|

|

|

|

|||||

|

|

The Q2 earnings season gets going in earnest this week, with almost 100 companies on deck to report results, including 38 S&P 500 members. This week’s reporting docket is dominated by the big banks, but we have several bellwethers from other sectors also reporting, like Netflix NFLX, 3M MMM, Schlumberger SLB, and others.

Regular readers of our earnings commentary are familiar with the significant negative estimate revisions trend that we experienced over the last few months. We saw this in estimates for 2025 Q2 as well as for the second half of the year.

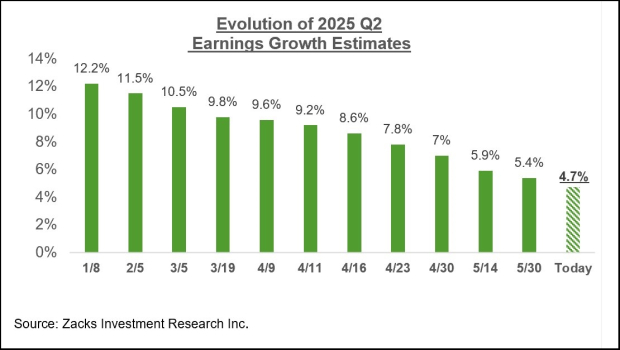

For 2025 Q2, the expectation is for earnings growth of +4.7% relative to the same period last year on +4% higher revenues. This will be a material deceleration from the growth trend of recent quarters and will be the lowest earnings growth pace since the +4.3% growth rate in 2023 Q3.

The chart below shows how Q2 estimates came down since the quarter got underway.

As we have been consistently flagging, earnings estimates took a renewed hit at the start of Q2, following the early April tariff announcement. This was particularly notable for Q2, but estimates for the following periods also got trimmed.

While the revisions trend has notably stabilized in recent weeks, the magnitude of cuts to 2025 Q2 estimates is bigger and more widespread relative to what we have become used to seeing in the post-COVID period.

Since the start of April, Q2 estimates have declined for 14 of the 16 Zacks sectors (Aerospace and Utilities are the only sectors whose estimates have gone up), with the biggest cuts to Autos, Energy, Transportation, Basic Materials, and Construction sectors.

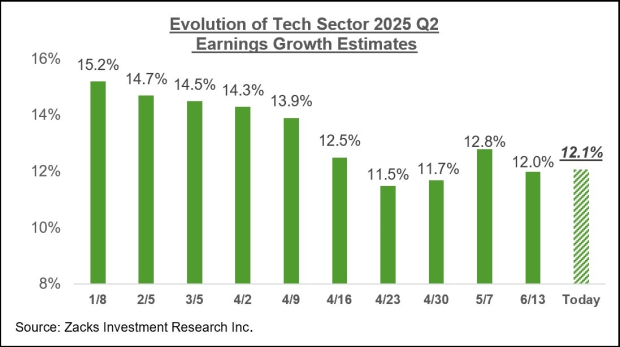

Estimates for the Tech and Finance sectors, the largest earnings contributors to the S&P 500 index, accounting for more than 50% of all index earnings, have also been cut since the quarter got underway. But as we have been pointing out in recent weeks, the revisions trend for the Tech sector has notably stabilized in recent weeks, which you can see in the chart below.

We see this same trend at play in annual Tech sector estimates as well.

While the tariff uncertainty is far from resolved, the market appears to have learnt to look past it. There is no question that elevated tariffs are a net negative for the economy as well as corporate profitability. But the consensus thought process appears to be that the worst of the issue is behind us, and the final tariff shape will be a lot less problematic than many had factored in at first.

What this means for the Q2 earnings season is that expectations are likely too low, setting us up for actual results to be significantly better than expected. We may not get a lot of actual guidance from management teams, given the many unresolved macro questions. But we remain confident that management teams’ qualitative commentary on business trends will be largely positive.

All in all, the setup for the Q2 earnings season looks very favorable to us.

The chart below shows current Q2 earnings and revenue growth expectations in the context of the preceding 4 quarters and the coming four quarters.

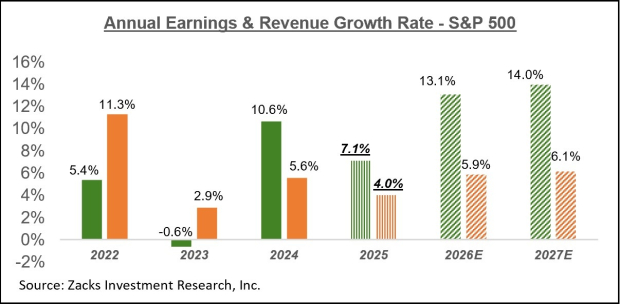

The chart below shows the overall earnings picture on a calendar-year basis.

In terms of S&P 500 index ‘EPS’, these growth rates approximate to $254.07 for 2025 and $287.36 for 2026.

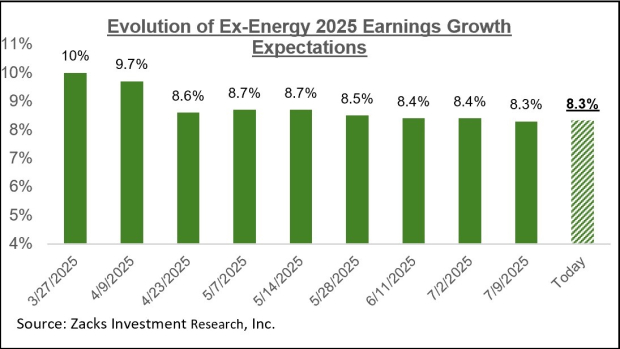

The chart below shows how these calendar year 2025 earnings growth expectations have evolved since the start of Q2. As you can see below, estimates fell sharply at the beginning of the quarter, which coincided with the tariff announcements, but have notably stabilized over the last four to six weeks.

A big contributing factor to the negative revisions trend has been the Energy sector, whose estimates have been steadily coming down for a while now. The Energy sector’s earnings are currently expected to be down -13.3% in 2025.

Excluding the Energy sector, total S&P 500 earnings in 2025 are expected to be up +8.3%. The chart below shows how the aggregate earnings picture has evolved outside of the Energy sector.

While many in the market will tune in to the Q2 earnings season this week, the reporting cycle has actually been underway already. Through Friday, July 11th, we have seen quarterly results from 21 S&P 500 members already.

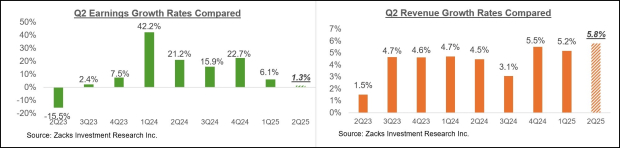

Total earnings for these 21 index members that have reported results are up +1.3% from the same period last year on +5.8% revenue gains, with 76.2% of the companies beating EPS estimates and 81% of them beating revenue estimates.

The comparison charts below put the Q2 earnings and revenue growth rates for these index members in a historical context.

The comparison charts below put the Q1 EPS and revenue beats percentages in a historical context.

We are not drawing any conclusions from these results, given how small the sample is at this stage.

As noted at the top, the reporting cycle ramps up this week, with 38 index members reporting results. Most of the big banks and brokers are on deck to report results this week, as are bellwethers from other sectors like Netflix, 3M, Schlumberger, and others.

Netflix shares have been standout performers lately, with the stock up +39.7% this year, handily outperforming the S&P 500 index’s +7% year-to-date gain. The stock was up big following each of the last three quarterly releases, so expectations remain high coming into this release.

Schlumberger, the oilfield services leader, is dealing with a downbeat market sentiment. The stock is down -1.2% this year, compared to Halliburton’s -13.8% decline and the broader market’s +6.9% gain. It is all about the outlook for oilfield activity levels, which in turn is a function of oil prices.

For a detailed view of the evolving earnings picture, please check out our weekly Earnings Trends report here >>>> Finance Earnings Outlook Improves: A Closer Look

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| 12 hours | |

| 14 hours | |

| 15 hours | |

| Feb-27 | |

| Feb-27 |

Six Months, 9 Offers and $81 Billion. How Hollywood's Nasty Takeover Was Won.

NFLX +13.77%

The Wall Street Journal

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Paramount Stock Up 20% On Warner Deal; Democrats Warn Of 'Vigorous' Investigation

NFLX +13.77%

Investor's Business Daily

|

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite