|

|

|

|

|||||

|

|

Novo Nordisk NVO shares have plunged 19.9% year to date, following a string of unfavorable outcomes, both pipeline and regulatory, that have led investors to bet against the company. The company reported disappointing data from two late-stage studies for its next-generation subcutaneous obesity candidate, CagriSema, a follow-up drug to Wegovy. In these studies, CagriSema demonstrated a lower-than-expected reduction in body weight, despite meeting the primary endpoints.

Earlier, Medicare announced that it will not cover costly weight-loss drugs, including NVO’s Wegovy (semaglutide), as obesity remains unclassified as a disease. Consequently, these medications, often viewed as cosmetic, may become less accessible to patients. Novo Nordisk is also currently facing a major transition in its executive management as CEO Lars Fruergaard Jørgensen will step down due to market headwinds and a decline in the company’s stock since mid-2024. The search for his successor is currently underway.

Moreover, Novo Nordisk faces intense competition from its arch-rival Eli Lilly LLY in the diabetes and obesity care market. LLY markets its tirzepatide injections as Mounjaro for type II diabetes (T2D) and Zepbound for obesity. Despite being on the market for less than three years, Lilly’s Mounjaro and Zepbound have witnessed strong sales driven by rapid demand. Zepbound had earlier outperformed Novo Nordisk’s Wegovy (20.2% compared with 13.7%, respectively) in a weight-loss head-to-head study. This could lead to a shift in patient preference from Wegovy to Zepbound, potentially resulting in a loss of market share. Lilly has also been taking significant strides in the development of oral therapies for obesity, effectively putting pressure on Novo Nordisk. In April 2025, LLY reported first phase III success for its oral GLP-1 candidate, orforglipron, in lowering blood glucose and promoting weight loss in T2D patients. Oral pills could boost adherence over injections.

Additionally, NVO recently ended its collaboration agreement with Hims & Hers Health, which will temporarily hurt its objective of increasing Wegovy’s patient access, resulting in a slowdown in obesity market share gain.

However, not all is wrong at NVO. Novo Nordisk is making good progress with its pipeline, which includes several other new candidates for T2D and obesity. The company also has strong fundamentals, and the untapped nature of the obesity market makes us believe that the setback is temporary. Let’s dig deeper and understand the company’s strengths and weaknesses to understand how to play the stock after the recent price drop.

Novo Nordisk’s success in recent years has been driven by its popular semaglutide-based GLP-1 products — Ozempic (injection) and Rybelsus (oral) for T2D, and Wegovy for obesity. The company holds a strong position in diabetes care, with one of the industry's broadest portfolios and a global diabetes market share of 33.3% as of March 2025, led by Rybelsus, Ozempic, and Victoza. It also dominates the GLP-1 segment with a 54% global market share.

Wegovy is a major revenue driver, with first-quarter 2025 sales up 83% to DKK 17.4 billion on strong prescription growth. Ozempic also continues to boost overall revenues. To protect its lead amid competition from Lilly, Novo Nordisk is heavily investing in its GLP-1 manufacturing capacity. As of July 1, CVS Caremark, a major pharmacy benefit manager, has designated Wegovy as its preferred GLP-1 therapy for weight loss.

Novo Nordisk is expanding semaglutide's reach through new indications. Wegovy is now approved for reducing major cardiovascular events, easing HFpEF symptoms, and relieving osteoarthritis-related knee pain in obesity. Ozempic’s label includes use in T2D patients with cardiovascular and kidney disease.

The FDA is reviewing Novo Nordisk’s application for a 25 mg oral semaglutide for obesity, with a decision expected by year-end. NVO has also filed Rybelsus for cardiac event prevention in T2D and is studying semaglutide for liver disease. A 7.2 mg Wegovy dose, showing up to 25% weight loss in the STEP UP study, is under EU review. Label expansion is also being sought for Ozempic in treating peripheral artery disease in the United States and the EU.

Beyond GLP-1s, Novo Nordisk is expanding into rare diseases, with regulatory plans for Mim8 (hemophilia A) and EU approval of Alhemo (hemophilia A/B with inhibitors). It also expects to file for semaglutide in metabolic dysfunction–associated steatohepatitis in both the United States and the EU in 2025.

Novo Nordisk is also developing several next-generation obesity candidates in its pipeline, especially targeting the lucrative U.S. market. The most advanced weight loss candidate in Novo Nordisk’s pipeline is CagriSema, a fixed-dose combination of a long-acting amylin analogue and Wegovy. The company is already planning its regulatory submission in 2026.

Novo Nordisk is also developing a small-molecule oral CB1 inverse agonist, monlunabant, in a mid-stage study. The company is currently gearing up to advance Amycretin, an investigational unimolecular GLP-1 and amylin receptor agonist, for weight management into late-stage development. The phase III program on amycretin is planned to be initiated during the first quarter of 2026.

Recently, Novo Nordisk signed a $2.2 billion deal with Septerna for developing and commercializing oral small-molecule medicines for treating obesity, T2D and other cardiometabolic diseases.

Competition in the obesity market is heating up as the obesity market is expected to expand to $100 billion by 2030, according to data from Goldman Sachs. Lilly and Novo Nordisk presently dominate the market.

Several other companies like Amgen AMGN and Viking Therapeutics VKTX are also making rapid progress in the development of GLP-1-based candidates in their clinical pipeline. Amgen has begun a broad phase III program on its dual GIPR/GLP-1 receptor agonist, MariTide, across obesity, obesity-related conditions and T2D, with the first two phase III studies initiated in March. Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity. Viking Therapeutics recently launched the late-stage VANQUISH program for subcutaneous VK2735 in obesity and T2D, following the initiation of the mid-stage VENTURE study on the oral version earlier this year.

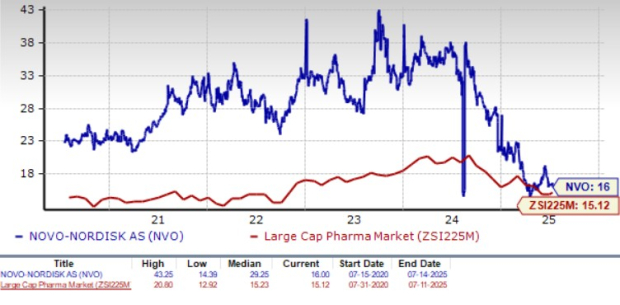

In the past year, Novo Nordisk shares have lost 51.1% compared with the industry’s 17% decline. The company has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below. The stock is currently trading below its 50 and 200-day moving averages.

Novo Nordisk is trading at a premium to the industry, as seen in the chart below. Going by the price/earnings ratio, the company’s shares currently trade at 16 forward earnings, which is higher than 15.12 for the industry. However, the stock is trading much below its five-year mean of 29.25.

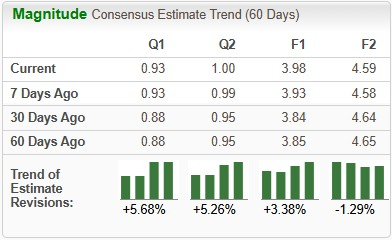

Earnings estimates for 2025 have improved from $3.85 to $3.98 per share over the past 60 days. During the same time frame, Novo Nordisk’s 2026 earnings per share estimates have declined from $4.65 to $4.59.

The stock’s return on equity on a trailing 12-month basis is 80.95%, which is higher than 33.55% for the large drugmaker industry, as seen in the chart below.

Novo Nordisk, currently carrying a Zacks Rank #3 (Hold), has the potential to boost shareholders’ wealth in the future. Despite past pipeline and regulatory setbacks, along with the ongoing transition in leadership, we remain confident that NVO is a good stock to retain. The company operates in a lucrative market that is rapidly expanding. Its strong year-over-year revenues and profits, fueled by rising demand for Wegovy and Ozempic, suggest long-term potential. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company is actively working to expand the approved uses of its key semaglutide products, Wegovy, Ozempic, and Rybelsus, which could significantly increase the eligible patient pool and drive future revenues.

However, Eli Lilly remains a formidable adversary in the obesity market space, which threatens NVO’s market share.

Hence, we can conclude that investors currently holding the NVO stock should not get spooked by the recent downtrend in the stock price. In fact, new Investors can use the current dip in the price to acquire the stock to enjoy significant value creation in the long run. Short-term investors are, however, advised to steer clear of the stock to avoid near-term volatility.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

AMGN

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite