|

|

|

|

|||||

|

|

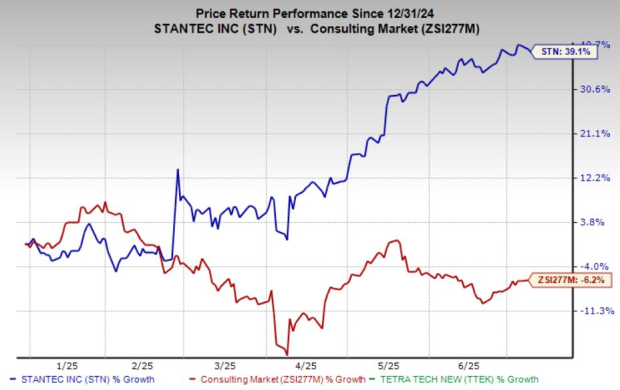

Stantec Inc. STN has delivered an impressive 39% year-to-date gain, sharply outperforming the industry’s 6% decline. In contrast, U.S. peers have seen mixed results: Tetra Tech TTEK is down 9%, while AECOM ACM has surged 40.5%.

However, after such a strong rally, the question is whether STN still offers upside. Compared to Tetra Tech’s pullback and AECOM’s comparable rally, is Stantec now overextended? Or can it sustain its momentum in the quarters ahead? Let’s dive into the details.

Stantec is capitalizing on strong global demand for infrastructure, water security, and climate-resilient solutions. The company is riding long-term secular tailwinds — like the global push to combat climate change, a growing focus on smart cities, and rising infrastructure investments — that are fueling robust demand for its consulting and engineering services.

In the first quarter of 2025, net revenues grew 13.3% year over year. Excluding acquisitions and currency tailwinds, organic revenue rose by a healthy 5.9%. In the United States, STN posted 2.4% organic growth. Strong activity in buildings, environmental services, and infrastructure segments helped support this growth.

Canada delivered even stronger growth, with revenues rising 15% year over year on a reported basis and 12.2% organically. Key contributors included wastewater projects, large industrial developments and rail initiatives, with additional boosts from airport work in Quebec and land development in Alberta. Globally, revenues jumped 20.3% year over year, including 7.5% organic growth. The U.K. water business surged over 20%, while energy transition projects and public sector funding lifted results in Australia and New Zealand.

Stantec’s global reach and sectoral diversity position it well for continued expansion.

Stantec isn’t just growing, it’s growing efficiently. In the first quarter of 2025, the company showcased solid margin expansion, powered by strong execution and favorable project mix. Project margins improved 10 basis points Y/Y to 54.3%, while adjusted EBITDA margins rose 70 basis points to 16.2%, driven by higher-margin work in Infrastructure and Energy & Resources, alongside disciplined cost control.

Lower administrative and marketing expense margin, including a pullback in discretionary spending, helped support this margin lift. STN’s proactive hiring strategy ahead of anticipated project rollouts sets the stage for better workforce utilization in the coming quarters, translating to higher operating leverage. As its recently acquired firms — Morrison Hershfield and Hydrock — continue to integrate, the company also expects synergies to kick in, further enhancing profitability.

Management has set its 2025 EBITDA margin guidance between 16.7% and 17.3%. With the first quarter already reaching 16.2%, momentum appears strong enough to potentially exceed the upper end of this range. If the company continues on this trajectory, aided by cost synergies and rising utilization, STN could deliver even more upside for investors.

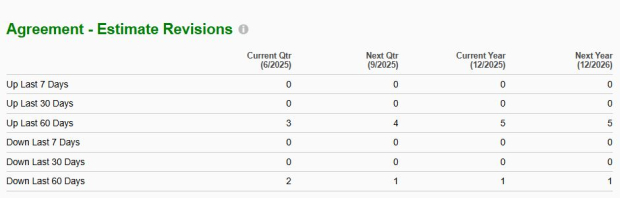

Stantec has seen a surge in positive analyst sentiment over the past 60 days, reflecting growing confidence in its earnings potential. Five analysts have raised their 2025 earnings estimates, while another five have upgraded projections for 2026. In sharp contrast, only one analyst issued a downward revision for each of those years, reinforcing a strong bullish consensus on the stock.

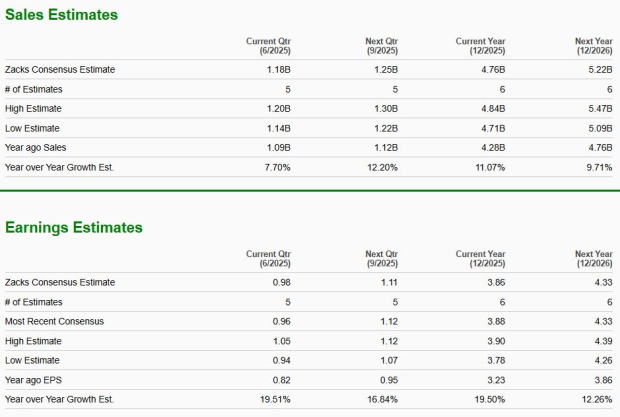

This wave of optimism aligns with upward revisions to both revenue and profit forecasts. STN’s earnings are now projected to grow by 19.5% in 2025 and 12% in 2026. Revenue expectations have also been lifted, with analysts now anticipating an 11% increase in 2025 and a 10% gain in 2026.

The broad-based upgrades suggest increasing confidence in Stantec’s ability to capitalize on infrastructure tailwinds, execute high-margin projects and integrate recent acquisitions effectively, all pointing toward sustained mid-term growth.

Stantec appears richly valued, trading at a 26.74 forward 12-month Price/Earnings (P/E) ratio, above its five-year median forward P/E of 22.56X. This elevated multiple may raise concerns, especially when compared to U.S. peers. Tetra Tech trades at 24.36X forward P/E, while AECOM trades even lower at 20.55X. The premium pricing could limit upside potential unless Stantec delivers significant earnings outperformance. With investor expectations already high, any slowdown in growth or margin expansion could pressure the stock’s valuation.

Given the stock’s premium valuation relative to its historical average and peers, a wait-and-see approach may be more appropriate for now. While Stantec’s fundamentals remain strong, much of the optimism appears priced in. Any execution hiccups or macroeconomic headwinds could compress its elevated multiples. Investors may consider holding off on fresh positions until earnings visibility strengthens or the stock pulls back to a more attractive entry point. For existing shareholders, holding makes sense, but closely monitoring upcoming results and margin trends will be key to reassessing risk-reward dynamics in the near term.

STN currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite