|

|

|

|

|||||

|

|

JPMorgan JPM and Wells Fargo WFC are major U.S. banking giants with strong retail and commercial banking operations and are impacted by interest rate trends and economic cycles.

JPMorgan is the largest U.S. bank with diversified strength across all areas of the financial sector, whereas Wells Fargo has regained strategic flexibility following the recent easing of its regulatory asset cap. Let us delve deeper and assess the prospects of each bank to determine which currently presents the stronger investment opportunity.

JPMorgan is expanding its footprint in new regions despite the rise of mobile and online banking. The company plans to open more than 500 branches by 2027, with 150 already built in 2024. This initiative aligns with the company’s broader effort to tailor its branch network to client needs, combining digital tools, expert guidance and an expansive physical footprint.

With the Federal Reserve expected to keep interest rates steady in the near term because of tariff-related concerns, relatively high rates will likely support JPMorgan’s net interest income (NII) and net yield on interest-earning assets as funding and deposit costs gradually stabilize. The company’s NII is expected to be $94.5 billion in 2025 (up almost 2% year over year).

JPM continues to be a dominant player in the investment banking (IB) business, holding the top position for global IB fees. While the company’s capital markets performance was decent in the first quarter of 2025, near-term IB prospects appear uncertain due to economic instability. However, its leadership position in the space is likely to offer support.

Further, JPMorgan cleared this year’s stress test impressively. The company’s projected common equity tier 1 (CET1) ratio was 14.2%, well-above the minimum requirement of 4.5%. Hence, it announced plans to increase its quarterly dividend by 7% to $1.50 per share and authorized a new share repurchase program worth $50 billion.

JPMorgan remains vigilant about the effects of continuous high rates and quantitative tightening on its loan portfolio. As such, the company’s asset quality is likely to remain under pressure in the near term. JPM expects card net charge-off (NCO) rates to be 3.6% this year, with the metric projected to rise to 3.6-3.9% in 2026.

One of the biggest developments for Wells Fargo in recent days has been the lifting of the $1.95 trillion asset cap imposed in the 2018 consent order by the Federal Reserve. This will likely result in a significant improvement in the company’s financial performance and long-term strategic positioning.

With this, the company can now boost deposits, grow its loan portfolio and broaden its securities holdings. This will lead to an increase in NII going forward. Moreover, WFC intends to expand fee-generating businesses like payment services, asset management and mortgage origination. These fee income-generating opportunities will bolster its top-line mix.

Furthermore, Wells Fargo is adopting a more balanced approach to its operations. While the bank is reducing headcount and streamlining processes, it is investing in its branch network and digital upgrades. This allows the bank to maintain a focus on cost management.

Wells Fargo is taking a strategic approach to its branch network, reducing its total branches by 3% year over year to 4,177 in 2024. At the same time, it is focused on modernization, having upgraded 730 branches last year, with plans to revamp the entire network over the next five years. These efficiency efforts are expected to result in $2.4 billion in gross expense reductions in 2025.

Similar to JPMorgan, Wells Fargo also cleared the 2025 stress test. Post that, the company announced its intention to raise its quarterly dividend by 13% to 45 cents per share. Further, the company noted that it can continue repurchasing shares. As of March 31, 2025, it had the authority to buy back up to $3.8 billion of common stock.

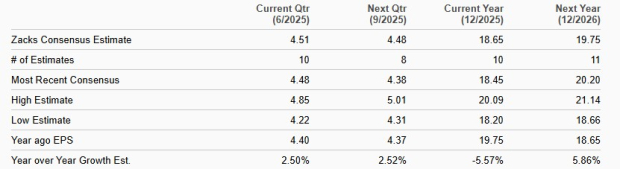

The Zacks Consensus Estimate for JPM’s 2025 revenues suggests a 1.3% decline, while for 2026, revenues are expected to grow 2.6%. Likewise, the consensus estimate for earnings implies a 5.6% fall for this year. However, earnings are projected to increase 5.9% next year.

JPM Earnings Estimate

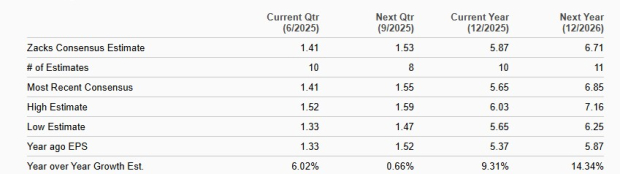

On the contrary, the Zacks Consensus Estimate for WFC’s 2025 and 2026 revenue implies year-over-year growth of 1.7% and 5.4%, respectively. The consensus estimate for earnings indicates an 9.3% and 14.3% rise for 2025 and 2026, respectively.

WFC Earnings Estimate

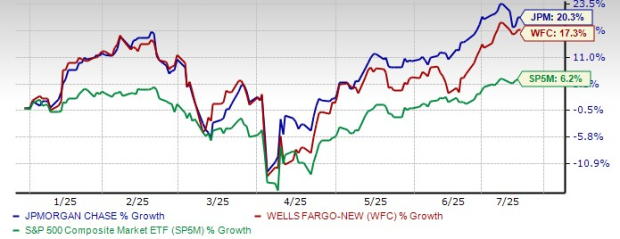

While 2025 started on a positive note, Trump’s tariff plans and geopolitical tension resulted in massive volatility, upending bullish investor sentiments. This year, shares of JPMorgan and Wells Fargo gained 20.3% and 17.3%, respectively.

JPM & WFC YTD Price Performance

Further, both have outpaced the S&P 500 Index. In terms of investor sentiments, JPMorgan clearly has the edge.

In terms of valuation, JPM is currently trading at a 12-month forward price-to-earnings (P/E) of 15.06X, while WFC stock is currently trading at a 12-month forward P/E of 13.21X.

P/E F12M

Meanwhile, the industry has a 12-month forward P/E of 14.58X. Hence, Wells Fargo is trading at a discount compared with the industry and JPM.

JPMorgan’s return on equity (ROE) of 16.88% is above WFC’s 12.15%. Further, the industry’s ROE is 11.93%. This reflects that JPM is more efficiently using shareholder funds to generate profits.

ROE

While Wells Fargo’s regained regulatory flexibility positions it for long-term growth and operational expansion, JPMorgan remains the stronger investment option at present. With its unmatched scale, diversified business model, industry-leading investment banking operations and robust capital return plans, JPM is better equipped to navigate economic uncertainty and deliver consistent shareholder value.

Despite near-term earnings pressure, JPMorgan’s superior ROE, dominant market position and stronger investor confidence justify a premium valuation. For investors seeking a resilient, well-rounded financial stock with both income and growth potential, JPM stock offers the more compelling case.

Currently, JPM and WFC both carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 37 min | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 8 hours | |

| 8 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 13 hours | |

| 13 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite