|

|

|

|

|||||

|

|

Aviation and defense services provider AAR CORP (NYSE:AIR) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 14.9% year on year to $754.5 million. Its non-GAAP profit of $1.16 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy AAR? Find out by accessing our full research report, it’s free.

"In Fiscal Year 2025, we delivered record sales and profitability and made meaningful progress against our strategic objectives," said John M. Holmes, AAR's Chairman, President and Chief Executive Officer.

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE:AIR) is a provider of aircraft maintenance services

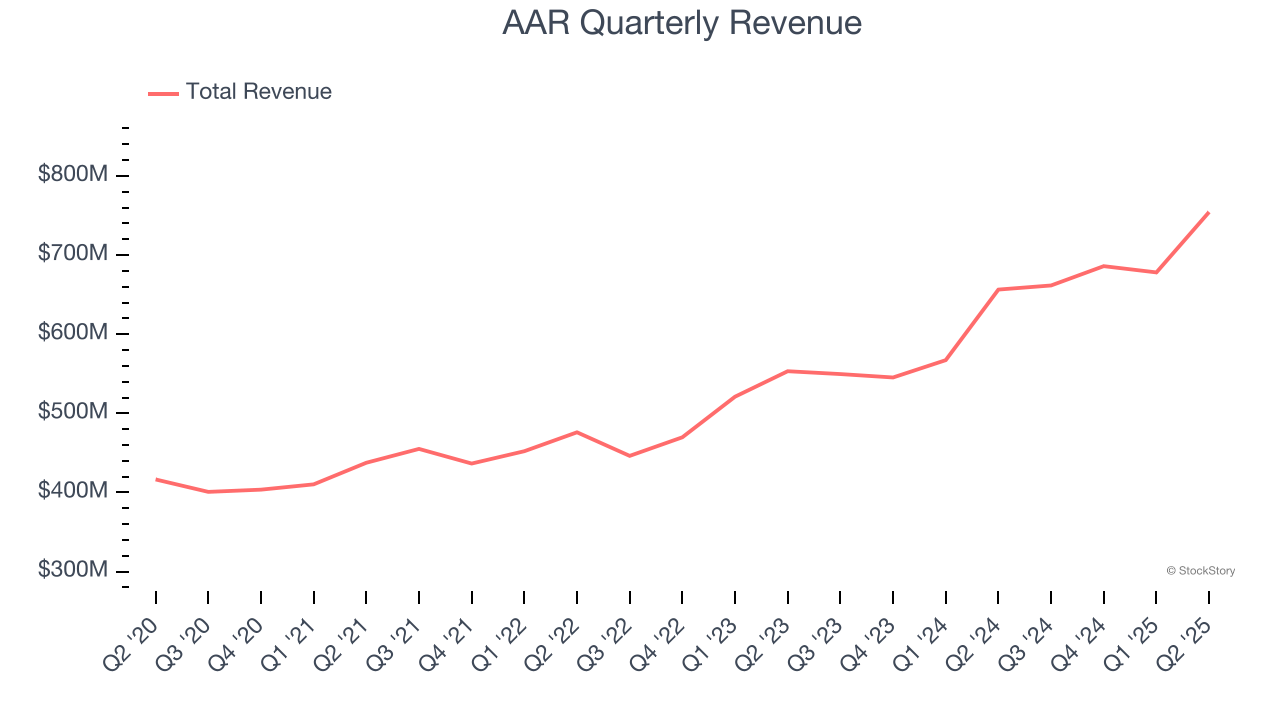

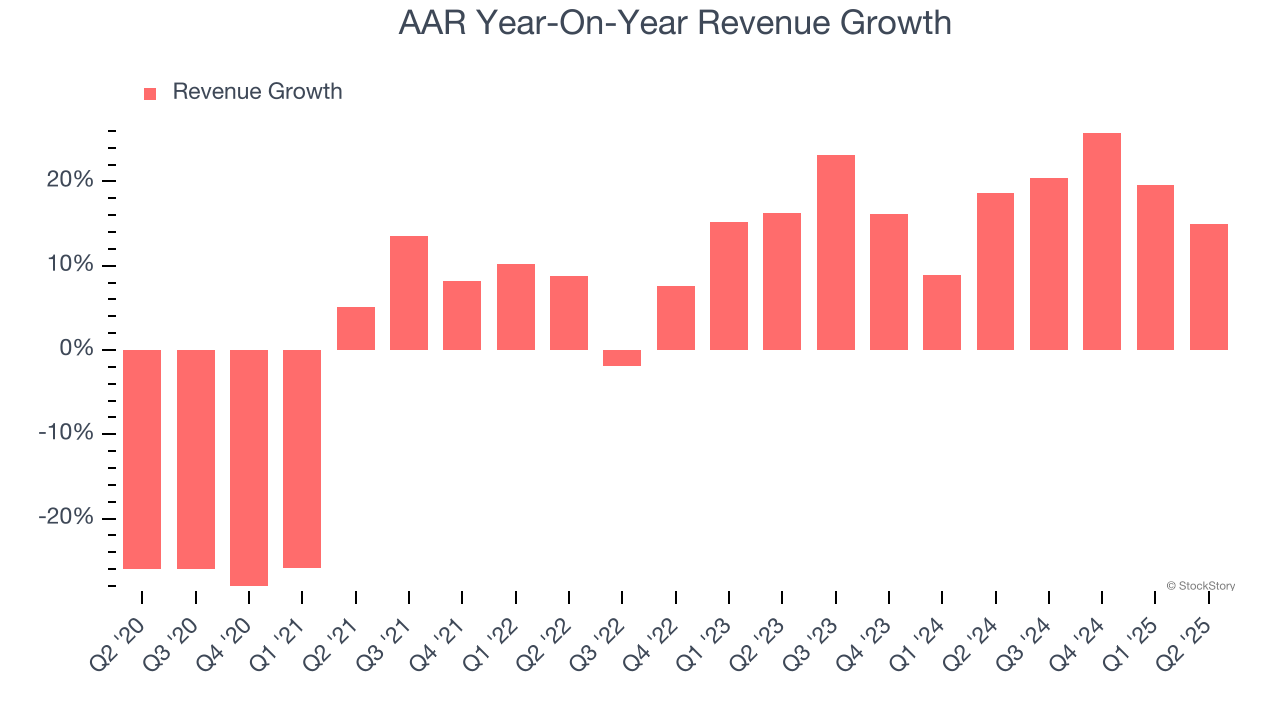

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, AAR grew its sales at a mediocre 6.1% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. AAR’s annualized revenue growth of 18.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated. We note AAR isn’t alone in its success as the Aerospace industry experienced a boom, with many similar businesses also posting double-digit growth.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Parts Supply, Repair & Engineering, and Integrated Solutions, which are 40.5%, 29.5%, and 26.5% of revenue. Over the last two years, AAR’s revenues in all three segments increased. Its Parts Supply revenue (engine and airframe parts) averaged year-on-year growth of 16.8% while its Repair & Engineering (maintenance, repair, and overhaul services) and Integrated Solutions (fleet management) revenues averaged 31.1% and 13%.

This quarter, AAR reported year-on-year revenue growth of 14.9%, and its $754.5 million of revenue exceeded Wall Street’s estimates by 8.6%.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

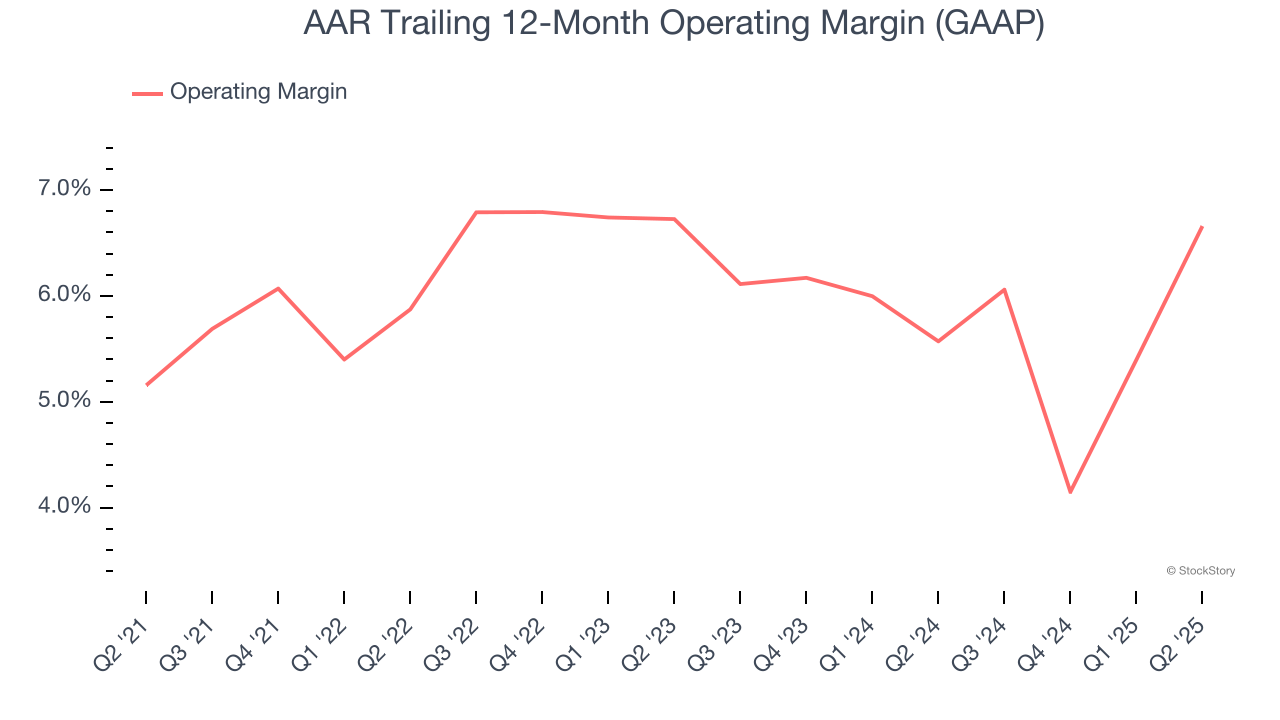

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AAR was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.1% was weak for an industrials business.

On the plus side, AAR’s operating margin rose by 1.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, AAR generated an operating margin profit margin of 9.7%, up 4.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

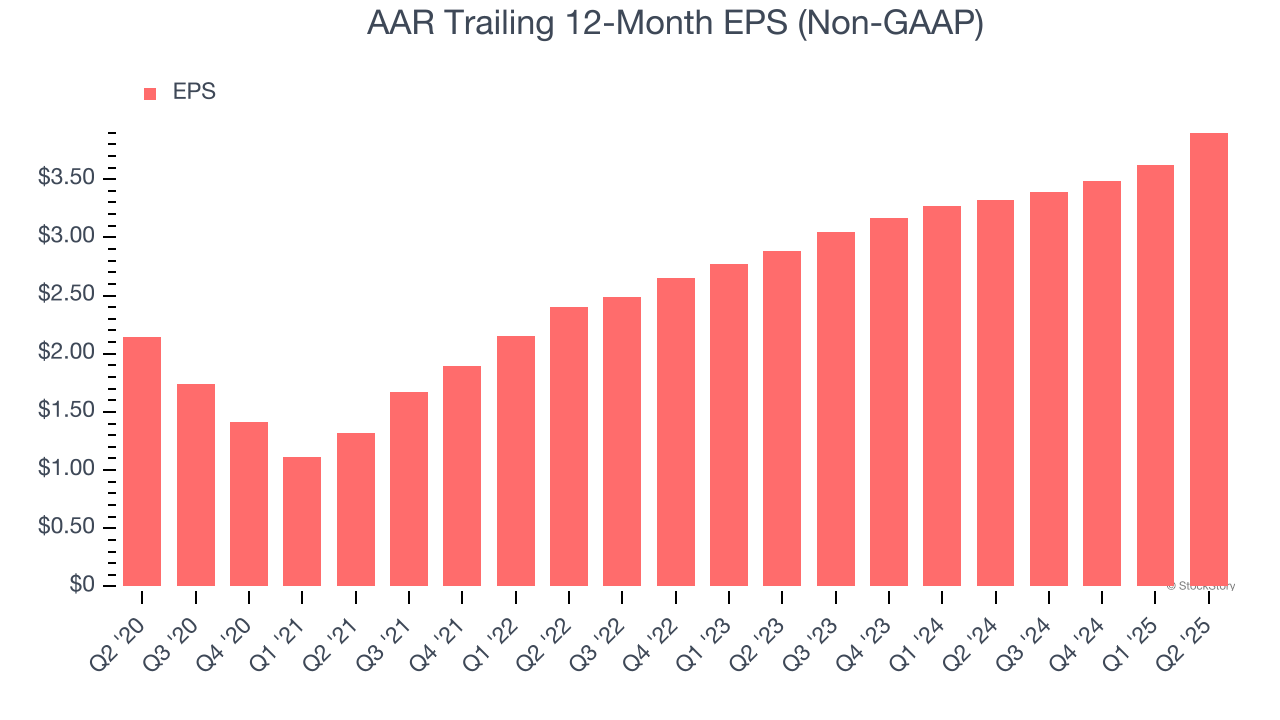

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

AAR’s EPS grew at a remarkable 12.8% compounded annual growth rate over the last five years, higher than its 6.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into AAR’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, AAR’s operating margin expanded by 1.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AAR, its two-year annual EPS growth of 16.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, AAR reported EPS at $1.16, up from $0.88 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects AAR’s full-year EPS of $3.90 to grow 15.6%.

We were impressed by how significantly AAR blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Zooming out, we think this was a solid print. The stock traded up 1.8% to $76.40 immediately following the results.

AAR may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-16 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-06 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 | |

| Feb-02 | |

| Jan-30 | |

| Jan-29 | |

| Jan-29 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite