|

|

|

|

|||||

|

|

Abouyt the Industry

Internet - Commerce continues to evolve as the technologies driving it advance.

On one side are increasingly powerful and capable user devices. On the other are increasingly sophisticated platforms, often combining chatbots and/or social media. While AI continues to deliver increased user satisfaction, the metaverse promises another paradigm shift.

Differentiation comes from better technology for improved showcasing, easier navigation and payment, speedier delivery and returns, brand building, comparison shopping, loyalty, etc. as well as good customer service and more shipping options, which generally tip the scales in favor of larger players. Particularly so, because there is fierce price competition necessitating deep discounting in many cases.

Current Trends Driving the Internet-Commerce Industry

Zacks Industry Rank Indicates Strength

The Zacks Internet - Commerce industry is a rather large group within the broader Zacks Retail And Wholesale sector. It carries a Zacks Industry Rank of #51, which places it in the top 21% of nearly 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. So the group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates positive near-term prospects.

Ecommerce being in the top 50% of Zacks-ranked industries is the result of its relative performance versus others. What we’re seeing in the aggregate estimate revisions are some ups and downs in estimates over the past year. The aggregate earnings estimate for 2025 is up 1.4%, having peaked in February and then moderating thereafter.

The 2026 number dipped sharply in September last year, improving somewhat thereafter, then dipping again in May 2025, before moving up again, netting -3.6%. The uncertainty around rate cuts and a possible recession in the offing may have contributed to the volatility.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Generates Strong Shareholder Returns

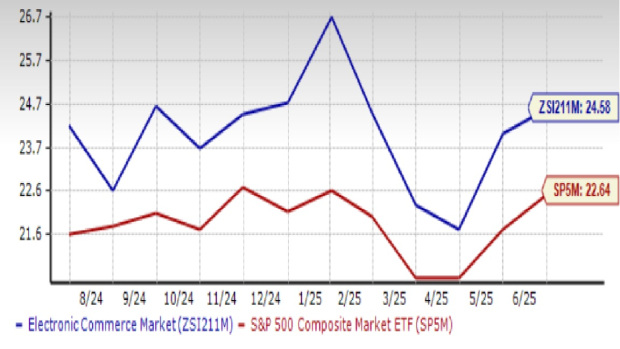

Over the past year, the Zacks Electronic - Commerce Industry has traded relatively close to the broader Retail and Wholesale sector as well as the S&P 500, although usually at a premium to both.

The stocks in this industry have collectively gained 18% over the past year, compared to the 16.5% gain for the broader Zacks Retail and Wholesale Sector and the 11.9% gain for the S&P 500.

One-Year Price Performance

Industry Slightly Overvalued

Historically, the industry has traded at a premium to the sector as well as the S&P 500. However, the difference has narrowed over time. Its current price-to-forward 12 months’ earnings (P/E) of 24.6X represents a premium of 8.6% to the S&P 500 and discount of 0.8% to the broader retail sector, which are currently trading at 22.6X and 24.8X, respectively. It’s worth noting, however, that the industry is currently trading at a slight premium to its own median level of 24.5X.

Forward 12 Month Price-to-Earnings (P/E) Ratio

2 Stocks to Add to Your Portfolio

The relatively strong growth prospects mean that there are a large number of stocks currently worth picking, especially because of the significant variety that exists in this industry in terms of lines of business, business model, location and so forth. This is also the reason that choosing can be tricky. We have used our proprietary ranking system to pick 2 stocks that appear attractive today.

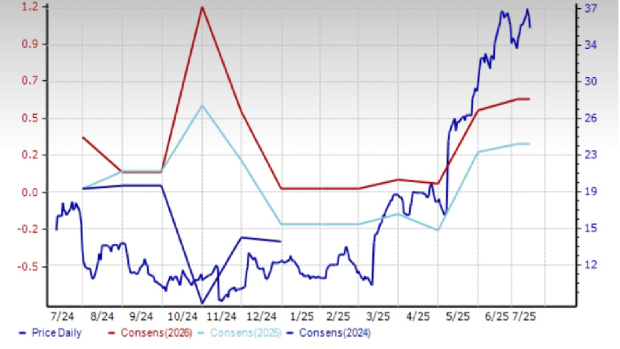

Groupon, Inc. (GRPN): Chicago-based Groupon is an online marketplace connecting buyers and sellers of goods; travel; and local dining, activities and experiences, accessed through Groupon mobile applications and localized groupon.com websites. It operates across thirteen countries although more than 76% of 2024 revenue came from the U.S.

Groupon’s outlook is not without challenges, given that the macroeconomic situation in the U.S. can very easily take a turn for the worse, which would pare recent gains in customer additions and sales, driven by a “hyper-local” strategy. Considering the very high debt levels (debt cap of 84%), operational challenges could increase if the sales momentum is not sustained. It is, however, worth noting that the company has had a relatively good history of beating expectations in the last several quarters and if this continues, there could be support for share prices. Groupon turned profitable in the last quarter, which is certainly reason to cheer.

Right now, the estimate revisions trend does look exciting. In the last 60 days, the Zacks Consensus Estimate for 2025 has gone from a loss of 18 cents to a profit of 30 cents a share. The 2026 EPS estimate has gone from 3 cents to 59 cents. Analysts currently expect about 1.5% revenue growth this year along with a 119% increase in per share profits. The 2026 EPS growth of 95% is expected to come off an 8% increase in revenue.

The shares of this Zacks Rank #1 (Strong Buy) company are up 146.9% over the past year, most of it in the last two months.

Price & Consensus: GRPN

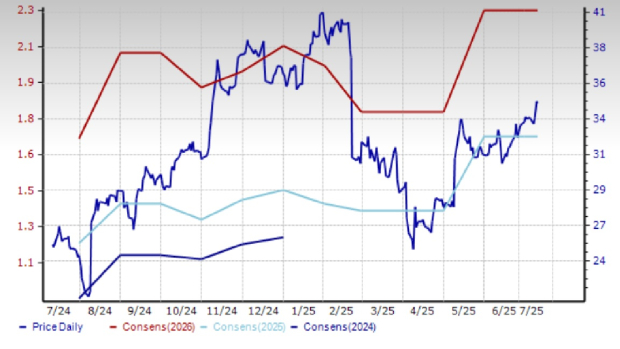

CarGurus, Inc. (CARG): CarGurus offers an online marketplace for both new and used cars mainly in the U.S. (93% of 2024 revenue), but also in Canada and the UK. The company targets both direct consumers (B2C) and dealers (B2B), offering them a range of data-driven services and financing options.

Marketplace services contributed 89% of 2024 revenue, roughly 7% came from dealer-to-dealer services and products, and the rest from Sell My Car - Instant Max Cash Offer. As of December 31, 2024, it had 29.3 million average monthly visitors in the U.S., which, in turn, attracted over 30,000 dealers, including 24,692 paying dealers.

CarGurus’ focus on improving dealer profitability with data-driven solutions as well as a more intuitive and seamless experience for consumers increasingly preferring to do more of the transaction online, is driving its marketplace business. Management is optimistic that this strategy is driving deeper consumer and dealer engagement, thus driving its markets share. The company has no debt and ample liquidity to drive the business further.

In the last 60 days, the Zacks Consensus Estimates for 2025 and 2026 have increased a respective 10 cents (4.9%) and 15 cents (5.7%). Analysts estimate 25% earnings growth on revenues that are expected to increase 5% in 2025. The 2026 estimates are equally encouraging: 28.1% earnings growth on 7.7% revenue growth.

This Zacks Rank #2 (Buy) stock is up 39.1% over the past year.

Price & Consensus: CARG

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Feb-27 | |

| Feb-26 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite