|

|

|

|

|||||

|

|

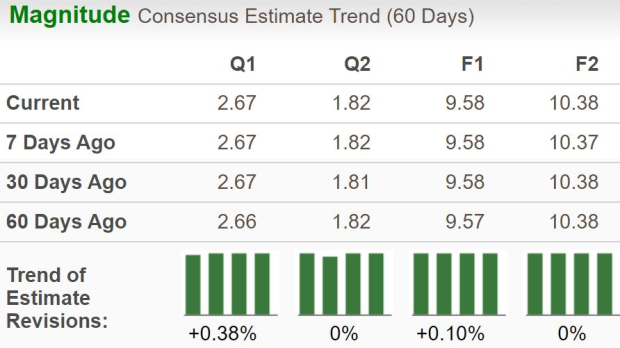

Marsh & McLennan Companies, Inc. MMC is set to report second-quarter 2025 results on July 17, 2025, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is currently pegged at $2.67 per shareon revenues of $6.91 billion.

Second-quarter earnings estimates have been revised upward over the past 60 days. The bottom-line projection indicates an increase of 10.8% from the year-ago reported number. Also, the Zacks Consensus Estimate for quarterly revenues implies year-over-year growth of 11.1%.

For 2025, the Zacks Consensus Estimate for Marsh & McLennan’s revenues is pegged at $26.95 billion, implying a rise of 10.2% year over year. Also, the consensus mark for 2025 earnings per share is pegged at $9.58, indicating growth of around 8.9% on a year-over-year basis. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Marsh & McLennan has a robust history of surpassing earnings estimates, beating the consensus estimate in each of the last four quarters, with the average surprise being 2.6%. This is depicted in the figure below.

Marsh & McLennan Companies, Inc. price-eps-surprise | Marsh & McLennan Companies, Inc. Quote

However, our proven model does not conclusively predict an earnings beat for the company this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat, but that is not the case here.

MMC has an Earnings ESP of -0.86% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The second-quarter top-line performance of Marsh & McLennan is likely to have been boosted by strong performances in its Risk and Insurance Services and Consulting segments. The Risk and Insurance Services segment is expected to have gained on the back of solid contributions from its Marsh and Guy Carpenter subdivisions. MMC's performance in the second quarter is likely to have received a significant boost from robust operations in the international market, with a particular focus on the Latin America region.

The Zacks Consensus Estimate for revenues from the Risk and Insurance Services segment indicates a rise of 14.7% from the prior-year quarter, whereas our estimate suggests a 14% jump. Also, the consensus mark for the segment’s adjusted operating income suggests a 12.9% increase from the prior-year quarter’s figure.

The Zacks Consensus Estimate for the overall Consulting segment’s revenues indicates growth of 5.6% from the prior-year quarter’s $2.2 billion, whereas our estimate for the metric suggests a 5% rise. Also, the consensus mark for the segment’s adjusted operating income is pegged at $491.3 million, suggesting 12.2% growth from the year-ago quarter’s reported number.

The factors stated above are expected to have positioned the company for a year-over-year improvement in the second quarter. However, the positives are anticipated to be partially offset by increasing expenses, making an earnings beat uncertain. Our estimate for total operating expenses in the quarter under review indicates a 7% year-over-year jump, primarily due to higher compensation and benefits. We expect the adjusted net margin to be 18.6% in the to-be-reported quarter, down from 19.2% a year ago.

While an earnings beat looks uncertain for Marsh & McLennan, here are some companies from the broader Finance space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Aon plc AON has an Earnings ESP of +0.56% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AON’s bottom line for the to-be-reported quarter of $3.40 per share indicates 9.7% year-over-year growth. It remained stable over the past week. AON’s earnings beat estimates in two of the last four quarters and missed twice, with an average surprise of 1%.

Primerica, Inc. PRI has an Earnings ESP of +0.55% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Primerica’s bottom line for the to-be-reported quarter is pegged at $5.18 per share, signaling 10% year-over-year growth. Primerica’s earnings beat estimates in each of the past four quarters, with an average surprise of 7.8%.

Assurant, Inc. AIZ has an Earnings ESP of +1.99% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Assurant’s bottom line for the to-be-reported quarter is pegged at $4.43 per share, indicating 8.6% year-over-year growth. Assurant’s earnings beat estimates in each of the past four quarters, with an average surprise of 16%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Aon appoints Nick Fraccalvieri to lead global facultative reinsurance unit

AON

Life Insurance International

|

| Feb-17 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite