|

|

|

|

|||||

|

|

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

JPMorgan JPM, Wells Fargo WFC, and Citigroup C will kick-start the June-quarter reporting cycle for the Finance sector on July 15th. These banks comfortably passed the Fed’s stress tests, opening the way for increased capital returns to shareholders through share buybacks and dividend hikes. However, the earnings outlook for the group remains subdued, with growth hindered by weak demand trends in both the conventional banking business and investment banking.

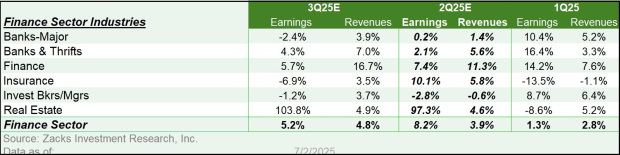

For JPMorgan, Q2 earnings are expected to be down -5.6% on -13.4% lower revenues. For Citigroup and Wells Fargo, Q2 earnings are expected to be down -3.2% and -6.8% from the year-earlier level, respectively. The Zacks Investment Brokers & Managers industry at the mezzanine level, which includes JPMorgan, Citigroup, and Wells Fargo, total Q2 earnings are expected to be down -2.8% from the same period last year, on -0.6% lower revenues. For the Zacks Finance sector, Q2 earnings are expected to be up +8.2% on +3.9% higher revenues, as the table below shows.

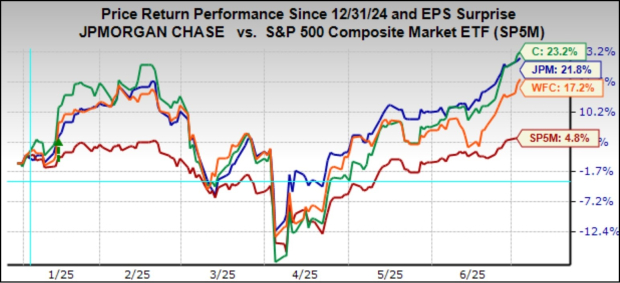

Unlike the group’s anemic earnings growth expectations, these stocks have been standout performers in the market lately, which likely reflects the aforementioned capital returns expectations and hopes of improving earnings growth in the coming periods. The chart below shows the year-to-date performance of JPMorgan, Citigroup, and Wells Fargo shares relative to the S&P 500 index.

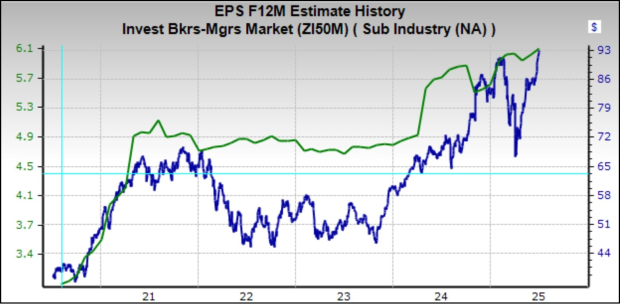

The green line in the chart below shows the evolving forward 12-month earnings estimates for the industry.

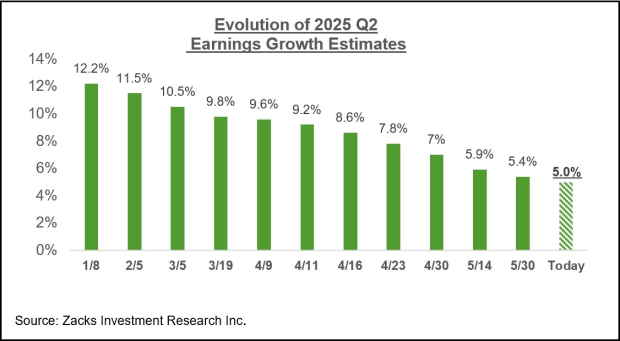

The start of Q2 coincided with heightened tariff uncertainty following the punitive April 2nd tariff announcements. While the onset of the announced levies was eventually delayed by three months, the issue has understandably weighed heavily on estimates for the current and upcoming quarters, particularly in the first few weeks following the April 2nd announcement.

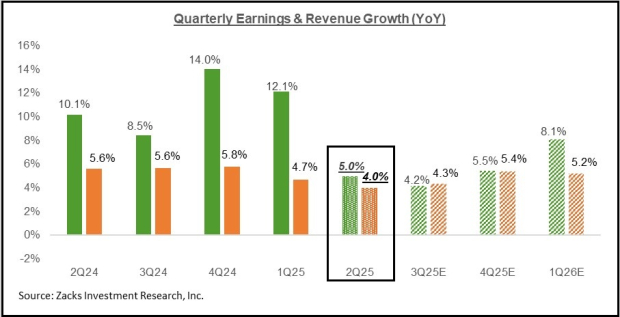

The expectation at present is for Q2 earnings for the S&P 500 index to increase by +5.0% from the same period last year on +4.0% higher revenues. The chart below shows how Q2 earnings growth expectations have evolved since the start of the year.

While it is not unusual for estimates to be adjusted lower, the magnitude and breadth of Q2 estimate cuts are greater than we have seen in the comparable periods of other recent quarters.

Since the start of the quarter, estimates have come down for 13 of the 16 Zacks sectors, with the biggest declines for the Transportation, Autos, Energy, Construction, and Basic Materials sectors. The only sectors experiencing favorable revisions in this period are Aerospace, Utilities, and Consumer Discretionary.

Estimates for the two largest earnings contributors to the index – Tech & Finance – have also declined since the quarter began.

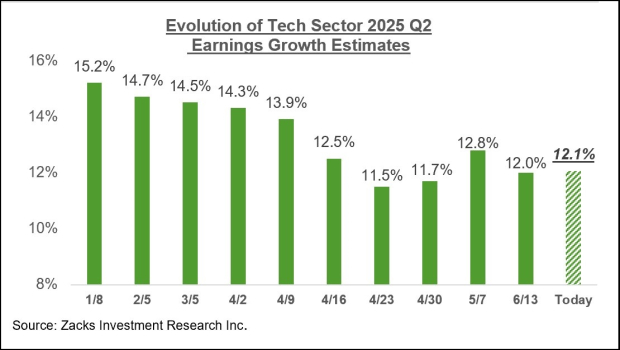

Tech sector earnings are expected to be up +12.1% in Q2 on +10.9% higher revenues. While these earnings growth expectations are materially below where they stood at the start of April, the revisions trend appears to have notably stabilized lately, as we have been flagging in recent weeks. You can see this in the sector’s revisions trend in the chart below.

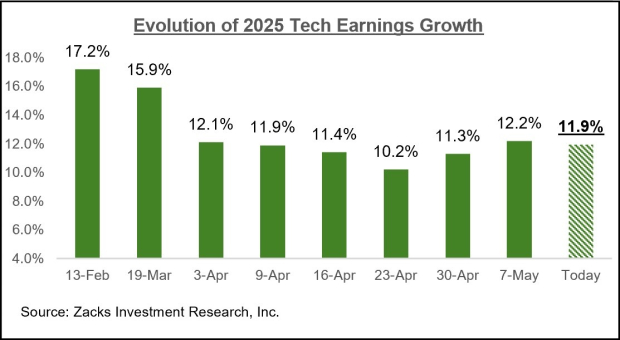

This stabilizing turn in the Tech sector’s revisions trend can be seen in expectations for full-year 2025 as well, as the chart below shows.

The two charts above show that estimates for the Tech sector have stabilized and are no longer under the type of downward pressure experienced earlier in the quarter. The Tech sector is much more than just any other sector, as it alone accounts for almost a third of all S&P 500 earnings.

The Earnings Big Picture

The chart below shows expectations for 2025 Q2 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

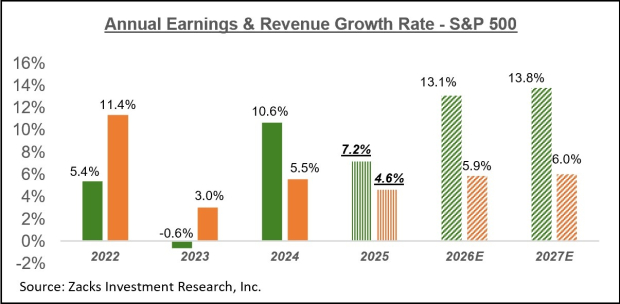

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

The market’s rebound from the post-tariffs April lows has been very impressive, likely suggesting that market participants don’t see the tariff uncertainty as presenting a significant threat. We find ourselves a bit skeptical of this sanguine view. Whatever the final level of tariffs turns out to be, it will have an impact on the earnings picture.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 47 min | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite