|

|

|

|

|||||

|

|

Helen of Troy Limited HELE experienced a sharp 22.7% drop in its share price during Thursday after-hours trading, following disappointing first-quarter fiscal 2026 results. The company’s revenues and earnings declined year over year and missed the Zacks Consensus Estimate.

HELE’s first-quarter performance fell well below expectations, caused primarily by significant tariff-related disruptions. These included the cancellation of direct import orders from China due to higher tariffs and the pull-forward of orders into the fourth quarter of fiscal 2025, resulting in elevated inventory levels and reduced replenishment in the first quarter of fiscal 2026. Sales in China remained weak because shoppers moved away from cross-border e-commerce to local distribution. There was also more competition from domestic sellers supported by government subsidies. In addition to tariff pressures, retailer inventory cuts and U.S. consumer trade-down led to 3–4% price drops, hurting sales and profit.

That being said, HELE remains focused on improving its go-to-market effectiveness, simplifying operations, refocusing on innovation to drive product-led growth, sharpening spending discipline and reinvigorating its culture with resilience and an owner’s mindset.

Helen of Troy posted adjusted earnings of 41 cents per share. The metric missed the Zacks Consensus Estimate of 91 cents per share. Moreover, the bottom line declined 58.6% from 99 cents reported in the year-ago period due to lower adjusted operating income and higher interest expense. These were somewhat countered by a reduction in adjusted income tax expense. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Helen of Troy Limited price-consensus-eps-surprise-chart | Helen of Troy Limited Quote

HELE reported net sales of $371.7 million, which missed the Zacks Consensus Estimate of $399 million, and also decreased 10.8% from $416.8 million posted in the year-ago period. This decline was caused by a $71 million or 17% decrease in Organic business. The decline reflected lower demand in the Beauty & Wellness segment, particularly for thermometers, fans and hair appliances, as well as reduced home and insulated beverage sales in the Home & Outdoor segment. The decline in Organic sales was partially offset by a $26.8 million or 6.4% contribution from the acquisition of Olive & June and strong domestic demand for technical packs in Home & Outdoor.

The consolidated gross profit margin contracted 160 basis points (bps) to 47.1% compared to 48.7% in the prior year. The decrease was primarily caused by the absence of favorable inventory obsolescence expense seen last year, consumer trade-down behavior, higher retail trade expenses and a less favorable brand mix within the Home & Outdoor segment. These factors were partially offset by the positive impact of the Olive & June acquisition in Beauty & Wellness and lower commodity and product costs, aided in part by cost savings from Project Pegasus initiatives.

The consolidated SG&A ratio increased 420 basis points (bps) to 45.1% due to higher marketing expenses, elevated outbound freight costs, $3.5 million in CEO succession costs, the impact of the Olive & June acquisition and unfavorable operating leverage resulting from the decline in net sales.

The adjusted operating income declined 62.5% to $16.1 million, while the adjusted operating margin decreased 600 bps to 4.3%. We expected an adjusted operating margin of 9.3% for the quarter.

Net sales in the Home & Outdoor segment declined 10.3% to $178 million, primarily due to softness in the home and insulated beverageware category. This was caused by continued competitive pressure, weaker overall consumer demand, reduced replenishment orders from retailers, cancellation of direct import orders in response to higher tariffs and retailer pull-forward activity in the fourth quarter of fiscal 2025 due to tariff uncertainty, which resulted in elevated retail inventory and lower replenishment. Additional headwinds included lower closeout channel sales and a net year-over-year decrease in distribution. These impacts were partially offset by strong domestic demand for technical packs and a favorable comparison to the prior year, which was affected by shipping disruptions at HELE's Tennessee distribution facility related to automation startup issues.

Net sales in the Beauty & Wellness segment fell 11.3% to $193.7 million due to a $50.3 million, or 23.0%, drop in Organic business sales. This was primarily due to weaker international thermometry demand in China, lower fan sales amid softer demand and tariff-related order cancellations, and reduced sales of hair appliances and prestige hair care products. These declines were partially offset by improved comparisons to prior-year shipping disruptions at Curlsmith, higher heater sales and a $26.8 million contribution from the Olive & June acquisition.

Helen of Troy ended fiscal 2025 with cash and cash equivalents of $22.7 million and total short- and long-term debt of $871 million. Net cash provided by operating activities for the fiscal first quarter of fiscal 2026 was $58.3 million. The free cash flow for the same period was $45 million.

Due to ongoing global tariff uncertainties and related macroeconomic challenges, the company is providing guidance only for the second quarter of fiscal 2026. It is actively assessing tariff cost exposure, mitigation strategies and retailer responses. To reduce risk, HELE is diversifying production outside China and aiming to cut China tariff-exposed cost of goods sold to below 25% by fiscal year-end.

The company expects consolidated net sales for the second quarter of fiscal 2026 to range between $408 million and $432 million, representing a decline of 14.0% to 8.9% compared to prior year figures.

By segment, Home & Outdoor sales are projected to decline 16.5% to 11.5%, while Beauty & Wellness sales are expected to decrease 11.3% to 6.1%, including an incremental $26 million to $27 million contribution from the Olive & June acquisition.

This sales outlook reflects ongoing consumer spending softness, increased macroeconomic uncertainty, a more promotional environment and consumer trade-down behavior, alongside tariff-related order cancellations, shifts in China’s distribution models, heightened competition and retailer inventory rebalancing.

The management anticipates GAAP diluted earnings per share between $0.56 and $0.68, with adjusted diluted EPS expected to decline 62.8% to 50.4%, ranging from $0.45 to $0.60 versus the prior year. Headwinds include a more promotional environment, consumer trade-downs, unfavorable mix, higher commodity and tariff-related costs (partially offset by Project Pegasus), prior-year operating inefficiencies from automation startup, and unfavorable operating leverage due to revenue declines. These impacts are partially mitigated by ongoing cost reduction efforts.

Helen of Troy envisions stable June 2025 foreign exchange rates, interest expense between $13 million and $14 million, a GAAP effective tax rate ranging from (84.9)% to (287.3)%, an adjusted effective tax rate between 28.9% and 30.9% and approximately 22.9 million weighted average diluted shares outstanding.

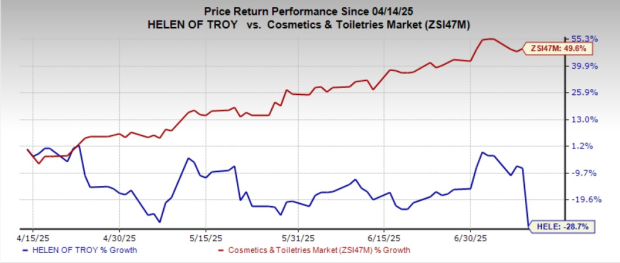

This Zacks Rank #3 (Hold) company has lost 28.7% in the past three months against the industry’s growth of 49.6%.

The Estee Lauder Companies Inc. EL manufactures, markets, and sells skincare, makeup, fragrance and hair care products worldwide. At present, it flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Estee Lauder’s current fiscal-year sales and earnings implies a decline of 8.4% and 43.2%, respectively, from the year-ago figures. EL delivered a trailing four-quarter earnings surprise of 107.4%, on average.

European Wax Center, Inc. EWCZ functions as the franchisor and operator of out-of-home waxing services in the United States and currently sports a Zacks Rank of 1.

The Zacks Consensus Estimate for European Wax Center’s current fiscal-year earnings indicates a rise of 35.6% from the year-ago period’s levels. EWCZ delivered an earnings surprise of 186.9% in the last reported quarter.

Coty Inc. COTY, together with its subsidiaries, manufactures, markets, distributes, and sells beauty products worldwide. It currently holds a Zacks Rank #2 (Buy). COTY delivered a negative earnings surprise of 81.5% in the trailing four quarters, on average.

The Zacks Consensus Estimate for Coty’s current fiscal-year sales and earnings implies growth of 4.6% and 21.6%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite