CRDO stock has charged 440% in the past two years to blow away Nvidia’s 280%. The stock recovered all of its initial 2025 drawdown to hit new highs on Wednesday. It could be due for a cooldown after its rally. Like ROK, Credo recently completed the bullish golden cross. Even with its massive tech-crushing climb, it trades in line with Tech on the price-to-earnings to growth (PEG) ratio front.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 min | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow Weakens As Nasdaq Lags; Biotech Name Hits Record (Live Coverage)

NVDA

Investor's Business Daily

|

| 1 hour |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

NVDA

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite